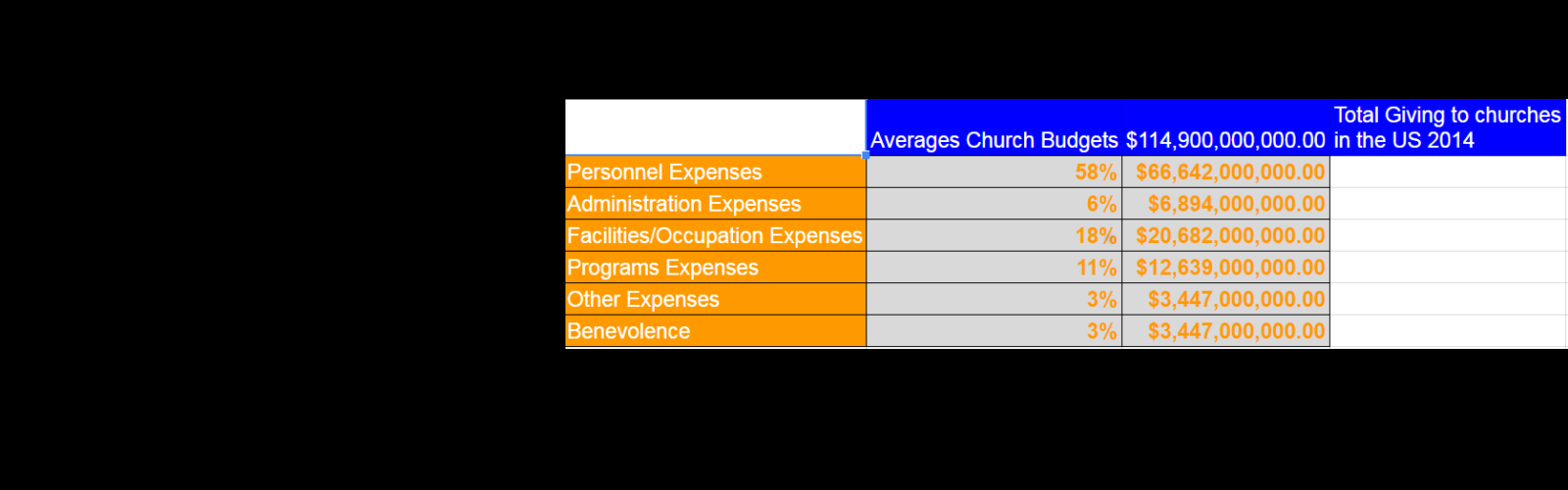

Church Budgets

This headline grabbed my attention…According to this article from Christianity Today, quoting a report from the Giving USA Foundation, American churches collected 114.9 BILLION dollars in 2014. (Numbers not available for 2015). We look at how church budgets break down on average. As we have discussed here before most of that money goes to keep the lights on and supply for the internal structure of the churches, as opposed to benevolence giving. (giving to those in need). If the popularity of Bernie Sanders has taught us anything it is that young people are more interested in our collective monies being used to help individuals and not to perpetuate the status quo, although they don’t care that said money is taken by force.

Let’s use the number collected by the Evangelical Credit union on church budgets to determine approximately how much of that money is being spent on what:

These numbers are an average simplification therefore the number to not equal 100%.

From Evangelical Credit union

Breaking these numbers down a bit we see some interesting things.

Personnel

This includes salaries, both full and part time, pension plan contribution, other benefits and taxes paid on behalf of employees.

Administration

Office supplies, postage, travel and membership dues.

Facilities

Utilities, maintenance and upkeep, debt (Mortgage) any other debt or fees associated with the building.

Program expenses

Children and youth programs, Adult programs, evangelism and outreach efforts, (benevolence has been pulled out to its own category)

Other Expenses

Building fund and cash reserves

Benevolence

Both local and international.

The numbers seem a bit off to me, even if you allow for program expenses to be outreach a full 82% of church budgets are paying salaries, building and to keep the lights on. Spending that is is some way inward facing. That is 94 BILLION dollars being spent by churches in the US to pay their pastors, buy their buildings and run their organizations. Charitywatch.org would give us a failing rating.

Of course, Charitywatch isn’t a fair comparison because pastors and staff are not strictly overhead, they are actually doing the work of the ministry in many cases. If we assume that half of the Pastors’ salaries are not overhead, but ends of our giving then our numbers are a little better at 53%. I am not sure of the best solution here, but I have been bothered by that 82% number ever since I read it. It feels like that money is more like paying country club dues that it is advancing the work of the Kingdom of God.

