Simple steps to financial stability

There are very simple biblical steps you can follow for financial stability. There are other steps that could be included but these are the most central biblically based steps everyone can try for.

There are very simple biblical steps you can follow for financial stability. There are other steps that could be included but these are the most central biblically based steps everyone can try for.

- Work hard

Col 3:23-24 Whatever you do, work at it with all your heart, as working for the Lord, not for human masters, 24 since you know that you will receive an inheritance from the Lord as a reward. It is the Lord Christ you are serving.

One of the biggest steps in creating financial stability is to learn to work hard. I don’t mean physically working hard, but as the Bible says whatever you do, do it will all of your heart. While hard work alone is no guarantee of financial stability lack or of a good work ethic will almost certainly lead to instability.

- Spend less than you make.

Prov 22:7 The rich rule over the poor, and the borrower is slave to the lender.

If you are in debt you are serving someone else. While the Bible does not specifically prohibit debt, it does warn against it in many ways. We can not live long spending more than we make, we are not congress.

Prov 6:6 Go to the ant, O sluggard; consider her ways, and be wise. Without having any chief, officer, or ruler, she prepares her bread in summer and gathers her food in harvest. How long will you lie there, O sluggard? When will you arise from your sleep? A little sleep, a little slumber, a little folding of the hands to rest, and poverty will come upon you like a robber, and want like an armed man.

The ant prepares for tough times. We must know that emergencies come up, bad things happen and we need to be able to prepare for them. If we are not spending less than we make we will never be able to prepare for our own emergencies let alone help others with theirs.

- Give generously

Deut 15:10 – Give generously to them and do so without a grudging heart; then because of this the LORD your God will bless you in all your work and in everything you put your hand to.

There are so many passages of scripture that call us to give generously that I can’t go into them all here. But we are not called to a specific amount or percent but to give generously, cheerfully, and as you have decided in your heart. If you are reading this then you are incredibly blessed and while the world wants to talk a lot about privilege the Bible does talk about grace and reminds us that as we have been freely given to we should freely give. We should be a people marked by generosity because it is a proof of our faith. (2 Cor 8)

What is Stewardship?

What is Stewardship?

Depending on where you are from, stewardship either means taking care of the earth or the campaign you run to build a new church building. Stewardship is the management of resources that do not belong to you. Financial managers, people who have power of attorney, even employees are all tasked with managing things that they don’t own.

Depending on where you are from, stewardship either means taking care of the earth or the campaign you run to build a new church building. Stewardship is the management of resources that do not belong to you. Financial managers, people who have power of attorney, even employees are all tasked with managing things that they don’t own.

Christians understand, we are bought with a price and we are not our own. (1 Cor 6:19-220) Christ purchased us with is own blood and he has blessed us with the ability to gain wealth. Wealth that is not our own, but his and we should use it to honor him.

Where we miss Stewardship?

There are few places we completely miss it on the call to stewardship:

- Just missing it: There are people who don’t realize that being a Christian affects all areas of you life, including your wallet and how you handle money. Maybe they just haven’t read the Bible and their church doesn’t teach it because they may offend people. Either way they just aren’t aware that the Bible calls you to be a steward of God’s resources.

- It’s my money: Yes, you work hard for your money. You spend time away from your family and sacrifice for your money. But you are only a steward of what God has entrusted to you. He has given you the ability to gain wealth (Deut 8:18). He has put you in the place to be where you are. Think of all the things that were outside of your control, but in God’s, to get you where you are.

- The Government is not Charity: Voting for money to be taken from one group and given to another is not charity it is theft. God called us to give, and care for the poor. He didn’t call us to force someone to do it. Render unto Caesar what is Caeser’s is a call to obedience but not an excuse to not give and steward your money properly.

- Lack of skills: You just weren’t taught about money and how it works. You don’t know how to properly plan for your money and create a budget. Stick around here and I will help you with that. Check out our self paced budget course.

Stewardship is a call to all of us, to be wise with our money and sacrifice “more” so others do not have to do without. Apart from all the political excuses, it is a shame that we have large expensive buildings and homes while people go hungry.

Increase your clarity and creativity by brain hacking

Ben Hardy again challenges us to change our routine so we can change our outcomes. I am also downloading his checklist of most effective techniques to see how effective they are. Anyone up to the challence with me?

https://medium.com/the-mission/this-10-minute-routine-will-increase-your-clarity-and-creativity-7ce61b11c2f9#.mbzddgd35

Save 20+ Hours Per Week

Being a good steward of your time means finding ways to do things better. This article by Benjamin P. Hardy has some great information on getting the most out of your time.

https://medium.com/the-mission/this-morning-routine-will-save-you-20-hours-per-week-c3088cd2c685#.r7drvuhj9

Self Paced Email Course

Want help putting a budget together? Check out our self paced email course. This course will walk you through the process step by step. The best part is that it is free and you can do it at your own pace. When you are finished with a lesson you let us know and we will send you the next lesson. No getting behind on daily tasks!!

