13 Free Entertainment Ideas

Image by zigazou76

When you are trying to live with stewardship in mind you often have to think differently than you may normally to have fun and entertain yourself. Here are a 13 free entertainment ideas. (or Almost free). Many of these things consider sunk costs, example number one assumes you already have a GPS or a smartphone.

- Go Geocaching – What is Geocaching? It is a real world GPS scavenger hunt. You use a GPS to find a set of coordinates where someone else has hidden a cache (usually Tupperware). Our kids love it because you trade toys in the caches and they love to find new parks to explore. We love it because it gets the whole family out of the house and doing something together.

- Hit up the public library – You can just sit and read to your younger ones while your older ones check out all sorts of new books they have never heard of. Most libraries have some sort of story time where the librarians of volunteers read a book to your kids.

- Play a board game – We have an extensive collection of board games and we love to play. Instead of going out and spending money find like minded people and have dinner together followed by some game time. Trade games with people if you have ones you are done with or don’t like. Introduce your children to the games you play instead of playing another round of Candyland. Our kids love Settlers of Catan Jr. (And I like it better than the original)

- Family movie night – This is a tradition in our house. We either get new movies from the library or watch some of our favorites. Make popcorn or a treat that goes with the theme of the movie, curl up on the couch and create memories.

- Public parks – Find out what is happening at your local and state parks. There are nature lessons and hikes, photography clubs and even geocaching gatherings. You just have to know what is going on and when.

- Set up a walking tour of your town – Local historical groups are a great resource then once you are started pack lunch make a map and take a walk. History will come alive as you actually walk through the areas where events took place.

- Take a photo walk – Take a camera and walk somewhere take pictures of anything you find interesting. It is amazing the cool things you drive by all the time but don’t notice.

- Check out any number of free courses online – Coursera, iTunes, Openculture or others that will allow you to learn something new for free.

- Take the day and clean up that one room – Not really fun but it really needs to be done. You know that space that you have been meaning to clean out/up for a while but things just keep piling up? Take a few hours and clean it. You will feel so much better.

- Learn how to fix something around the house – I really like to fix things(or at least try to) but I am not very confident on the how-to part. You tube is great for that. Last month I drained my hot water tank to fix a knocking sound it had been making. Just to your research and you may be able to fix it by yourself and save yourself the repairman bill.

- Have a water fight(summer) – This was a great morning in our house. We bought big squirters at the dollar store filled up a bucket and the four of us had a fight for about an hour.

- Have a snowball fight (Winter) – If it is winter take some time to make a batch of balls and have a snowball fight.

- Try new shows on Youtube – Youtube isn’t just for cat videos anymore. There are actually networks of content being created by quality brands. Try Geek and Sundry, Machinima, and more

What are things you do to entertain yourself for little or no money? Let us know in the comments.

Amazon Subscribe and Save

Most people know about Amazon. Many people order electronics, books and toys from the E-tailer. Fewer people know that you can order all sorts of household items from Amazon. We order most of our non-perishable household supplies from amazon as well.

Amazon started from an online bookseller in 1995 to being one of the largest internet companies in the world selling everything from books to furniture. Amazon has prices lower than most stores and they often deliver free to your door (if you have a prime membership or order $25 or more in qualified products).

But Amazon Subscribe and Save is almost a secret compared to other offerings by the online giant. If you can plan carefully it can save you a ton of money.

What is Amazon Subscribe and Save?

Amazon Subscribe and Save is a subscription ordering service. You set up a subscription to have a product delivered in 1-6 month intervals and receive an additional 5% off your purchase. If you have 5 orders arrive on the same monthly subscription delivery date you save an additional 15% off your entire order. This is where the planning comes in. Take a look or keep track of what you are buying and how often.

What is available in Amazon Subscribe and Save?

What all is available from Amazon by subscription? Almost everything! Non-perishable grocery products, cleaning supplies, baby supplies diapers, cat food and dog food almost everything you could want that doesn’t grow on trees. You can see the vast selection here. If there are products that you buy regularly you should compare prices to amazon.