This is one of the primary reasons I have been attracted to the house church or cell church models over the years, it feels like a more efficient use of our collective resources. That being said I am part of a traditional model that thinks about this regularly and doesn’t actually fit these numbers for various reasons.

What do you think about these numbers?

Giving Differently

Thought like this should make us think about how we help the poor in our context. There is evidence that giving cash directly to the poor may do more for them than expensive programs meant to do for them what we feel they can’t do for themselves. What are your thoughts?

What’s good on paper is not always what is best for you.

Personal finance is a strange space. The people who are really into it are normally numbers people. They are really good at working out the numbers to find the one right way to do things. Every personal finance writer knows the right way to create a budget, the right amounts for an emergency account, and the right order to pay off your debt. The problem is all those things that look good on paper don’t work in real life nearly as well.

For example, there is a debate that rages among personal finance geeks over whether you should pay off your highest interest rate debt or your lowest balance debt first . The logic being that paying off the higher interest rate saves you interest in the long run, but paying off the lower balance builds emotional momentum. Most PF people including myself will argue for the mathematical advantage of paying off the higher interest rate. But, if you never get over that first hump and give up along the way it doesn’t matter if it is mathematically advantageous; doing it inefficiently is still better than not doing it at all.

. The logic being that paying off the higher interest rate saves you interest in the long run, but paying off the lower balance builds emotional momentum. Most PF people including myself will argue for the mathematical advantage of paying off the higher interest rate. But, if you never get over that first hump and give up along the way it doesn’t matter if it is mathematically advantageous; doing it inefficiently is still better than not doing it at all.

I think it is also best to give yourself a raise and reduce your tax return at the end of the year. After all I am sure you can use that money better than the government can. There is no reason to give them an interest free loan all year. Or is there? If you are the kind of person who may not use the extra money wisely and the only way you can save money is by forcing yourself to do it through your tax return, then it is the right thing for your; even if it isn’t mathematically (or politically) the best.

Personal finance is personal. Just because it is good on paper or in theory does not mean it is the best thing for you. As you begin your own personal finance journey don’t assume your life has to fit into the mold of anyone. Try what ever you need to do in order to be successful. That may mean throwing out the rules we personal finance geeks write. It may mean doing it your own way, and if you are successful you win.

Image by superfantastic

How to help kids manage money

How do you help your kids manage money? This is an article where I don’t think I have the one right answer. My girls are still young and have trouble understanding the value of money. We have tried a few things to help them get the concept, but I think these ideas are all part of the whole and not magic cures in and of themselves.

How do you help your kids manage money? This is an article where I don’t think I have the one right answer. My girls are still young and have trouble understanding the value of money. We have tried a few things to help them get the concept, but I think these ideas are all part of the whole and not magic cures in and of themselves.

We are open about money with our kids.

My wife and I have been fairly open about how money works and the value of it. (Although because kids talk I still haven’t told them how much I make.) We explain that everything costs money and how much. I explain that God has blessed me with a job to be able to pay for our home and our food. We tell them how we give to the church regularly and the other ministries we sponsor. My wife takes them shopping and they understand the cost of items. When they ask why things cost money I explain how capitalism should work and how it should be a win-win for everyone. They have a few business ideas I need to encourage because of these conversations and a few episodes of Shark Tank.

We give them their own money

Well they work for it. They earn tickets for doing their chores which can be traded in for money or screen time. Their money is divided into a three part bank for giving, spending and saving. Any money is spending is theirs to do with that they please. (Although it is really hard when they want to buy crap.) Saving money must be targeted to a larger purchase they are working towards. Their giving must be directed outside of our home to church or to something else like the girls we sponsor through compassion international.

This is hopefully setting a pattern in their life. They are able to save money and delay gratification. They love to give money to good causes and have even thought of a few creative causes on their own. This is great because it gets them thinking about someone besides themselves.

We show them the water

You remember the saying, you can lead a horse to water? We show our kids the wise choices and explain them to them as best we can but we still let them make bad choices. “You can buy ice cream from the truck or you can buy a whole box from the store at the same price.” It seems to be working more and more as our older daughter is talking to us about her thought process and the smarter choices. I am sure they won’t always make the right choices but who does? We have let them suffer the consequences of their bad habits so they will hopefully learn a lesson down the road.

Did you parents do anything to help you understand money? What worked what didn’t work? What will you do with your kids? I really want to know because I don’t have the answers on this one.

Image by goodncrazy

7 Stewardship Principles

There are certain stewardship principles that encompass all other tips we can express. They are not sure fire paths to riches but principles that should guide any Christians view of money.

