Preparing for Christmas early.

Now that the Christmas season is over you may be asking yourself “How am I going to do this better next year?” Preparing for Christmas can be easy if you know what you want to do.

Now that the Christmas season is over you may be asking yourself “How am I going to do this better next year?” Preparing for Christmas can be easy if you know what you want to do.

Many of us get carried away with the “Christmas spirit” and spend more than we intended to. Maybe this is even done with the best intentions, we love the people we are buying for and we want to bless them but there are smart ways to do it and not so smart ways.

- Start a Christmas account – Many banks still offer these accounts you setup your direct deposit to do a small amount every

paycheck and then they mail you a check in October. We don’t use a traditional “Christmas” account but a simple savings account from Capital one 360. We just pull out the money we will need come shopping time. The table to the left can show you how much you can save based on your pay period.

paycheck and then they mail you a check in October. We don’t use a traditional “Christmas” account but a simple savings account from Capital one 360. We just pull out the money we will need come shopping time. The table to the left can show you how much you can save based on your pay period. - Plan ahead and buy at the right time – Prices fluctuate throughout the year depending on the product. Air conditioners are less expensive in the winter than they are in the spring. If there is a larger ticket item that you know you are going to buy for the holidays plan ahead and buy it when it is cheapest. How do you know when things are cheapest? Lifehacker had you covered.

- Determine your plan – Do you need to buy for everyone you know? Or even everyone in your family? No you don’t. You can trade names and do a secret Santa, so you can buy one gift that matters instead of a couple of dozen gift cards. We have decided to do a “Want, Need, Wear, Read” approach within our family so we are limiting the items we are exchanging. Hopefully this will prevent crap from building up in our kids’ play room.

- Work the system – This takes a little bit of work but you can buy gift cards to buy your gifts and get rewards for doing so. Our local Kroger offers discounts on gas when you spend money at groceries, including gift cards. We do most of our shopping on Amazon so we first go to the store and buy gift cards. Then we get discounts on the gas we will use to go over the river and through the woods to Grandmothers house. If you are disciplined enough you can even use a rewards credit card to get some rewards that way.

Christmas doesn’t have to be stressful if we plan ahead what steps have you taken or do you want to take in order to be prepared for Christmas next year.

Image by decar66

This post includes affiliate links to companies that may reward me if you click them.