The Three Marriages

The three marriages most of will face, hopefully, they will be with the same people. Here they are with survival tips…

Your First Marriage

For the majority, this is what we think about as a traditional marriage. It is the first of our three marriages. We are young, single, perhaps no kids and we find the person we want to spend the rest of our lives with. If you are married you know that first year of marriage can be rough. If you aren’t married yet, have not doubt, adjusting to your new life as one can be rough.

For the majority, this is what we think about as a traditional marriage. It is the first of our three marriages. We are young, single, perhaps no kids and we find the person we want to spend the rest of our lives with. If you are married you know that first year of marriage can be rough. If you aren’t married yet, have not doubt, adjusting to your new life as one can be rough.

This will be your first marriage. Determine how you will decide on the little things that shape the way your family will operate for the coming years.

Trouble Spots:

- There will be fights about nothing or silly junk

- Adjustments as you both learn how your family will operate. (Hint: it won’t be exactly the same as the family you came from)

- Stress about how you handle money, this is a subcategory of of the others two but it can be a very big deal.

Survival Steps:

- Pray for one another and for your marriage.

- Determine now how you will work through those tough times.

- Create a safety word that allows either of you walk away before your anger leads to sinful behaviour.

- Apologize and repent quickly and often, this builds a solid Gospel based habit between you.

- Men: Keep doing what you did to win her, keep pursuing her.

- Women: Assume positive intent from your husband. He probably isn’t trying to anger you.

Your Second Marriage

Kids; Nothing will throw off your marriage like kids. The two of you are no longer the only members of your family. I still believe you should be the center, but it will look differently than it did in your “First marriage”. I say that your relationship should be the center because if you aren’t intentional about maintaining your relationship with your spouse your may not make it to the last of your three marriages.

Of course I know that some people have marriage one and two at the same time and God bless you, I have no idea how you make it work. I have asked for a friend, who has a great marriage like this, to write something on that but haven’t heard back from him yet.

Trouble Spots:

- Kids are going to demand your attention and make you tired.

- Work, church, kids activities will fill your life.

- During this time the “Seven Year” itch comes into play. The infatuation you feel can wane and you need to be determined to love your spouse anyway.

Survival Tips

- Make time for each other, keep a date night. Be intentional.

- Activities will keep you busy keep your family rooted in your church and the Gospel of Christ.

- Repent to your kids when you sin against them show them the gospel in your life.

Marriage Three

I have seen many strong marriages completely fall apart when the kids leave the house. Parents suddenly look at one another and realize they are more than parents. This may be the toughest of the three marriages because of the many transitions happening at once. Of course, I am speaking to this only from an outside perspective. My wife and I are in our second marriage and have years before we hit this phase.

Trouble Spots

- Sudden lack of busy-ness can bring your hidden issues into sharp focus and even amplify them.

- The empty nest may force you to face struggles you’ve had from the beginning of your marriage you have been able to ignore because the kids helped you avoid them.

- Each of you may have trouble with your own identity now that your parenting role is changing. Who are you when you are not being a parent.

- For many couples, the second half of marriage packs a 1-2-3 punch of physical, social, and emotional change according to Mary Jo Pedersen author of For Better, For Worse, For God: Exploring the Holy Mystery of Marriage

Survival Tips

- Be aware of your own sinful tendencies; they may be amplified. Don’t be ashamed to seek professional Christian counseling during this transition.

- Get involved in social activities together, church groups etc. where you can create new shared experiences with one another instead of growing more isolated.

- Be intentional about your plans. What do you want to accomplish together in this new time together?

What other obstacles or tips do you have for these various marriages?

This article contains affiliate links if you purchase through those link I will receive a percentage of the purchase.

Preparing for Christmas early.

Now that the Christmas season is over you may be asking yourself “How am I going to do this better next year?” Preparing for Christmas can be easy if you know what you want to do.

Now that the Christmas season is over you may be asking yourself “How am I going to do this better next year?” Preparing for Christmas can be easy if you know what you want to do.

Many of us get carried away with the “Christmas spirit” and spend more than we intended to. Maybe this is even done with the best intentions, we love the people we are buying for and we want to bless them but there are smart ways to do it and not so smart ways.

