Create Wiggle Room in your Budget

Creating wiggle room in your budget.

Creating wiggle room in your budget.

So you have just created your budget and you now you want to get started in paying off your debt, but you don’t think you have enough extra money to really make a difference. Well, this step is about finding ways to create some wiggle room in your budget. Doing this requires dedication and sacrifice.

Here are some ideas; your goal in this step is to try at least 5. The more effort you put into this step the faster it will be to pay off your debt.

1. Get more in your paycheck instead of in your refund. By using this IRS calculator you can find the real amount you should have withheld from your paycheck. Use the extra money to start paying off your debt.

2. Take the Chicken Challenge – The Chicken Challenge was coined by the Cord Killers Podcast. Call your cable company and tell them you want to cancel your cable. Worst case is you actually cancel it and live off netflix or hulu, more than likely they will cut your bill.

3. Take a look at your cell phone bill, look at other carriers like republic, or PCS wireless or any other smaller carriers that may give you a smaller bill each month.

4. Look over this list of 100+ ways to save money.

5. Get creative, if you are serious about getting your financial life under control then you may have to do things you have never done and make sacrifices you have never made to be successful.

6. Stop eating out for a month

7. Suspend any other subscriptions that are costing you money each month.

Image by svilen001

What is a 401(k)?

What is a 401(k)?

Photo by 401k 2013

As I have written previously I work with a lot of college students in our church as a part of my ministry there. There are always questions about 401(k)s; What they are how they work. The fact is that many people simply don’t understand this very important retirement vehicle.

So, what is a 401(k)? It is a savings plan named after the section of the law that created it. It allows an employee to take a portion of their pre-tax income, up to $17,500 for 2013,(Those over 50 are allowed to add $5,500 to that amount) to a qualified employer sponsored investment plan. Many employers choose to match their employees contributions to some degree adding additional money to the pot.

So, what do those things mean? Pre-tax dollars means that the money contributed to your 401k are not counted as income when you are taxed. If your paycheck was $1000 and you contribute $100 to your 401k then you only pay taxes on $900. ($1000-$100) This allows you to save money up front on taxes. Because you will pay taxes on the money when you retire it is called a tax deferred plan. This also begs the question “Will taxes be higher now or when I retire” I would guess taxes have no where to go but up since we are only paying for 2/3 of the government we have now and we will eventually have to pay for the remainder.

Employer match

This is one of the sexiest aspects of the 401k plan. With the average 401k plan employers contributed 4% of the employee’s salary most commonly in the form of a direct match. An employer will match dollar for dollar every dollar an employee contributes up to a certain percent, the average is 4%. Meaning that if Joe contributes 4% of his paycheck to his 401k the company contributes the same amount to his 401k. This work out to be a 100% return on investment; Joe doubles the money in his 401k.

Not all employers do a direct percentage match some match $.50 on the dollar or some other amount but knowing how your 401k plan works is important to making the most of your plan. As in our above example Joe’s employer matches up to 4% of his salary. This means that if Joe is contributing less than 4% to his own retirement then he leaving his employers money on the table.

Getting your money out of your 401(k)

Getting your money out of a 401(k) can be difficult or have penalties depending on the circumstances of your plan. Traditionally, you can only make withdraws from a 401(k) under certain circumstances.

- When the employee retires, becomes disabled or is no longer employed by the employer who sponsored the plan.

- The employee hits age 59.5

- The employee experiences a hardship as defined under the plan, if the plan permits hardship withdrawals

- Upon the termination of the plan

With some plans it is possible to take a loan of 50% of the vested value of the account but not all plans allow for this option.

Summary

A 401(k) is a retirement plan that has some great aspects and that also has some drawbacks.

Pros:

- Most employers contribute additional money to the retirement of the employee.

- Tax benefits.

Cons:

- Mandatory withdraws at age 70.5

- Taxes are likely to be higher when you actually have to pay them on the money in the account unless you believe you will be in a lower tax bracket when you are pulling money from your account.

Obviously, I can’t cover everything there is about 401(k)s but hopefully this gives a basic idea about what they are and how they are used.

Photo by 401k 2013

Amazon Subscribe and Save

Most people know about Amazon. Many people order electronics, books and toys from the E-tailer. Fewer people know that you can order all sorts of household items from Amazon. We order most of our non-perishable household supplies from amazon as well.

Amazon started from an online bookseller in 1995 to being one of the largest internet companies in the world selling everything from books to furniture. Amazon has prices lower than most stores and they often deliver free to your door (if you have a prime membership or order $25 or more in qualified products).

But Amazon Subscribe and Save is almost a secret compared to other offerings by the online giant. If you can plan carefully it can save you a ton of money.

What is Amazon Subscribe and Save?

Amazon Subscribe and Save is a subscription ordering service. You set up a subscription to have a product delivered in 1-6 month intervals and receive an additional 5% off your purchase. If you have 5 orders arrive on the same monthly subscription delivery date you save an additional 15% off your entire order. This is where the planning comes in. Take a look or keep track of what you are buying and how often.

What is available in Amazon Subscribe and Save?

What all is available from Amazon by subscription? Almost everything! Non-perishable grocery products, cleaning supplies, baby supplies diapers, cat food and dog food almost everything you could want that doesn’t grow on trees. You can see the vast selection here. If there are products that you buy regularly you should compare prices to amazon.

Keep an eye out

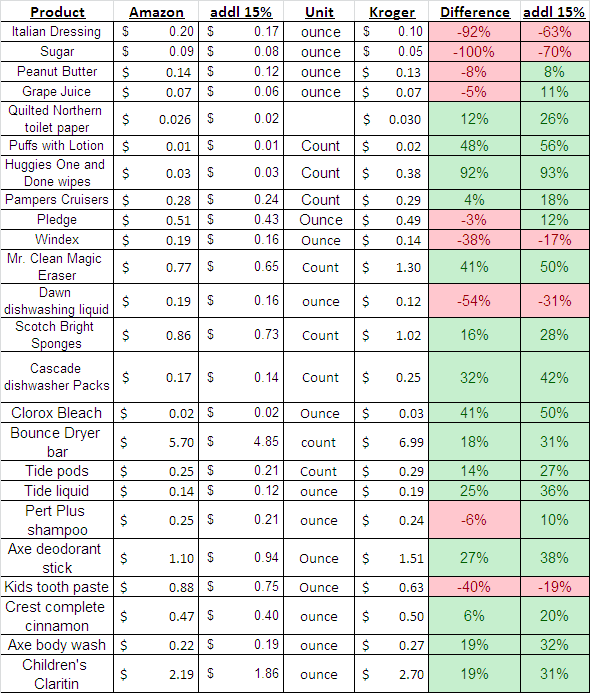

Just as many with many deals, you have to watch carefully. Just because you are buying in bulk or subscribing does not mean you are always getting the best deal. In preparation for this article I took a walk through our local Kroger and compared the prices on Amazon. While some prices were great savings others items were cheaper at the store. There were a few items that would be a better deal on Amazon if timed correctly to enable the additional 15% savings for having 5 items delivered at the same time.

Here are the prices I reviewed. Red means Amazon was a higher price; green indicate Amazon had a better price.

This article contains affiliate links. Cover Photo by 401(K) 2013