Church Budgets

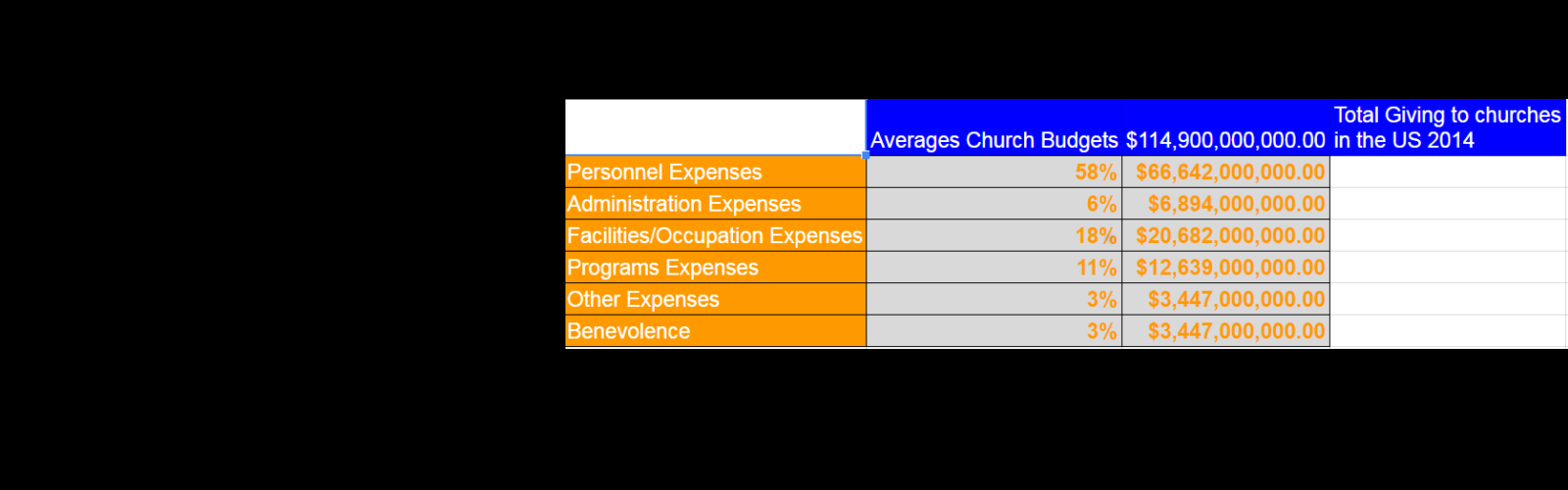

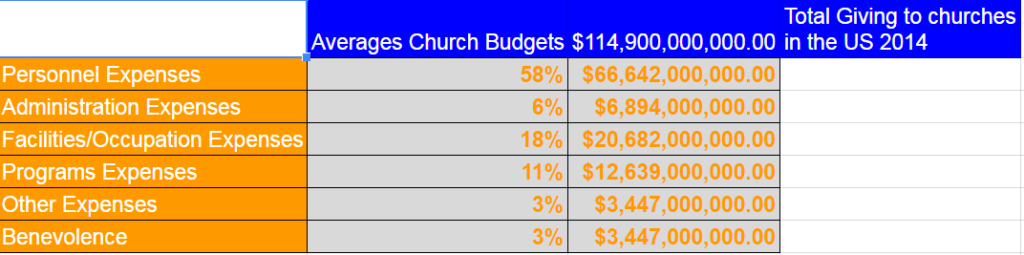

This headline grabbed my attention…According to this article from Christianity Today, quoting a report from the Giving USA Foundation, American churches collected 114.9 BILLION dollars in 2014. (Numbers not available for 2015). We look at how church budgets break down on average. As we have discussed here before most of that money goes to keep the lights on and supply for the internal structure of the churches, as opposed to benevolence giving. (giving to those in need). If the popularity of Bernie Sanders has taught us anything it is that young people are more interested in our collective monies being used to help individuals and not to perpetuate the status quo, although they don’t care that said money is taken by force.

Let’s use the number collected by the Evangelical Credit union on church budgets to determine approximately how much of that money is being spent on what:

These numbers are an average simplification therefore the number to not equal 100%.

From Evangelical Credit union

Breaking these numbers down a bit we see some interesting things.

Personnel

This includes salaries, both full and part time, pension plan contribution, other benefits and taxes paid on behalf of employees.

Administration

Office supplies, postage, travel and membership dues.

Facilities

Utilities, maintenance and upkeep, debt (Mortgage) any other debt or fees associated with the building.

Program expenses

Children and youth programs, Adult programs, evangelism and outreach efforts, (benevolence has been pulled out to its own category)

Other Expenses

Building fund and cash reserves

Benevolence

Both local and international.

The numbers seem a bit off to me, even if you allow for program expenses to be outreach a full 82% of church budgets are paying salaries, building and to keep the lights on. Spending that is is some way inward facing. That is 94 BILLION dollars being spent by churches in the US to pay their pastors, buy their buildings and run their organizations. Charitywatch.org would give us a failing rating.

Of course, Charitywatch isn’t a fair comparison because pastors and staff are not strictly overhead, they are actually doing the work of the ministry in many cases. If we assume that half of the Pastors’ salaries are not overhead, but ends of our giving then our numbers are a little better at 53%. I am not sure of the best solution here, but I have been bothered by that 82% number ever since I read it. It feels like that money is more like paying country club dues that it is advancing the work of the Kingdom of God.

