Preparing for Christmas early.

Now that the Christmas season is over you may be asking yourself “How am I going to do this better next year?” Preparing for Christmas can be easy if you know what you want to do.

Now that the Christmas season is over you may be asking yourself “How am I going to do this better next year?” Preparing for Christmas can be easy if you know what you want to do.

Many of us get carried away with the “Christmas spirit” and spend more than we intended to. Maybe this is even done with the best intentions, we love the people we are buying for and we want to bless them but there are smart ways to do it and not so smart ways.

- Start a Christmas account – Many banks still offer these accounts you setup your direct deposit to do a small amount every

paycheck and then they mail you a check in October. We don’t use a traditional “Christmas” account but a simple savings account from Capital one 360. We just pull out the money we will need come shopping time. The table to the left can show you how much you can save based on your pay period.

paycheck and then they mail you a check in October. We don’t use a traditional “Christmas” account but a simple savings account from Capital one 360. We just pull out the money we will need come shopping time. The table to the left can show you how much you can save based on your pay period. - Plan ahead and buy at the right time – Prices fluctuate throughout the year depending on the product. Air conditioners are less expensive in the winter than they are in the spring. If there is a larger ticket item that you know you are going to buy for the holidays plan ahead and buy it when it is cheapest. How do you know when things are cheapest? Lifehacker had you covered.

- Determine your plan – Do you need to buy for everyone you know? Or even everyone in your family? No you don’t. You can trade names and do a secret Santa, so you can buy one gift that matters instead of a couple of dozen gift cards. We have decided to do a “Want, Need, Wear, Read” approach within our family so we are limiting the items we are exchanging. Hopefully this will prevent crap from building up in our kids’ play room.

- Work the system – This takes a little bit of work but you can buy gift cards to buy your gifts and get rewards for doing so. Our local Kroger offers discounts on gas when you spend money at groceries, including gift cards. We do most of our shopping on Amazon so we first go to the store and buy gift cards. Then we get discounts on the gas we will use to go over the river and through the woods to Grandmothers house. If you are disciplined enough you can even use a rewards credit card to get some rewards that way.

Christmas doesn’t have to be stressful if we plan ahead what steps have you taken or do you want to take in order to be prepared for Christmas next year.

Image by decar66

This post includes affiliate links to companies that may reward me if you click them.

Why you and your spouse should have the money talk.

Recently, my wife and I have been slacking off on our money talk. I am the money nerd in our family so I track most of the data and I wanted to get back on track with keeping her in the loop.

1. The money talk keeps you accountable

It is easy to get sloppy with money. I am guilty of using more money than I should to by special treats for my family. Having a consistent money talk with my wife keeps me accountable. I know I will have to talk to her about those little treats. It makes me think twice and helps to keep us directed toward our goals. It isn’t that I am hiding bad things but those little treats are working against our goals.

2. The money talk keeps you on the same page.

It is easy to put the budget on cruise control. But, things can get out of line easily. Having the money talk will make sure you and your spouse are on the same page. It makes sure that the goals you set at one time are still the goals want to be pursuing. It gives you the opportunity to review and change those goals should the need arise.

3. The money talk brings you together.

This one was a big one for us most recently. I felt like I had let my family down by making some minor mistakes with the budget. We have a pretty complicated system and it is hard to manage sometime. Having the money talk was hard for me because it required me to admit I had made the mistakes and seek my wife’s forgiveness. It was tough on my pride, but it brought us together as a couple

Bottom line the more you talk about money the smoother it will go if you both are walking in grace.

Do you have any tips on how to have this conversation?

Image by kabaldesch0

Gather your debt records

Your third step in the process is to gather your debt records. Student loans, credit card statements, car loan statement. Statements from all the debts you carry.

Your third step in the process is to gather your debt records. Student loans, credit card statements, car loan statement. Statements from all the debts you carry.

Putting all of this information in one place can be a little scary if you have never done the calculation before or are unsure of your current financial situation. The easiest way to conquer the fear of the unknown is to know it. Think of it this way, before your GPS will tell you which way to go it has to find your current location. This process is finding your current location so you can make the correct turns go forward.

There is information you need to know from each of your debt records

Balance

The total amount of money you owe on the debt.

Interest Rate

The cost of borrowing the money. This is usually listed as “interest rate” or “APR” which stands for Annual percentage rate.

Monthly Minimum Payment

How much you have to pay each month to not be delinquent on your debt. Keep in mind making minimum payments only it will take up to 20 years to pay off a credit card.

You can use this handy Google doc if you like.

All of this information will become very important as we move forward in getting rid of our debts.

Image by Kantamate555

Track your Spending

Track your spending

This is part two in a series on how to arrange your finances. If you haven’t already read part 1 to get off on the right track.