There are certain stewardship principles that encompass all other tips we can express. They are not sure fire paths to riches but principles that should guide any Christians view of money.

- Be generous first – Deuteronomy 26 calls for a sacrifice of the first fruits of the harvest as a sacrifice. It is a principle of the Bible to give the first to God and not to wait to give your leftovers. You will always have money for what you pay first. People often say they can’t give any money to the Gospel but it is often because they wait until after they have spent it all to think about giving.

- Pay yourself second – Similar to #1 you should pay your self second. If you wait until the end of the month to invest what is left then you will regularly find you have little or nothing left for yourself.

- Have a plan for your money – There is an old cliche that says “Failing to plan is, planing to fail.” I say it this way, “Your money will be spent somehow; you can decide where or let it to chance” You should create a plan on how all of your money is going to be spent. That doesn’t mean just when going to the store, but where you will invest it. Have a plan for all of your money. Call it a budget, or a plan but you have to know where your money is going.

- Don’t leave money on the table – We do it all the time in many ways; here is how to avoid a few of them. Negotiate on everything. You never know when it could save you some money. Make the most of your 401(k), make sure you are getting all the match you can.

- Spend less than you make – This should be obvious to anyone not in government but you can’t survive for long spending more money than you bring in. Eventually those bills will come due.

- Have an emergency fund – Start with a baby fund of $1000 or so, because everything thing that goes wrong seem to cost around $1000. And then move to having 3-6 months of expenses set aside in case you lose your job or have some other financial emergency.

- Understand your insurance needs– Insurance can be an important part of your financial plan. Depending on your situation in life you may need more or less. Insurance can prevent certain financial disasters. A cheaper premium may be cheap for a reason, so research before you do business with any company.

These stewardship principles are crucial to getting off on the right foot. In fact if you were able to stick to all 7 you would be better than 95% of people in America.

image by Dee’lite

Prevent Fights About Money in Marriage

Photo by yourdon

I have talked to many couples about money over the years and there always seems to be some tension around money within marriages. According to some evidence fighting over money greatly increases chances of divorce. It may be a testament to how powerful the love of money is in our culture.

My wife and struggled with how to handle our finances in a biblical fashion and how to handle money issues within our marriage with the grace of the gospel and we have learned a few things about preventing fights about money in marriage:

- Don’t become money Pharisees: Many church folks talk about money with a very legalistic mindset. We set hard and fast rules to live by when it comes to our money and then we experience the same guilt with money that we do with every other sin in our lives because we broke the rules. You will both make mistakes or have already and there must be grace for those mistakes just like any other sins that have been forgiven by Jesus.

- Remember to communicate: It is easy if one spouse “Does the bills” or “Handles the money” for the other spouse to feel left out especially if that spouse also doesn’t bring in any income. I have had to work very carefully to keep my wife involved and help her to know that our money is OUR money. We have gone as far as to schedule a weekly finance meeting where we go over spending, budget and planning. Mint.com creates great little graphs for my presentations.

- Create and commit to your budget together: The initial budget should be something you and your spouse decide on together. It may be a tough conversation but you can help one another by calling out the idols you have in your life around money. My wife, by nature of taking care of our home, is responsible for spending a large share of our budget that isn’t automated. She does her best to stick to the budget we agree to and we discuss it when it needs to be changed.

- No questions asked money: If you can afford it allow one another play money. If my wife wants to order a new gadget for her camera she doesn’t have to ask me she just buys it. Similarly, I don’t have to ask her when I want to go out for lunch. We each have our own accounts with direct deposits that are ours alone.

- Automate things: When possible automate savings and bills. Saving is much less painless when you don’t have to do anything to accomplish it. We have a whole article on how to do it here.

- Ask “Why do I feel this way”: We all have experiences with money that lead us to think a certain way about it. I, for example, value my savings like an idol just for its own sake. I trust that having no debt and money in the bank will save me from life’s circumstances instead of trusting in Jesus as my savior.

- Know your Role: No not that men are the breadwinners and woman should be home barefoot and in the kitchen. (Although my wife hates shoes and loves to cook). Know how your individual styles complement one another. Or know what you can and cannot do. By way of example: My wife will hold onto cash like it is gold. She will spend that $50 in her purse several times. Each time intending to deposit it to cover the purchase she just made. I ,on the other hand, will hold onto cash and spend on a card because it isn’t concrete money to me.

This list, like most of this blog, is a monument to our failures. We have learned many of these lessons the hard way. What else can you do in order to prevent fights about money in marriage?