This is one of the primary reasons I have been attracted to the house church or cell church models over the years, it feels like a more efficient use of our collective resources. That being said I am part of a traditional model that thinks about this regularly and doesn’t actually fit these numbers for various reasons.

What do you think about these numbers?

What’s good on paper is not always what is best for you.

Personal finance is a strange space. The people who are really into it are normally numbers people. They are really good at working out the numbers to find the one right way to do things. Every personal finance writer knows the right way to create a budget, the right amounts for an emergency account, and the right order to pay off your debt. The problem is all those things that look good on paper don’t work in real life nearly as well.

For example, there is a debate that rages among personal finance geeks over whether you should pay off your highest interest rate debt or your lowest balance debt first . The logic being that paying off the higher interest rate saves you interest in the long run, but paying off the lower balance builds emotional momentum. Most PF people including myself will argue for the mathematical advantage of paying off the higher interest rate. But, if you never get over that first hump and give up along the way it doesn’t matter if it is mathematically advantageous; doing it inefficiently is still better than not doing it at all.

. The logic being that paying off the higher interest rate saves you interest in the long run, but paying off the lower balance builds emotional momentum. Most PF people including myself will argue for the mathematical advantage of paying off the higher interest rate. But, if you never get over that first hump and give up along the way it doesn’t matter if it is mathematically advantageous; doing it inefficiently is still better than not doing it at all.

I think it is also best to give yourself a raise and reduce your tax return at the end of the year. After all I am sure you can use that money better than the government can. There is no reason to give them an interest free loan all year. Or is there? If you are the kind of person who may not use the extra money wisely and the only way you can save money is by forcing yourself to do it through your tax return, then it is the right thing for your; even if it isn’t mathematically (or politically) the best.

Personal finance is personal. Just because it is good on paper or in theory does not mean it is the best thing for you. As you begin your own personal finance journey don’t assume your life has to fit into the mold of anyone. Try what ever you need to do in order to be successful. That may mean throwing out the rules we personal finance geeks write. It may mean doing it your own way, and if you are successful you win.

Image by superfantastic

Create a budget

A budget sounds scary (or boring), but it is just a tool used for making decisions on how to spend your money when your emotions are not running crazy. It is like a map on your journey to financial improvement. If you would like more details on why you need a budget check out this article.

A budget sounds scary (or boring), but it is just a tool used for making decisions on how to spend your money when your emotions are not running crazy. It is like a map on your journey to financial improvement. If you would like more details on why you need a budget check out this article.

If you haven’t go ahead and read it now. Now, the question is “how do I create a budget?” If you have never actually had a written budget before then figuring out how to create a budget can feel confusing, but it doesn’t have to be.

When I talk with people one on one I usually recommend one or two methods depending on the preference of the individual. I will talk through both here.

Create a budget on Paper.

- Gather up all of your bills for the past month.

- If you don’t have them from last month then keep them when they come this month.

- Track every penny you spend.

- Do it in a notebook, or keep receipts of your spending or use one debit card for all spending then use the statement to actually make your budget you won’t have to guess.

- Put it down on paper.

- If you don’t want to create your own there are plenty of places to find budget templates. However, searching those out may lead to more confusion so here is a simple budget template to get you started.

- Fill in the green spaces that apply to you and the yellow column on the right will tell you what percentage of your income you are spending on any particular category.

- You may not need every single line so only use what suits you. I actually find it most useful to keep categories as broad as possible. But, you need to do what is right for you and knowing that takes experience, so play with it.

- My wife and I have gone through dozens of forms of budgets in our time of trying to organize our finances.

Create a budget with Mint.

- Mint is a free online personal finance program. (Also available on mobile platforms) It is owned by Intuit the same company that owns Quicken and many other programs. They have been in the business for a long time and they are very reputable and secure.