When you track your spending it will do a few things for you. It will help you determine where your money is really going each month. Many times we think we know how we are spending our money, but forget about little purchases we make along the way; nickle and diming your self, so to speak.

Secondly, you will actually spend your money more wisely. There is something about tracking spending that will make you think about purchases. It causes you to make more deliberate decisions when you are spending your money.

There are a couple of different ways to go about this. Feel free to use which ever one works for you. The importance is not in how you get it done but simply that you get it done.

I suggest signing up for mint.com or a similar service. This will import your records from your checking account and help you to categorize them appropriately. Although watch out, they are not always right, or the categories may be too broad.

Secondly, you can track your spending by hand. Keep receipts for everything you spend and write it all down. This way requires a bit more work on your end, but will help you more in controlling your spending, who wants to manually write down junk spending?

Once you have tracked your money for a month, you should have captured a majority of your spending and have a good idea of where you are starting from. It will make the following steps more easy and accurate.

Image by Ken Teegardin

Balance Giving vs Investing

When I get to the Q&A portion of my classes there is a question I always get. “How do you balance giving and saving/investing?”

When I get to the Q&A portion of my classes there is a question I always get. “How do you balance giving and saving/investing?”

I wish I had a straight answer for the question of giving vs investing, but any short answer does a disservice to the question itself. As believers we are called to give sacrificially and generously to those in need. And it is a part of our culture and even sensible to save money for things like retirement. If you are looking to build a retirement nest egg and give sacrificially it can be a struggle to find any balance between them.

Obviously this isn’t an easy question to answer but here are a few things to consider.

-

Are you living sacrificially?

Take a look at your budget and your spending and ask “Is my giving impacting my lifestyle?”

CS Lewis put it this way:

I am afraid the only safe rule is to give more than we can spare. In other words, if our expenditure on comforts luxuries, amusments etc is up to the standard common among those with the same income as our own we are probably giving away too little. If our chartities do not at all pinch or hamper us, I should say they are too small. There ought to be things we would like to do but can not because our charities exclude them (Mere Christianity)

-

Retirement isn’t biblical

This is a concept most people don’t realize. Retirement isn’t something the bible even addresses. Retirement is a twentieth century invention and it was created to force older workers out of the system so they would stop slowing down production. The only way to do it was to pay them not to work. Now it is just assumed that we will get to stop working one day even if we can’t afford it.

We may need to save for the loss of income as we reach retirement age, but shouldn’t assume that there will come a time where we are not working.

-

Giving in light of God

As Christians we should think about our giving in light of God as the great giver. God planned to show his goodness to us before the foundation of the world in giving his son to save us. Jesus models for us what type of sacrifice we are supposed to display.

Philippians says “Have this mind among yourselves, which is yours in Christ Jesus, who, though he was in the form of God, did not count equality with God a thing to be grasped, but emptied himself, by taking the form of a servant, being born in the likeness of men. And being found in human form, he humbled himself by becoming obedient to the point of death, even death on a cross.” Phil 2:5-8

If Jesus was willing to set aside equality with God we can be willing to set aside equality with our neighbors’ standard of living.

You should always have a car payment.

You should always have a car payment. Unless you live somewhere like NYC where you don’t need a car, then you can move on to another one of our great articles. You should always have a car payment, not so you can drive the newest model every year, that would be crazy. However, most of us are in a place where we will be needing a new car sooner or later. How are you going to pay for that car without going into debt and taking on a few hundred dollars a month?

You should always have a car payment. Unless you live somewhere like NYC where you don’t need a car, then you can move on to another one of our great articles. You should always have a car payment, not so you can drive the newest model every year, that would be crazy. However, most of us are in a place where we will be needing a new car sooner or later. How are you going to pay for that car without going into debt and taking on a few hundred dollars a month?

Always have a car payment and make it to yourself.

If your car is paid off, find some money in your budget and dedicate it to your car fund. Even if it is just $50 or $100 dollars a month it will help a lot in the long run.

Think about it. If you take out a loan for a $10,000 car and you just pay the minimum you are paying around $2000 in interest over the course of the 5 year loan. That is 20% increase in the cost of the car. Would you have paid 20% more for your car up front?

Every thousand dollars you put down saves you close to $200 in extra interest. And perhaps you can even save enough to not need a loan in the first place. If you take good care of your car there is no reason why you can’t pay cash for your next one.

This habit also prevents lifestyle creep. If you always have a car payment you never get used to living without one. Then if you really did need to take out a loan you don’t won’t feel the squeeze in your budget, because the payment is already there.

I am a fan of driving a car as long as you can, but I will admit I don’t feel like taking that route with my wife and kids so perhaps she can get a newer car before I do.