Keep an eye out

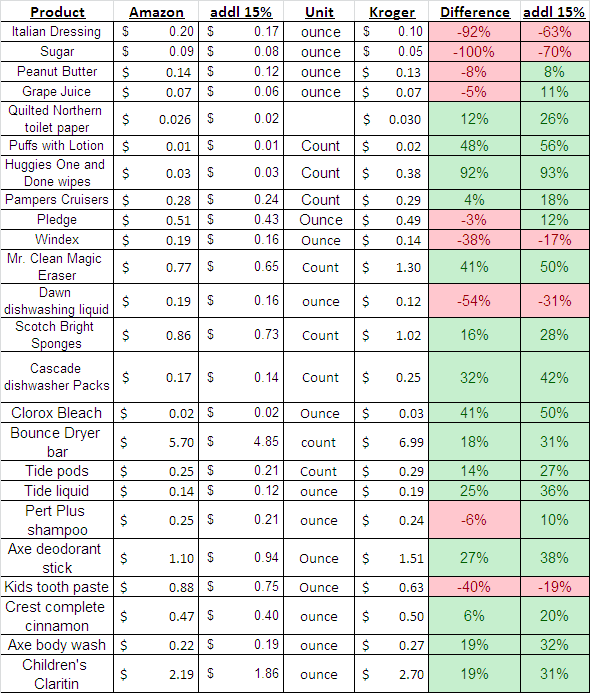

Just as many with many deals, you have to watch carefully. Just because you are buying in bulk or subscribing does not mean you are always getting the best deal. In preparation for this article I took a walk through our local Kroger and compared the prices on Amazon. While some prices were great savings others items were cheaper at the store. There were a few items that would be a better deal on Amazon if timed correctly to enable the additional 15% savings for having 5 items delivered at the same time.

Here are the prices I reviewed. Red means Amazon was a higher price; green indicate Amazon had a better price.

This article contains affiliate links. Cover Photo by 401(K) 2013Kids and Money what you need to know

Last week I started to write a nice simple article about kids and money. That article ended up more about our relationship with money and less of a “how to”. You can read it here. So, this week I will try again.

Teaching your children about money is an incredibly important. Many of us grew up in homes without formal training on money. Without an example from our own parents what we end up teaching our kids by our example. Your kids will pick up on the way you think about money, good and bad. We should try to teach our children good habits and how to think about money.

Here are some topics to think about when it comes to kids and money:

Teach them how to give early

Early on we got divided piggy banks

Early on we got divided piggy banks for our girls. This hopefully teaches them that their money is for different things: savings, giving and spending. We help them divide up their money as they get it so they will understand what each different section is for. Setting that money aside to give makes them excited to give when the need arises. They have offered to buy gifts for the girls we sponsor through Compassion international. This is the type of thing we hoped for when we started training them with money.

By doing this now we hope that it will be more natural to them and that they will not be so “possessed by their possessions” money will simply be a tool at their disposal to use for God’s purposes and not something to be hoarded and lusted after…hopefully.

Allowance: Given or earned?

This is a big question: Should you give an allowance to your children, no strings attached or make your children earn their money? I have seen a lot of good articles on both sides and I have seen families that I love and respect do it both ways to great success so I don’t actually know that I can offer much wisdom on this topic, but to know your own children. Each of these methods can have different effects on children and you will have to watch and learn and even perhaps change your own views on what is best based on how your children learn.

We have always had chores for our children to earn money. We currently use the Accountable Kids chore system and it has helped our girls not only to get all their chores done, but to start to learn how to relate an amount of work to the things they want to buy. It has worked for us but we are by no means under the impression that is a perfect system. We are thinking about combining those chores with a standard rate allowance to give them an idea of how to budget with a standard income.

How much of their own money to they have to spend?

I have know of families where the kids had to buy ALL of their own things, clothes, food, toys everything. These kids worked hard and were paid well for their work and they were expected to spend that money on necessities and luxuries. I have also known families who gave their kids money and never gave them the opportunity to spend it. Then how do you help them to spend it wisely? Do you let them waste it on cheap toys that they will break or lose in days? (Yes, it is what they really want right now but it is stupid!)

I think there needs to be some sort of balance here but I don’t claim to know the right answer. I bring it up more as food for thought.

I would love to hear opinions on any of these topics drop a comment below on how you handle these issues with your kids or how you think you should.

Teaching kids about money

Teaching Kids About Money is not a New Law

Teaching Kids About Money is not a New Law

Teaching kids about money through a gospel lens is is something I am still working on figuring out. Our daughters 7 and 5 are still learning how to count money let alone spend it. However, I want them to understand early how money plays a role in our life. I want them to see Christ as sufficient and to not think money will fulfill their life. It shouldn’t be that hard right?