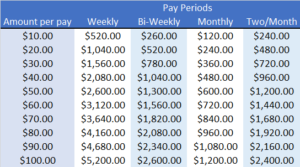

- Start a Christmas account – Many banks still offer these accounts you setup your direct deposit to do a small amount every

paycheck and then they mail you a check in October. We don’t use a traditional “Christmas” account but a simple savings account from Capital one 360. We just pull out the money we will need come shopping time. The table to the left can show you how much you can save based on your pay period.

paycheck and then they mail you a check in October. We don’t use a traditional “Christmas” account but a simple savings account from Capital one 360. We just pull out the money we will need come shopping time. The table to the left can show you how much you can save based on your pay period. - Plan ahead and buy at the right time – Prices fluctuate throughout the year depending on the product. Air conditioners are less expensive in the winter than they are in the spring. If there is a larger ticket item that you know you are going to buy for the holidays plan ahead and buy it when it is cheapest. How do you know when things are cheapest? Lifehacker had you covered.

- Determine your plan – Do you need to buy for everyone you know? Or even everyone in your family? No you don’t. You can trade names and do a secret Santa, so you can buy one gift that matters instead of a couple of dozen gift cards. We have decided to do a “Want, Need, Wear, Read” approach within our family so we are limiting the items we are exchanging. Hopefully this will prevent crap from building up in our kids’ play room.

- Work the system – This takes a little bit of work but you can buy gift cards to buy your gifts and get rewards for doing so. Our local Kroger offers discounts on gas when you spend money at groceries, including gift cards. We do most of our shopping on Amazon so we first go to the store and buy gift cards. Then we get discounts on the gas we will use to go over the river and through the woods to Grandmothers house. If you are disciplined enough you can even use a rewards credit card to get some rewards that way.

Christmas doesn’t have to be stressful if we plan ahead what steps have you taken or do you want to take in order to be prepared for Christmas next year.

Image by decar66

This post includes affiliate links to companies that may reward me if you click them.

Keeping Christmas Under Control

It is that time of year. People start thinking about Christmas shopping about this time. If you haven’t been keeping a Christmas fund already you may be thinking “How will I handle this?” How do we let the whole year go by without making plans to keep Christmas under control.

It is about Jesus…

Remember the true point of Christmas. It is a celebration of our Lord Jesus not our Lord Materialism. Create traditions with your children that will point your children toward the Gospel of Jesus Christ. We always do a birthday cake for Jesus on Christmas eve, for example. We have always based our gift giving on the idea that God has given his greatest gift to us and so we give gifts as a reminder of that Gospel truth. What type of ideas do you have to keep it simple and focused on Christ?

Christmas Under Control

For Christians Christmas shouldn’t be about materialism. The average American expects to spend $882 dollars on Christmas this year according to the American Research Group. All too often our culture pushes us toward worshiping at the retail altar. If you train your children early to appreciate the little things you are off to a good start. There is no reason to try to buy your children’s affections once a year.

For Christians Christmas shouldn’t be about materialism. The average American expects to spend $882 dollars on Christmas this year according to the American Research Group. All too often our culture pushes us toward worshiping at the retail altar. If you train your children early to appreciate the little things you are off to a good start. There is no reason to try to buy your children’s affections once a year.

- Set a budget – Determine how much money you can afford or want to afford before you open up amazon. We have a free budget sheet here.

- Something they want, something they need and something to read – This three point idea will help you keep things under control

- Secret Santa – If you have a larger family or group you feel you need to buy for then offer the idea of exchanging names and only buying for one or two people.

- Free gifts – Never forget the power of things that can’t be bought. Free babysitting coupons for a night out can be priceless.

Keep a running list…

If you are like me you freeze up when it comes to actually buying the gifts. We have the money, we planned for it but what does my wife actually want? I have taken to keeping a running list of anything my wife mentions or anything I think she may like throughout the year. This way I don’t have to worry too much when it comes to thinking for ideas.

What ideas do you have on keeping Christmas real? Put it in the comments..

No Spend Month

No Spend Month

My Wife and I are calling for a No Spend Month for August. Why? We let a few things get away from us. We had used our credit card in an attempt to build up some reward points and in the process over spent. We had carried a balance for a few months and decided to bite the bullet and pay it off. Fortunately for us we have the money to pay it off in another account, I just like having money in the bank.

So, in order to replace the money from that account we have decided to do our “No Spend Month.” What does that mean? We normally have budget allowances for categories like eating out, clothes, Christmas, and other but for this month all of that money is going to pay back our the money we used to pay off that Credit card.

Last night was the first time we were challenged. The girls are out of town and normally that means we go out to eat and treat ourselves. Last night we didn’t allow ourselves to do it. We went to the park and played Pokemon Go. We went home and my wife shopped and gotten us nicer meals for home than usual, but they came out of our grocery budget, which isn’t part of our “No Spend August” (Hey, you gotta eat)

We looked for ideas to do that didn’t cost us any extra money. Play a game, binge a show on Netflix, swim in our pool (no kids makes is peaceful). We even helped one another make plans to be successful in our respective goals.

Do you need a No Spend Month?