Financial Samurai has a great article on how to determine how much you can spend on a car. It is an interesting idea but I am not sure how practical it is if you try to live it out. It would definitely help to prevent getting in over your head.

Prevent Fights About Money in Marriage

Photo by yourdon

I have talked to many couples about money over the years and there always seems to be some tension around money within marriages. According to some evidence fighting over money greatly increases chances of divorce. It may be a testament to how powerful the love of money is in our culture.

My wife and struggled with how to handle our finances in a biblical fashion and how to handle money issues within our marriage with the grace of the gospel and we have learned a few things about preventing fights about money in marriage:

- Don’t become money Pharisees: Many church folks talk about money with a very legalistic mindset. We set hard and fast rules to live by when it comes to our money and then we experience the same guilt with money that we do with every other sin in our lives because we broke the rules. You will both make mistakes or have already and there must be grace for those mistakes just like any other sins that have been forgiven by Jesus.

- Remember to communicate: It is easy if one spouse “Does the bills” or “Handles the money” for the other spouse to feel left out especially if that spouse also doesn’t bring in any income. I have had to work very carefully to keep my wife involved and help her to know that our money is OUR money. We have gone as far as to schedule a weekly finance meeting where we go over spending, budget and planning. Mint.com creates great little graphs for my presentations.

- Create and commit to your budget together: The initial budget should be something you and your spouse decide on together. It may be a tough conversation but you can help one another by calling out the idols you have in your life around money. My wife, by nature of taking care of our home, is responsible for spending a large share of our budget that isn’t automated. She does her best to stick to the budget we agree to and we discuss it when it needs to be changed.

- No questions asked money: If you can afford it allow one another play money. If my wife wants to order a new gadget for her camera she doesn’t have to ask me she just buys it. Similarly, I don’t have to ask her when I want to go out for lunch. We each have our own accounts with direct deposits that are ours alone.

- Automate things: When possible automate savings and bills. Saving is much less painless when you don’t have to do anything to accomplish it. We have a whole article on how to do it here.

- Ask “Why do I feel this way”: We all have experiences with money that lead us to think a certain way about it. I, for example, value my savings like an idol just for its own sake. I trust that having no debt and money in the bank will save me from life’s circumstances instead of trusting in Jesus as my savior.

- Know your Role: No not that men are the breadwinners and woman should be home barefoot and in the kitchen. (Although my wife hates shoes and loves to cook). Know how your individual styles complement one another. Or know what you can and cannot do. By way of example: My wife will hold onto cash like it is gold. She will spend that $50 in her purse several times. Each time intending to deposit it to cover the purchase she just made. I ,on the other hand, will hold onto cash and spend on a card because it isn’t concrete money to me.

This list, like most of this blog, is a monument to our failures. We have learned many of these lessons the hard way. What else can you do in order to prevent fights about money in marriage?

Automate Your Finances

One of the best steps in getting your budget under control is to automate finances. As much as possible, make your financial matters a hands off activity. This way you are eliminating human error like forgetting to send the payments or spending more than your budget  allows, and your savings happens without your effort.

allows, and your savings happens without your effort.

Limit access to money

One of the most effective ways to automate your finances and control your spending is to limit access to your money. Your money is going to be spent the question is if it will be spent where you would like. The best example of this is 401(k). This money is normally taken out of your paycheck before you see it, like taxes. So, you do not have a choice in how you spend that money. Most people never even pay attention to how much money is taken from them in taxes.

This can be done in very simple ways. If your company has a direct deposit option you can limit yourself by only depositing the amount you need for your budget into your main checking account while remaining funds should be deposited into a savings or investment account. This helps control lifestyle creep (the propensity to spend more as you make more) because you don’t actually see an increase in your main bank account where it can be easily spent.

Example:

If your monthly budget for your bills is $1000 and you get paid once per month you would only deposit $1000 into your main checking account. If your paycheck was $1200 then you would deposit $200 in a savings account.

If you got paid every two weeks you deposit $500 per check if you can balance your bills on two different pay periods, that may take some time to set up and get right.

This prevents you from having easy access to “extra money”. I use quotes there because all of your money should have a purpose even if it isn’t immediate, and there should be a plan for all of your money. Don’t let your money sit around and be lazy, send it off to work for you in an interest bearing account, or in an investment of some kind.

Automate your bills

Most utilities offer a budget program which allows you to pay the same amount all year round instead of being hit with high electric bills for your air conditioning in the summer and for your heating in the winter. They will average the last year of your bills and give you one median payment. This allows you to set up a recurring payments of a single amount; no forgetting and no sticker shock on your bills.