But, as I researched some articles to write this I discovered something. Most of the articles I found from big time Christian resources were no different the advice you would read from secular sources: Teach them to save early, teach them how interest works against you, make them earn their money so they understand the value of it and show them how to spend it properly. The only thing that set them apart from secular resources was talk of the tithe.

In their book Give Them Grace: Dazzling Your Kids with the Love of Jesus Elyse Fitzpatrick and Jessica Thompson say, and I am paraphrasing because for the life of me I can’t find the quote, “If your parenting isn’t any different than a Jew, Muslim or a moral humanist you are not parenting as a Christian.” We can have all the steps and rules we want when it comes to our money and we will only create little pharisees. Our parenting, in every way, should always call us back to the cross and the gospel of Jesus Christ.

Honestly, I started to write this article as a to-do list just like the ones I read.. That is why I was so irritated by what I found when doing my research. There are already tons of those articles out there here are a couple:

Teaching Kids about Money – We can’t assume the Gospel.

But, like so many of our sermons these articles assume the gospel instead of preaching it. The gospel calls us to give as we have been freely given. I believe the gospel calls us not to be selfish with out money. The Gospel calls us to give what we have cheerfully and sacrificially. The Gospel calls us to make Jesus the center of our life and live like he is completely sufficient. The question is how to do instill those principles in our children when we are living like it isn’t true. We work hard to get more to keep up with our neighbors and perhaps to give more but only to “sanctify the rest” so we can feel good about spending it however WE want.

Even by following a list of to-do’s, like the ones above, we need to be careful that we are not teaching our children to rely solely on their own wisdom to provide for all their needs, lest when financial trouble befall them they blame God because they feel like they followed all “His rules” and it didn’t work. Then God becomes a liar in their eyes because they equate good financial advice with the gospel.

Those of us who sinfully find our security in money love to look at the book of Acts and brush off the “socialist” lifestyle they lived as being simply a description of how they lived and not instructional as to how Christians are to live. However, giving statistics of Christians bear out that we have a lot to learn from those in the early church.

Maybe I will write a list of ideas on the practical side later because I do believe there is a need for that , right now I feel like the church needs to turn its eyes back on the cross when it comes to money. I know I do.

Where is your missing money?

Image by Ano Lobb

We all have missing money. You get to the end of your week and you know you had enough money to pay for everything you needed, but somehow you are coming up short. Where is your missing money?

Look, I have been talking, writing and lecturing about personal finance for years now and it still happens to me. I know exactly how much extra money I have in my various accounts. I know that we deposit extra into our main bank account to ensure we don’t overdraft. I know we have extra paychecks a few times a year so I know there is technically extra in the account we pay our bills from. So, I spend it because I know it is there. That is where my missing money is; living it up outside of my budget.

My guess is you have a few dollars floating around outside your budget. We all do. This problem arises when you allow money to sit idly in an account somewhere doing nothing. It will run away from you when you aren’t paying attention. Money wants to be spent, or used in some way and it will find a way to get what it wants. What can you do to keep your hard earned dollars from becoming missing money? I am glad you asked.

Give your money something to do.

The secret to keep your money from going missing is to give it something to do. You money, like most of us, wants to feel like it has a purpose. You need a plan for all of your money, give it something to do. It doesn’t matter if it is paying off debt, paying for your bills, or being put in a nice quiet interest bearing account or investment to make more money for you.

Alright, the metaphor has gone far enough. I recommend you automate everything with your bank to make sure all of your money is going somewhere and doing something. Here are a few ideas.

- Recurring bills that are the same each month. (mortgage, car loan, insurance etc…) — Have an account where money goes to pay these bills that you can’t spend from. Each month set up an automatic payment with your bank to pay these bills’ total balance each month.

- Recurring bills that are not the same every month (utilities) — Call each of your utilities and see if you can make them stable. Many utilities will let you pay the yearly average of your bills all year. That way you know exactly how much you are going to pay each month.

- Any money left in your budget — Use it to pay off your debt if that is your goal, or put it in an interest bearing or investment account so you can’t spend it. That way it isn’t in a place where you can spend it on frivolous things.

Following these types of ideas will keep you from asking “Where did my money go?” It just won’t be available to spend.

What other ideas do you have? Tell us in the comments.

Envelope budget

Envelope budget system

My wife and I often get asked how we manage our budget on a practical level. It is all well and good to have a piece of paper somewhere telling you how much money you are supposed to spend each month, but it is much more difficult to actually manage to that budget. There are many ways this can be done. Mint.com‘s budget system will track all of your spending categories and can even alert you when you go over budget. Some people do this manually with a spreadsheet or by keeping all of their receipts. We use an envelope budget. We pull cash each paycheck and put that money into envelopes.

