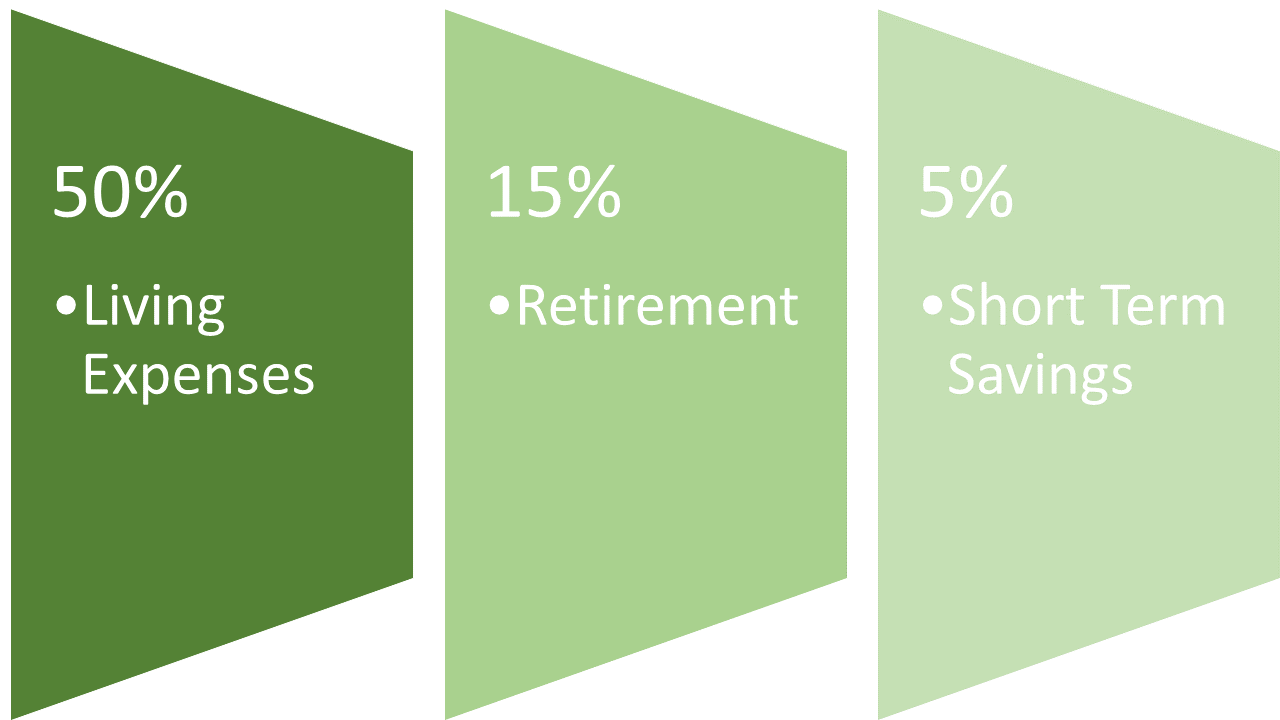

50/15/5 Rule

I have recently gotten an email from Fidelity introducing a concept they call the 50-15-5 rule. You live on 50% of your income invest 15% in retirement and 5% in short term emergency savings. Of course, that is only 70%. The remainder can be used on what you like, according to Fidelity, paying off debt, or investing more.

gotten an email from Fidelity introducing a concept they call the 50-15-5 rule. You live on 50% of your income invest 15% in retirement and 5% in short term emergency savings. Of course, that is only 70%. The remainder can be used on what you like, according to Fidelity, paying off debt, or investing more.

This is a great idea if you have the disposable income. Many people don’t have that kind of luxury. It did help me see I am not putting enough away for retirement. Lifestyle creep has worked its way into my life and my budget. Extra money I have been earning over the years is eating into my budget and not being used intentionally.

If you have trouble keeping to a budget this may be an easier way to go. You put away your savings mark off 50% of your income and spend it to live. The other 30% you can use for discretionary items, like giving. It would be easier than doing a zero based budget or some other method if you are aren’t a numbers persons.

I have been examining different budget methods. I am a numbers geek, but not everyone is. There are many other methods out there to use to control your spending. If one of them works for you then use it. Just be intentional about stewarding your money.

About the author