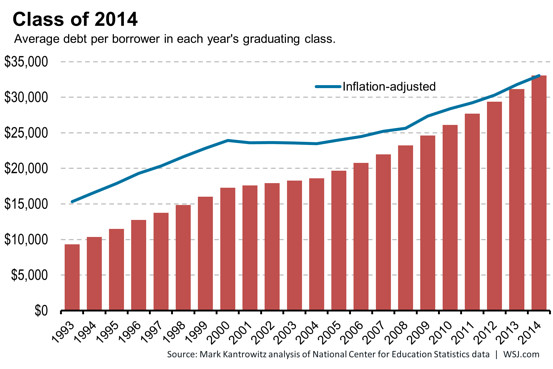

Congratulations to Class of 2014, Most Indebted Ever

The Wall Street Journal says “As college graduates in the Class of 2014 prepare to shift their tassels and accept their diplomas, they leave school with one discouraging distinction: They’re the most indebted class ever.”

I have often wondered if my choice to go back to school was a good one based on my situation. I was 32 and had no degree to speak of, but I was already deep into a career that required a degree. I was very fortunate to get into IT work during the boom when all you needed was a warm body and some aptitude. (which thanks to my parents getting me a C64 when I was 8, I had in spades) Did I really need to go back to school? Probably not, I took on some debt to do it although because of the program I was able to complete my degree in from 0-BA in two years. In working with a lot of college grads who are now turning to a bleak job market I have to wonder how much longer we will swallow the bitter pill of college.

There are some careers are always going to need a degree, but it seems like apprentice programs and boot camps would serve many people better in the log run. If you are going to take out a small mortgage for a career that pays $30,000 a year it isn’t a good investment or good stewardship of your money. I hope things turn around before my girls are old enough to face this ever growing mountain of debt.

HT to: http://ift.tt/UVpGPS

Christmas Spending Is a Test of Your Treasure

David Mathis over at Desiring God wrote a great article about how we regard money this time of year. It is worth the read just to challenge yourself on the idolatry of money. It is really hard to not spend money on things this time of year. But we are not called to spoil ourselves or our children. We are called to honor Christ. I do believe you can do that by giving gifts because that reflects the time when God gave the gift of himself but it is a fine line to not go overboard.

Not only are we on gift-expectation overload with Christmas, but then comes the year’s end and that one last chance for tax-deductible charitable giving. December bids us dig deeper in our wallets than any other season.

HT to: http://ift.tt/12OET8W

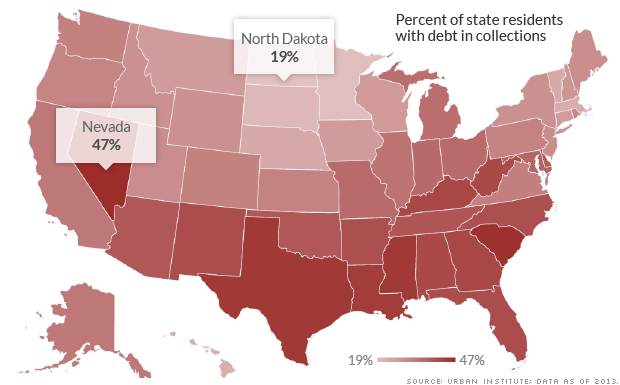

1 in 3 American adults have ‘debt in collections’

This is a pretty scary number. This is why being a good steward of your finances is so important.

Debt in collections by state

Americans have a debt problem. An estimated 1 in 3 adults with a credit history — or 77 million people — are so far behind on some of their debt payments that their account has been put “in collections.” That’s a key finding from a new Urban Institute study.

HT to: http://ift.tt/1nC2iSX