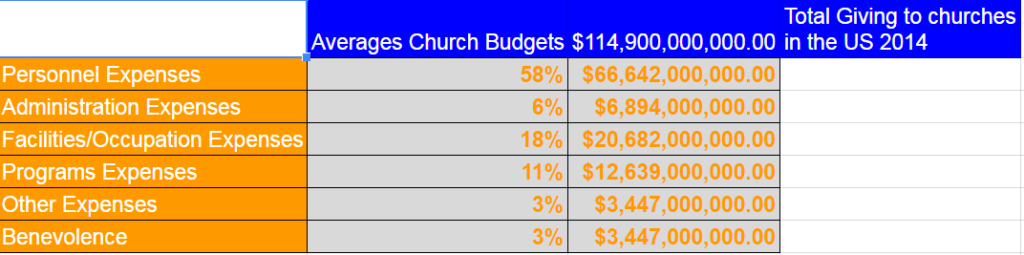

Give to everyone? Is Jesus Kidding?

Image by jorgempf

Are we really called to give to everyone? Luke 6:30 and Matthew 5:42 are two scriptures I would really like to remove from the Bible, if I am being honest.

Give to everyone who begs from you, and from one who takes away your goods do not demand them back.

I live in a city and people are begging all the time, on every freeway off ramp, on every street corner. I have been approached multiple times in parking lots with stories of running out of gas and loss of debit card, and a dead cell phone. How am I to handle these things as a Christian? These scriptures make it fairly clear that I am to give to anyone who begs (some bibles say “asks”), but Paul says that anyone who doesn’t work doesn’t eat. So, it is not as straightforward as just giving to everyone, at least I don’t want it to be.

I want to handle my money responsibly, but I also want to be obedient to Jesus and not be selfish with my money. How do we handle this dilemma. I will be upfront that I don’t know if I have a solid correct answer. This article is more about exploring the issue. If you are looking for a hard and fast answer: move along.

Why do we not want to give to everyone?

As with many things, asking why we feel a certain way can be very helpful.

- I don’t like the idea I’m being ripped off.

- I don’t want to be made a fool of.

- I don’t want to be parted with my hard earned cash under false pretenses.

I give all the time when people I know are in need because I know them and their situation. They aren’t faking it.

The gospel answers to these questions, of course, come from a proper understanding of stewardship; It isn’t my money in the first place, it is God’s. He has the right to require it of me anyway he likes, if I am to call myself a believer. Does it matter if the individual is sinning by lying to me. That is up to God to handle and he will either by forgiving them and making them his children or by allowing them to bear the punishment for their sins.

So, am I simply worried about being a bad steward of God’s money? Maybe, but them I am reminded of a story I have heard about CS Lewis.

One day, Lewis and a friend were walking down the street and came upon a begger who reached out to them for help. While his friend kept walking, Lewis stopped and proceeded to empty his wallet. When they resumed their journey, his friend asked, “What are you doing giving him your money like that? Don’t you know he’s just going to squander all that on ale (beer)?” Lewis paused and replied, “That’s all I was going to do with it.”

If I am honest, even if I gave $20 to everyone beggar on every off ramp holding a sign that says “stranded” I would still give away less money than I waste on frivolous things.

Is there a biblical reason not to give to everyone?

Money is at best a temporary solution to the issue facing the person asking. Giving money to a person on the street is a great way for us to feel better about ourselves without actually doing any good for the person we give the money to in many cases. It seems to me that in the biblical context people knew more about one another. If you saw the same person begging in the same place every day for a year you could assume they were not able to work. You could ask if you didn’t already know their story. However, in our day that is very unlikely.

Paul was pretty clear in saying that if a man doesn’t work he doesn’t eat. Laziness was not acceptable. But how do we know if that is the case if we don’t have a relationship with the people in need?

As Christians we are called to give and help above and beyond. That is why Jesus called us to give to everyone who asks. He didn’t qualify it because he knew we would look for any excuse at all to not obey.

What do you think? What are your considerations when it comes to giving to everyone that asks of you?

Rich Young Ruler

The Rich Young Ruler

And behold, a man came up to him, saying, “Teacher, what good deed must I do to have eternal life?” And he said to him, “Why do you ask me about what is good? There is only one who is good. If you would enter life, keep the commandments.” He said to him, “Which ones?” And Jesus said, “You shall not murder, You shall not commit adultery, You shall not steal, You shall not bear false witness, Honor your father and mother, and, You shall love your neighbor as yourself.” The young man said to him, “All these I have kept. What do I still lack?” Jesus said to him, “If you would be perfect, go, sell what you possess and give to the poor, and you will have treasure in heaven; and come, follow me.” When the young man heard this he went away sorrowful, for he had great possessions.