These envelopes correspond to various categories of our spending and when the envelope is empty we are out of money for that particular category. If there is no money in the “Eating out” envelope we eat at home. Or at least we should, we aren’t perfect. Using this method makes all the money spent more tangible, you think more about each decision to spend. It also helps us to ensure we don’t go over our budgets because in theory we shouldn’t be using our debit card, where spending is much easier to lose track of .

Advantages to the Envelope budget system

- Spending is easier to track – As I mentioned above, you know exactly how much money you have left in a particular category. You can all so put your receipts in the envelope to replace the cash to know exactly where you spent the money.

- Theoretically impossible to break – If you only spend the money that is in the envelope you will never go over your budgeted amount.

- Money easily carries over to next budget period – Money not spent during the week or month carries over ino the next time period. This allows for visual savings or if you need larger amounts like for a family hair cut.

Image by kgnixer

Drawbacks to the Envelope budget system

- You don’t always have the right envelope – We have many times decided to go out to eat after church but we didn’t bring our eating out envelope. Now we have to decide what to do? Will you deposit the money you spent from your envelope?

- You need to pull cash regularly – It is inconvenient and we often forget to pull the cash so we end up using the debit card and trying balance that by not pulling the full amount of cash.

Envelope budget apps

These are from the Google play store. Sorry I don’t use iOS but there must be some out there?

How do you manage to your budget? Are there any good apps you can recommend? Tell us in the comments below.

Rich Young Ruler

The Rich Young Ruler

And behold, a man came up to him, saying, “Teacher, what good deed must I do to have eternal life?” And he said to him, “Why do you ask me about what is good? There is only one who is good. If you would enter life, keep the commandments.” He said to him, “Which ones?” And Jesus said, “You shall not murder, You shall not commit adultery, You shall not steal, You shall not bear false witness, Honor your father and mother, and, You shall love your neighbor as yourself.” The young man said to him, “All these I have kept. What do I still lack?” Jesus said to him, “If you would be perfect, go, sell what you possess and give to the poor, and you will have treasure in heaven; and come, follow me.” When the young man heard this he went away sorrowful, for he had great possessions.

And Jesus said to his disciples, “Truly, I say to you, only with difficulty will a rich person enter the kingdom of heaven. Again I tell you, it is easier for a camel to go through the eye of a needle than for a rich person to enter the kingdom of God.” When the disciples heard this, they were greatly astonished, saying, “Who then can be saved?” But Jesus looked at them and said, “With man this is impossible, but with God all things are possible.” Matthew 19:16-22 ESV

Image by shuttermon

This passage from Matthew is my second least favorite of all scriptures. I know you aren’t supposed to say you have a least favorite, but it is. Because it cuts deep. I may not be that rich young man, but I feel like I am the one next in line to talk to Jesus and I no longer want to ask my question. This rich young man has sins similar to mine. We both love the comfort money gives us. We both identify ourselves with our monetary success. (Let’s be honest, most men do. Not sure about the ladies) We are both hard pressed to give it all up to follow Jesus.

Passages like this one hurt because they point out the idols we have in our lives. Idols in this case are not little statues that we worship as false gods but are things we have given a higher priority in our lives over than Jesus. I spend more time thinking about my job and my money than I do about Jesus most of the time.

The rich young ruler was probably a giver, after all that is part of a pious life. I bet he was a regular, constant tither. But he wanted wanted his “stuff” more than he wanted to follow Jesus. I am sure I am projecting, but I can hear the questions in his mind “Who would I be if I didn’t have my possessions? Certainly, he can’t mean that literally. Couldn’t I do much more good if I kept it and invested it and gave more?”

Of course, I don’t believe that Jesus is calling us all to a life of poverty, but I believe Jesus saw into this man’s heart and saw what he loved and what would prevent him from being his disciple. He saw his love of money.

If you are someone, like I am, who is interested in becoming a good steward then you must constantly be vigilant that money has not become an idol for your. You must guard against your debt free life becoming more important than your walk with the Lord. It is a very fine line and a very easy trap to fall into.