- Sign up for an account on mint.com

- Register your primary spending accounts

- Mint will automatically pull in your all of your account activity and automatically categorize it for you. (Watch out they are not always accurate)

- Use Mints built in budgeting feature to set up the categories for your spending. Mint will let you know how much you have left in every category. You can even set up a alerts to let you know.

Having a budget down on paper, even digital paper is the first step in getting your personal finances under control. There is something about actually writing things down that acts as a commitment device. But, understand that a budget isn’t set in stone. Month to month things may vary and you will have to account for that. For the first few months you should keep a close eye on things and maybe make adjustments as needed. You may have forgotten about something that you will need to adjust for. This is not a “Set it and forget it” kind of thing.

Image by Tax Credits

Envelope budget

Envelope budget system

My wife and I often get asked how we manage our budget on a practical level. It is all well and good to have a piece of paper somewhere telling you how much money you are supposed to spend each month, but it is much more difficult to actually manage to that budget. There are many ways this can be done. Mint.com‘s budget system will track all of your spending categories and can even alert you when you go over budget. Some people do this manually with a spreadsheet or by keeping all of their receipts. We use an envelope budget. We pull cash each paycheck and put that money into envelopes.

These envelopes correspond to various categories of our spending and when the envelope is empty we are out of money for that particular category. If there is no money in the “Eating out” envelope we eat at home. Or at least we should, we aren’t perfect. Using this method makes all the money spent more tangible, you think more about each decision to spend. It also helps us to ensure we don’t go over our budgets because in theory we shouldn’t be using our debit card, where spending is much easier to lose track of .

Advantages to the Envelope budget system

- Spending is easier to track – As I mentioned above, you know exactly how much money you have left in a particular category. You can all so put your receipts in the envelope to replace the cash to know exactly where you spent the money.

- Theoretically impossible to break – If you only spend the money that is in the envelope you will never go over your budgeted amount.

- Money easily carries over to next budget period – Money not spent during the week or month carries over ino the next time period. This allows for visual savings or if you need larger amounts like for a family hair cut.

Image by kgnixer

Drawbacks to the Envelope budget system

- You don’t always have the right envelope – We have many times decided to go out to eat after church but we didn’t bring our eating out envelope. Now we have to decide what to do? Will you deposit the money you spent from your envelope?

- You need to pull cash regularly – It is inconvenient and we often forget to pull the cash so we end up using the debit card and trying balance that by not pulling the full amount of cash.

Envelope budget apps

These are from the Google play store. Sorry I don’t use iOS but there must be some out there?

How do you manage to your budget? Are there any good apps you can recommend? Tell us in the comments below.