And Jesus said to his disciples, “Truly, I say to you, only with difficulty will a rich person enter the kingdom of heaven. Again I tell you, it is easier for a camel to go through the eye of a needle than for a rich person to enter the kingdom of God.” When the disciples heard this, they were greatly astonished, saying, “Who then can be saved?” But Jesus looked at them and said, “With man this is impossible, but with God all things are possible.” Matthew 19:16-22 ESV

Image by shuttermon

This passage from Matthew is my second least favorite of all scriptures. I know you aren’t supposed to say you have a least favorite, but it is. Because it cuts deep. I may not be that rich young man, but I feel like I am the one next in line to talk to Jesus and I no longer want to ask my question. This rich young man has sins similar to mine. We both love the comfort money gives us. We both identify ourselves with our monetary success. (Let’s be honest, most men do. Not sure about the ladies) We are both hard pressed to give it all up to follow Jesus.

Passages like this one hurt because they point out the idols we have in our lives. Idols in this case are not little statues that we worship as false gods but are things we have given a higher priority in our lives over than Jesus. I spend more time thinking about my job and my money than I do about Jesus most of the time.

The rich young ruler was probably a giver, after all that is part of a pious life. I bet he was a regular, constant tither. But he wanted wanted his “stuff” more than he wanted to follow Jesus. I am sure I am projecting, but I can hear the questions in his mind “Who would I be if I didn’t have my possessions? Certainly, he can’t mean that literally. Couldn’t I do much more good if I kept it and invested it and gave more?”

Of course, I don’t believe that Jesus is calling us all to a life of poverty, but I believe Jesus saw into this man’s heart and saw what he loved and what would prevent him from being his disciple. He saw his love of money.

If you are someone, like I am, who is interested in becoming a good steward then you must constantly be vigilant that money has not become an idol for your. You must guard against your debt free life becoming more important than your walk with the Lord. It is a very fine line and a very easy trap to fall into.

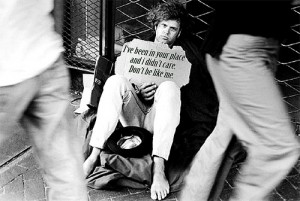

Biblical Stewardship

Image by Mompes

Biblical stewardship is what this blog is all about. which has to do with heart and mindset as much as the practical approach to money. Stewardship is an unusual word in our age. Uless you are talking about environmental stewardship you won’t hear it much.

From a Christian perspective it is the understanding that you own nothing, but that everything belongs to the LORD; we have been temporarily entrusted with the proper use of those resources.

The dictionary definition of Stewardship is:

the conducting, supervising, or managing of something;especially: the careful and responsible management of something entrusted to one’s care.

The church at large has done a poor job at balancing concepts of biblical stewardship. Our views of how to handle money seem to flow with the larger economic situations. For example, during the booming growth of the 1990’s “prosperity” theology took off and crept into mainstream church thought. Now, during a recession many people are shunning such theology for a theology of poverty. I don’t believe either of these extremes is a realistic example of biblical stewardship. Biblical stewardship is the recognition that we own nothing, but are managers of God’s money and resources. We are to use our resources as God would like us to use them and and not allow money to take over our life choke out our fruitfulness. (Parable of the sower)

Mark Driscoll and Gerry Breshears talk about four ways money can be stewarded in their book Doctrine They are broken down into two sets of two categories: Rich/Poor and Righteous/Unrighteous. Some people are rich and deal righteously with the treasure God has entrusted into their care. Some people are poor who do not handle their lot righteously. Stewardship is not something merely for the well to do. Both rich and poor are called to be good stewards of their money.

Mark Driscoll and Gerry Breshears talk about four ways money can be stewarded in their book Doctrine They are broken down into two sets of two categories: Rich/Poor and Righteous/Unrighteous. Some people are rich and deal righteously with the treasure God has entrusted into their care. Some people are poor who do not handle their lot righteously. Stewardship is not something merely for the well to do. Both rich and poor are called to be good stewards of their money.

Neither the circumstances of the global economy, nor our personal economy should determine how we steward the money entrusted to us. How we steward God’s money should be determined by the biblical principles God has laid out, humility and generosity. If you are a believer then all of your decisions. financial or otherwise, should be made in light of what the God of the universe has already given you in his Son. Working out the details is what this website is about. Subscribe and follow along on the journey as we look at both practical money saving advice as well as scriptural issues.

If you have just found this site take a look around…