Extra Income, what should I do?

To Pay or not to Pay (off your debt)

I get a form of this question all the time. Should I pay off debt or invest it? Paying off existing debt is a safe bet. Think of it this way, if you are paying 19% on a credit card then by paying off that card you are saving 19% interest. That is money in your pocket every month that you can use to pay off other bills or start investing.

If you debt is low interest and/or tax deductible you may be better off by paying your monthly minimums and investing the extra money you have. Here is why..

Using debt to make money

Imagine if I told you that I would pay you 100$ tomorrow if you loaned me 90$ today? Suppose that you didn’t have 90$, but you could borrow it from a friend and pay him back 95$ next week. You would make 5$. You can do the same thing with your debt if you have a solid investment plan and some time.

According to most resources, the average return from the stock market over the long term is between 7% and 12%. If you are paying 4% on your mortgage, for example, you could take extra money and pay off that debt or you could take the same extra money and invest it. Sure, you would be paying interest on that money, but over time you will make more money investing. There would be some months where you may not, if the stock market has a bad run, but over time you should make more money.

This type of decision is not to be entered into lightly. Previous performance is no indication of future performance. That means that the stock market could make 1% over the next 30 years and you would lose money.

Additionally, it may be more important for you to be out of debt and play things safe. You may want to leave the rat race and start your own business. This is why I normally tell people to pay off their debt. It is the right emotional choice for most people, but it is possible to make more money and possibly pay off your debt sooner with the proper investment strategy.

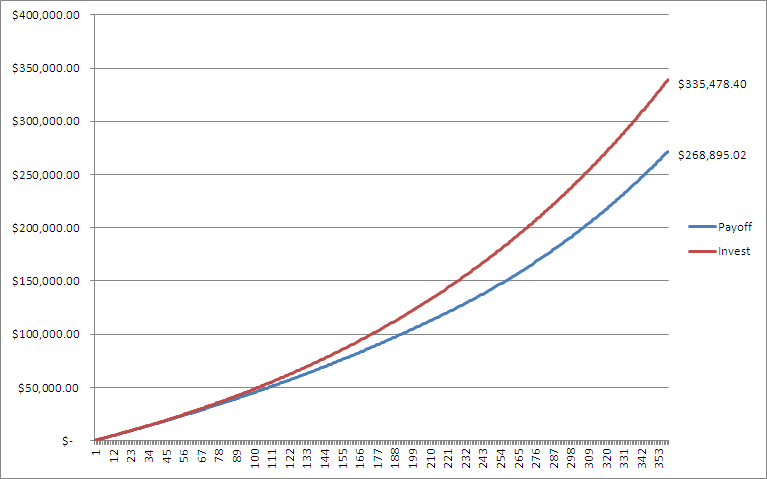

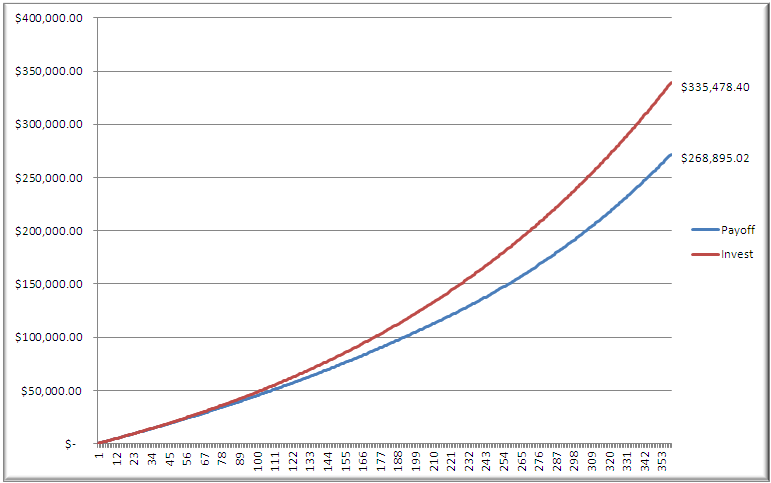

The chart below shows the difference in total value over 30 years when you invest at a conservative 6.5% instead of paying off a mortgage that has a rate of 3.5%. The numbers include the equity in the home as well as investment income. Once the mortgage is paid off the money that was being used to pay off the mortgage is then invested at 6.5%

Of course, there are many assumptions involved in these calculations. Your particular situation may be different, but many people have never even considered the benefits of not paying off their debt.

This is for informational purposes only, everyone should do their own investigation and due diligence.

1 Comment so far

DavidPosted on3:05 pm - Mar 20, 2017

Paying off larger debts (mortgage or car) is usually sub-optimal. Theoretically, you should payoff debts faster only if the interest rate is larger than the expected returns of your investments in the long term. Great post!

About the author