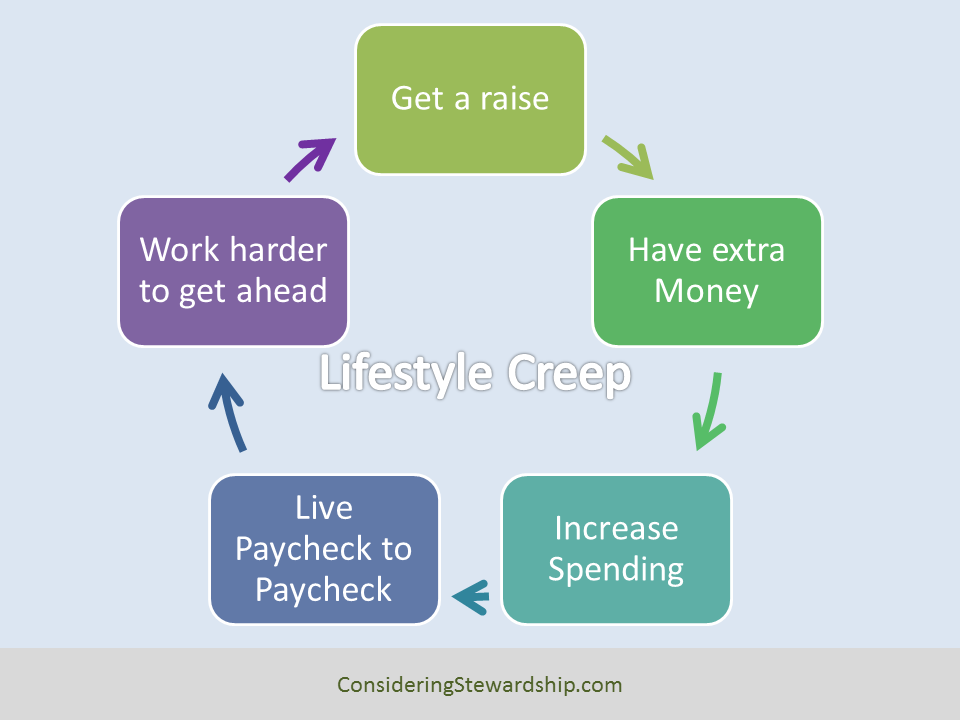

Lifestyle Creep

What is Lifestyle Creep?

Lifestyle creep is defined by investopedia as:

Lifestyle creep is defined by investopedia as:

A situation where people’s lifestyle or standard of living improves as their discretionary income rises either through an increase in income or decrease in costs.

This simply means spending more money just because you can. For most of us that comes when we get a raise. We can spend more now; we can buy the little things we have always wanted.

My wife and I have noticed that we spend more on things that we didn’t “need” before. It happens to us all, when we are forced to do so we can live on very little and be quite satisfied, remember college? What is it that happens to us that causes us to spend more later down the line? Our lifestyle creeps.

Is lifestyle creep bad?

If lifestyle creep isn’t intentional then I would argue that, yes, it is bad, because it means you are not in control of yourself and your finances. If you and your family have intentionally made the decision to improve your lifestyle or increase your budget for the right reasons, then great. I am not arguing that everyone should be living like broke college students. Most of us paid our dues, and if we have kids now they would love ramen noodles and mac and cheese for every meal it would not be healthy for anyone.

If we aren’t paying attention and lifestyle creep happens then we are not being good stewards of our money. We are just allowing it to flow whatever direction we feel like at the time. Not being careful and intentional with the money entrusted to you can cost you down the line by reducing the amount of money you can give or save.

The more expansive your lifestyle is, the harder you will be hit by financial crisis if and when it comes. If you live more simply, by definition you require less money each month. If you lose your job or have an emergency expense you will have more money to be able to handle it.

How to Prevent Lifestyle Creep.

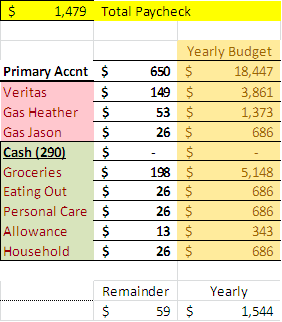

The best way I have found to prevent lifestyle creep is to automate your finances as much as possible. Direct deposit is a huge benefit for this. My wife and I know exactly how much we have budgeted and that is all that goes into our regular checking account from my paycheck. This is easily explained with an example.

This is what our actual budget looks like but I have changed the numbers a little. The $1479 would be my total paycheck. Only $650 is deposited into our primary account (The one we have easy access to). The remainder is directly deposited into a secondary account where it then transferred to other savings plans and pays our monthly bills.

The pink accounts are non-cash spending. Veritas is our church and that is automatically sent by the bank every two weeks with every paycheck

The green line items are our cash spending. We actually pull cash and put them into envelopes marked as groceries, eating out etc… There is a whole set of reasons why we settled on cash spending.

It leaves us with a little ($59) left over every two weeks. When I get my next paycheck I pull what is left over from that $59 dollars out and into a savings account. Every two weeks we are starting from scratch and keeping to the same budget.