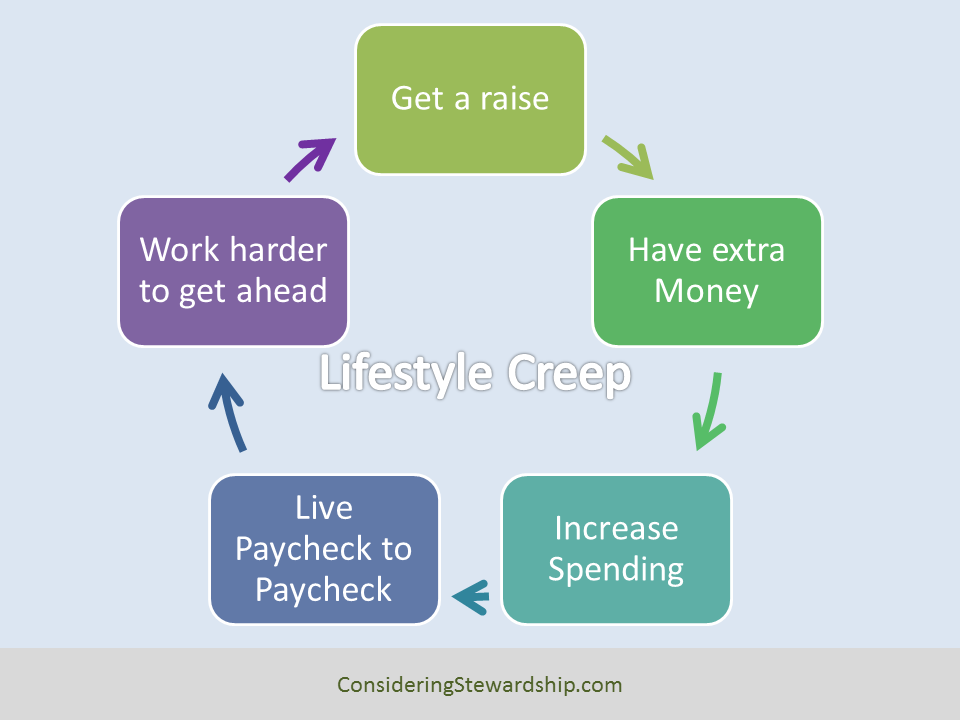

Lifestyle Creep

What is Lifestyle Creep?

Lifestyle creep is defined by investopedia as:

Lifestyle creep is defined by investopedia as:

A situation where people’s lifestyle or standard of living improves as their discretionary income rises either through an increase in income or decrease in costs.

This simply means spending more money just because you can. For most of us that comes when we get a raise. We can spend more now; we can buy the little things we have always wanted.

My wife and I have noticed that we spend more on things that we didn’t “need” before. It happens to us all, when we are forced to do so we can live on very little and be quite satisfied, remember college? What is it that happens to us that causes us to spend more later down the line? Our lifestyle creeps.

Is lifestyle creep bad?

If lifestyle creep isn’t intentional then I would argue that, yes, it is bad, because it means you are not in control of yourself and your finances. If you and your family have intentionally made the decision to improve your lifestyle or increase your budget for the right reasons, then great. I am not arguing that everyone should be living like broke college students. Most of us paid our dues, and if we have kids now they would love ramen noodles and mac and cheese for every meal it would not be healthy for anyone.

If we aren’t paying attention and lifestyle creep happens then we are not being good stewards of our money. We are just allowing it to flow whatever direction we feel like at the time. Not being careful and intentional with the money entrusted to you can cost you down the line by reducing the amount of money you can give or save.

The more expansive your lifestyle is, the harder you will be hit by financial crisis if and when it comes. If you live more simply, by definition you require less money each month. If you lose your job or have an emergency expense you will have more money to be able to handle it.

How to Prevent Lifestyle Creep.

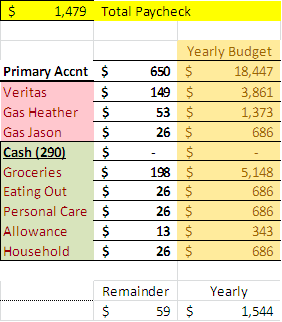

The best way I have found to prevent lifestyle creep is to automate your finances as much as possible. Direct deposit is a huge benefit for this. My wife and I know exactly how much we have budgeted and that is all that goes into our regular checking account from my paycheck. This is easily explained with an example.

This is what our actual budget looks like but I have changed the numbers a little. The $1479 would be my total paycheck. Only $650 is deposited into our primary account (The one we have easy access to). The remainder is directly deposited into a secondary account where it then transferred to other savings plans and pays our monthly bills.