For years we split our bills in half and paid half every two weeks with our paychecks, to make sure we didn’t spend it while we were waiting for the bill. It forced us to do some manual work thanks to those three paycheck months but it wasn’t bad. Now we use a different account for monthly bills that doesn’t get touched so we always have enough money and the bills are set to pay the full amount automatically.

How have you automated your finances and made your life simpler?

- Automate your finances

Extra Income, what should I do?

To Pay or not to Pay (off your debt)

I get a form of this question all the time. Should I pay off debt or invest it? Paying off existing debt is a safe bet. Think of it this way, if you are paying 19% on a credit card then by paying off that card you are saving 19% interest. That is money in your pocket every month that you can use to pay off other bills or start investing.

If you debt is low interest and/or tax deductible you may be better off by paying your monthly minimums and investing the extra money you have. Here is why..

Using debt to make money

Imagine if I told you that I would pay you 100$ tomorrow if you loaned me 90$ today? Suppose that you didn’t have 90$, but you could borrow it from a friend and pay him back 95$ next week. You would make 5$. You can do the same thing with your debt if you have a solid investment plan and some time.

According to most resources, the average return from the stock market over the long term is between 7% and 12%. If you are paying 4% on your mortgage, for example, you could take extra money and pay off that debt or you could take the same extra money and invest it. Sure, you would be paying interest on that money, but over time you will make more money investing. There would be some months where you may not, if the stock market has a bad run, but over time you should make more money.

This type of decision is not to be entered into lightly. Previous performance is no indication of future performance. That means that the stock market could make 1% over the next 30 years and you would lose money.

Additionally, it may be more important for you to be out of debt and play things safe. You may want to leave the rat race and start your own business. This is why I normally tell people to pay off their debt. It is the right emotional choice for most people, but it is possible to make more money and possibly pay off your debt sooner with the proper investment strategy.

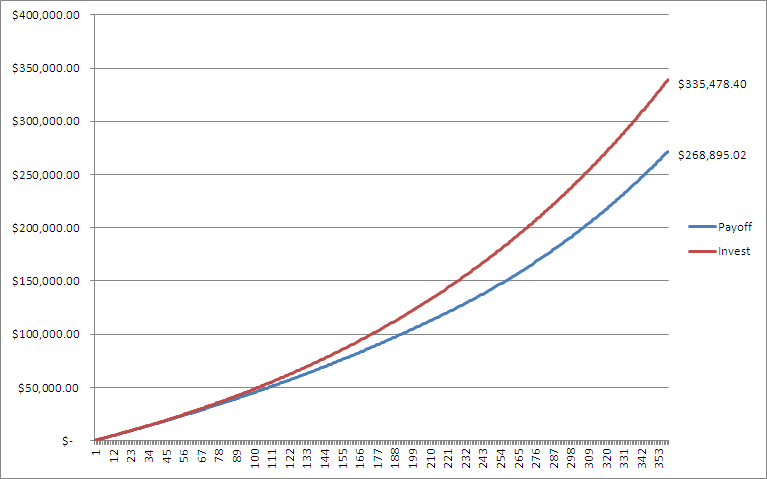

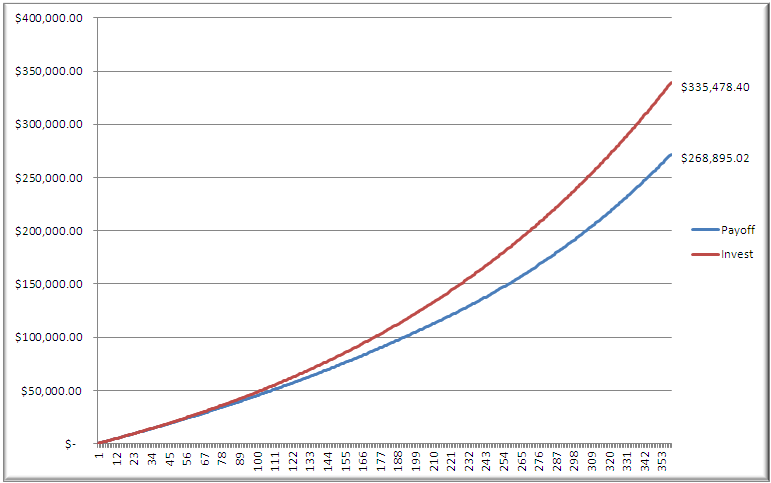

The chart below shows the difference in total value over 30 years when you invest at a conservative 6.5% instead of paying off a mortgage that has a rate of 3.5%. The numbers include the equity in the home as well as investment income. Once the mortgage is paid off the money that was being used to pay off the mortgage is then invested at 6.5%

Of course, there are many assumptions involved in these calculations. Your particular situation may be different, but many people have never even considered the benefits of not paying off their debt.

This is for informational purposes only, everyone should do their own investigation and due diligence.