This way even when I get my yearly raise we don’t see it in our primary spending account. Our budget changes when we decide it needs to, not simply because there is more to spend. This worked out very well when I got an unexpected bonus from work, we didn’t say “Hey, let’s spend it” In fact I forgot to tell my wife until a few months later that I got a bonus at all. (oops)

Improving your lifestyle is not a bad thing; if I lived like I did in college with my kids CPS may show up at my door. But if we are to be good stewards of our finances we should be in control. And we should be constantly looking out for things getting out of hand.

Improve your Budget

Photo by hisks

Great so now you have a budget written down and you are all ready to have your spending under control. How can you improve your budget? Pay attention to it for starters. The biggest mistake people make is to ignore the budget they have just put together. It is easy to assume that everything will take care of itself now that your monster spread sheet is put together or that you have set everything up on mint.com. But, alas, it simply isn’t that easy.

I will let you in on something, even if you used my budget template as I suggested, you forgot something on your budget. There is a bill that will come due that wasn’t part of your initial tracking period. That is OK. You will just need to adjust your budget now. Is it ok to change your budget? If it is intentional, absolutely. The problem arise when you simply overspend, without planning. You will need to adjust your budget several time until you have it to a good place and then you will, hopefully, get a raise or something else will change in your financial life that will require you to change or even rewrite your budget.

Understanding that your budget is a living document will help you not stress out when things come up that you require you to make adjustments.

What could I have forgotten?

- Did you put money aside for the Holidays? That is one of the biggest times to destroy your budget. Save money for travel, gifts and extra workout equipment to get rid of those holiday meals meals.

- Bills that don’t come due every month; Car insurance, homeowners insurance; subscription fees.

- Do you have an emergency fund? Cars need repairs, hot water tanks blow up. If you don’t want to blow your budget you need to have money put aside for these things, they will happen.

- It also helps to give yourself an allowance so you have some money to spend when you want something. Leaving yourself out of the budget will lead to burnout.

What else can you do to improve your budget?

Why do I need a budget?

“Why do I need a budget?”

When discussing personal finance or stewardship. One question comes up when I start talking about budgets.

“Why do I need a budget?”

I normally respond, “The same reason you need a map or a GPS.”

A budget tells you how you are going to get to where you want to go. Of course, that assumes you already know where you are and where it is you want to go with your money. Many people don’t. A budget will also answer the question “Where am I now?” from a financial perspective.

Why do I need a budget?

It is possible to get where you want to go without a map or a GPS if you are familiar with the area and you pay attention. However, if you are in unfamiliar territory or don’t pay close attention then it will be difficult to get from point A to B. Don’t think of a budget as a chain to keep you in line. It is a tool to achieve your goals. You can use it to get out of debt, or to give more to those in need or what ever goal you feel called to.

How can I set up a budget?

Setting up a budget can take many forms and I will talk about them at length on this site. But, first I want to give a general overview of the concept.

Know where you are.

Many people I talk to about their finances don’t have a very good idea of where they stand financially. I ask them to keep track of every penny for thirty days and to break down their spending in to different categories. This can be done in a notebook, on a smartphone or with something like mint.com but doing it will give you some good information.

- You will know where your money is going.

- You will know where it isn’t going. (Which can be just as important)

- You will know if you are spending more than you are making regularly.

These answers will give you a good idea of where you are financially. It may not be a pretty picture, but it is your picture and now you know what you can do to improve it or overhaul it completely.

Know where you want to be.

You really can’t make a plan until you know where you want to be. Do you want to spend less so you can get out of debt? Do you want to be able to give more to your church or ministry? Do you want to stop losing ground and spend less than you make?

These decisions are, of course, very personal ones and it is something you will need to decide on your own (with your spouse) or with good council. Getting an outside opinion can be embarrassing but I have found that asking someone who isn’t emotionally involved in the details can often offer insight you wouldn’t have gotten otherwise.

Image by duchesssa