The pink accounts are non-cash spending. Veritas is our church and that is automatically sent by the bank every two weeks with every paycheck

The green line items are our cash spending. We actually pull cash and put them into envelopes marked as groceries, eating out etc… There is a whole set of reasons why we settled on cash spending.

It leaves us with a little ($59) left over every two weeks. When I get my next paycheck I pull what is left over from that $59 dollars out and into a savings account. Every two weeks we are starting from scratch and keeping to the same budget.

This way even when I get my yearly raise we don’t see it in our primary spending account. Our budget changes when we decide it needs to, not simply because there is more to spend. This worked out very well when I got an unexpected bonus from work, we didn’t say “Hey, let’s spend it” In fact I forgot to tell my wife until a few months later that I got a bonus at all. (oops)

Improving your lifestyle is not a bad thing; if I lived like I did in college with my kids CPS may show up at my door. But if we are to be good stewards of our finances we should be in control. And we should be constantly looking out for things getting out of hand.

Marriage and Money and Grace

Image by penywise

Last week I had an article with financial questions for marriage. These questions were meant to get good conversations started regarding marriage and money. I have handed them out in pre-marriage classes for a few years now and they have gotten good reviews from the couples that have used them.

It is incredibly important for engaged couples to discuss spiritual, sexual and financial histories, but there must be grace for mistakes made with money just as there would be for ones sinful sexual history.

It is understood fairly well in our churches today that there is grace for sexual sin. Our sinful nature, being what it is, all couples have some sort of sexual sin in their past that they have to work through. We talk about it and plan for it. However we don’t offer the same opportunity to financial sins, we just don’t think it that serious.

That is because sexual sin doesn’t hang over our heads as obviously as our financial sins can. After all, as long as you are no longer sleeping with other person it is easy to think of those sins as in the past, not comprehending how they affect you every day. However, if you enter a marriage having lived selfishly with your money for years, you may come into the marriage with a substantial amount of debt. That debt will be staring you in the face every day until it is paid off which can be years after the honeymoon is over.

That can be a burden on a marriage, one spouse may begin to believe that they are paying (literally) for the sins of the other’s past. Our culture or our church does not do a good job of dealing with this aspect of marriage and money. For the general culture it is because crushing debt is as ubiquitous as premarital sex, and just as acceptable. For the church? It is partially because we have understood financial issues from the perspective of the culture, or perhaps it is because we just don’t talk about such things, or perhaps it is because we don’t have a good understanding of how the grace of God applied to that area of our lives as well.

My wife understood when we got married that she was getting my debt. It wasn’t a crushing amount, but it existed and since she came into our marriage without any debt it would have been easy for her to be arrogant about our financial situation. It may have been easy, but it wouldn’t have been Christ like. It took a few years to understand, but she had her own set of issues related to money. As we come to understand one another’s sins better it is a an opportunity to extend the grace of God to one another all over again. And that is what we are called to do in all areas of not just with marriage and money.

We have to understand the spiritual side of money, Jesus talked about it a lot and it wasn’t just how to save more and spend less. He talked about the effect it has on our hearts. He talked about what money can meant to us. But he also says “My grace is sufficient” for that as well. We are called to have that same grace with one another.

20 Financial Questions for Marriage

image by nikareteku

Here are a list financial questions for marriage to get a good conversation started. Couples need to learn to develop open and honest communication about money and it isn’t always easy. Walking through these questions can help a couple come to some understanding about their own thoughts and the thoughts of their spouse.

I hand this out as part of my marriage finance class.

Just remember to remain humble, your goal here is mutual sanctification not to “win” a fight.

- How important is money to you?

- How rich do you want to be?

- What sacrifices will that require?

- How did your parents deal with money?

- How does that impact how you deal with it?

- How might it impact your marriage?

- How do you think about consumer debt?

- Have you completely discussed your financial past?

- Perhaps pull credit reports and review them?

- Will you both work when you have kids?

- What are your past and present financial obligations?

- How do you handle your money: are you a spender or saver?

- How much will we earn together?

- What are our financial goals?

- How will we budget?

- Who will do the record keeping?

- How will we make financial decisions together?

- How important are Christmas gifts, vacations and new cars to you?

- What worked well for your family growing up?

- What financial mistakes do you not want to repeat from growing up?

Use these questions to get a conversation started. It may lead to some self examination and learning which can be good. Ask God to guide your conversation so it doesn’t become sinful, but helps you to understand one another better.

What are some other considerations or questions to ask to help your marriage?

image by nikareteku