Even if you didn’t overspend there are some benefits to doing your own No Spend Month.

- It will help you live conservatively – We all need a reminder that this is possible every once in awhile.

- It will help you reach your goals faster – All that extra money you don’t spend can go right toward your goals

- It helps you realize you don’t need as much as you think – You can survive without spending that extra money.

- It will draw your family together – Think of creative ways to accomplish this as a family and do it together.

Don’t know how you could do it. Try these articles and give your ideas in the comments below.

http://www.livingwellspendingless.com/31-days/livingwellspendingzero/

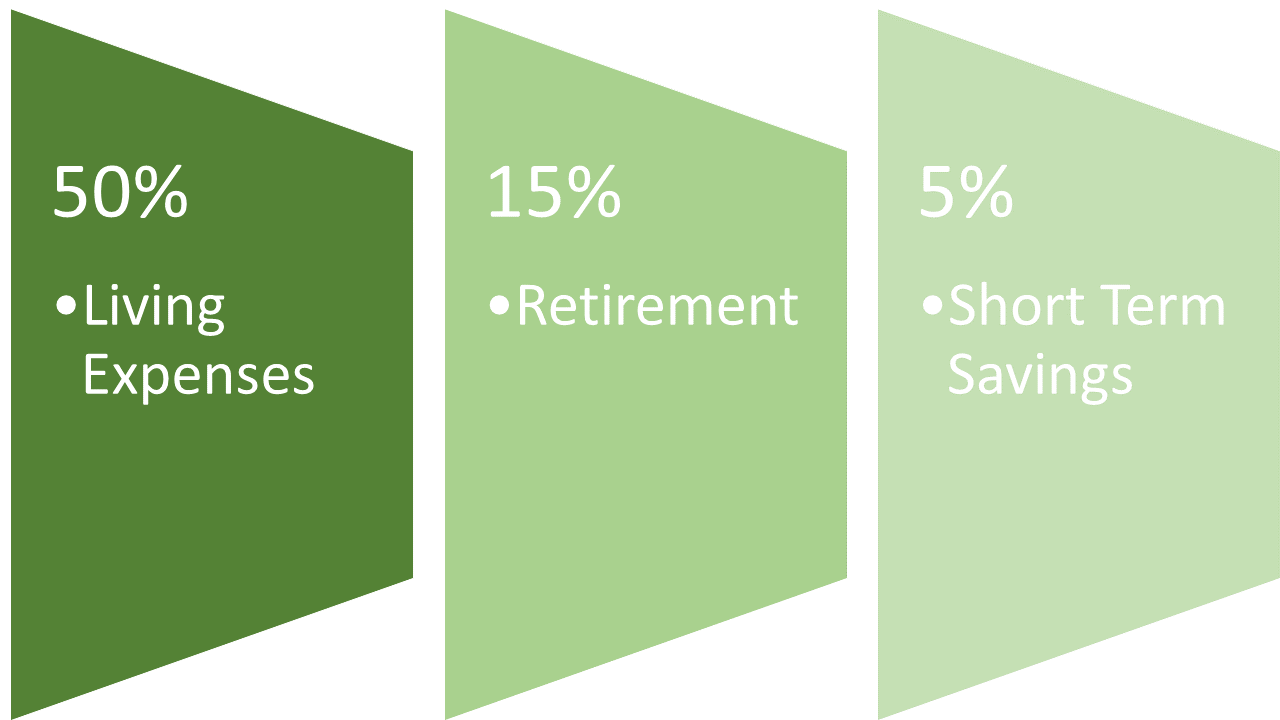

50/15/5 Rule

I have recently gotten an email from Fidelity introducing a concept they call the 50-15-5 rule. You live on 50% of your income invest 15% in retirement and 5% in short term emergency savings. Of course, that is only 70%. The remainder can be used on what you like, according to Fidelity, paying off debt, or investing more.

gotten an email from Fidelity introducing a concept they call the 50-15-5 rule. You live on 50% of your income invest 15% in retirement and 5% in short term emergency savings. Of course, that is only 70%. The remainder can be used on what you like, according to Fidelity, paying off debt, or investing more.

This is a great idea if you have the disposable income. Many people don’t have that kind of luxury. It did help me see I am not putting enough away for retirement. Lifestyle creep has worked its way into my life and my budget. Extra money I have been earning over the years is eating into my budget and not being used intentionally.

If you have trouble keeping to a budget this may be an easier way to go. You put away your savings mark off 50% of your income and spend it to live. The other 30% you can use for discretionary items, like giving. It would be easier than doing a zero based budget or some other method if you are aren’t a numbers persons.

I have been examining different budget methods. I am a numbers geek, but not everyone is. There are many other methods out there to use to control your spending. If one of them works for you then use it. Just be intentional about stewarding your money.