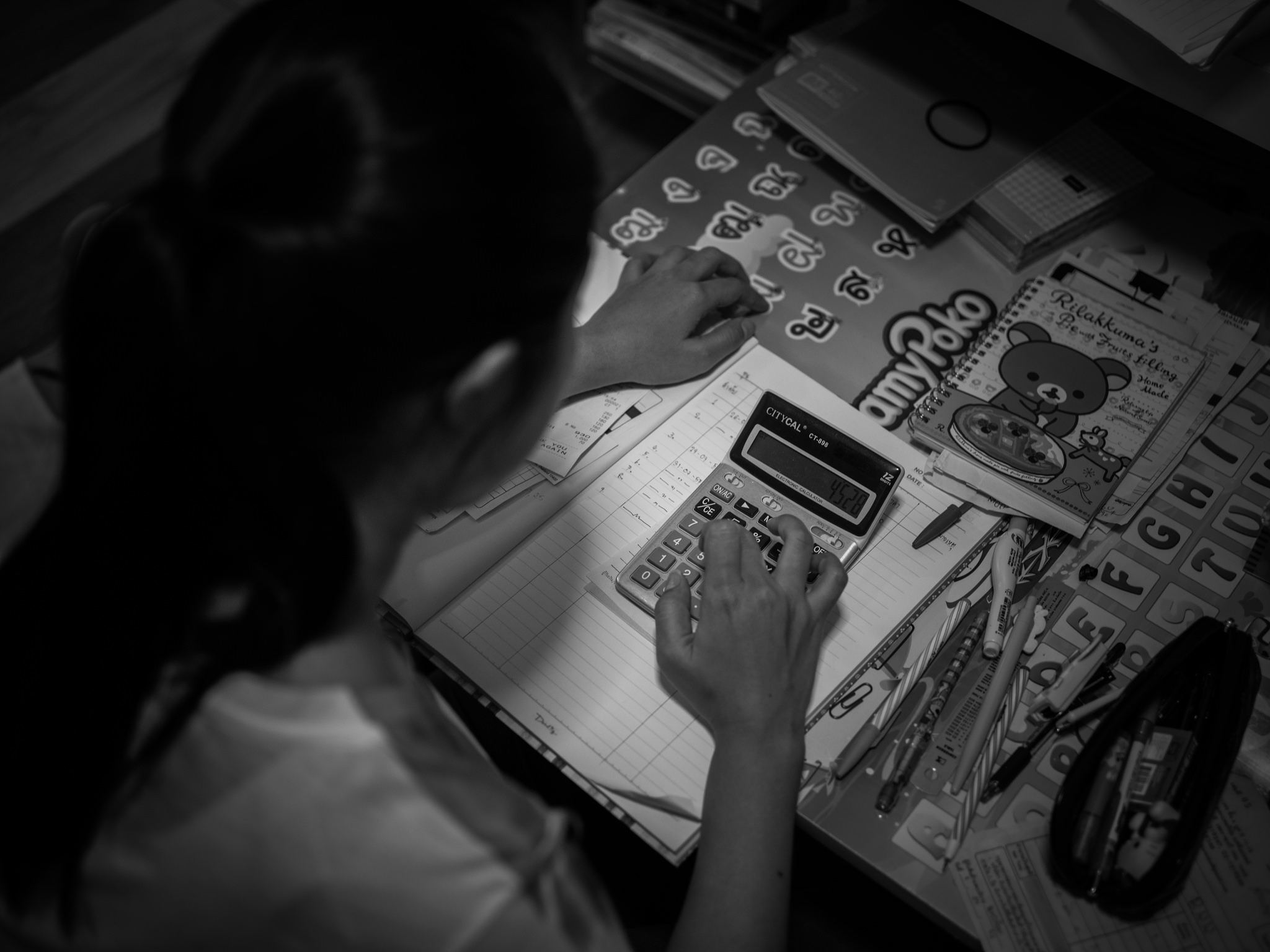

Gather your debt records

Your third step in the process is to gather your debt records. Student loans, credit card statements, car loan statement. Statements from all the debts you carry.

Your third step in the process is to gather your debt records. Student loans, credit card statements, car loan statement. Statements from all the debts you carry.

Putting all of this information in one place can be a little scary if you have never done the calculation before or are unsure of your current financial situation. The easiest way to conquer the fear of the unknown is to know it. Think of it this way, before your GPS will tell you which way to go it has to find your current location. This process is finding your current location so you can make the correct turns go forward.

There is information you need to know from each of your debt records

Balance

The total amount of money you owe on the debt.

Interest Rate

The cost of borrowing the money. This is usually listed as “interest rate” or “APR” which stands for Annual percentage rate.

Monthly Minimum Payment

How much you have to pay each month to not be delinquent on your debt. Keep in mind making minimum payments only it will take up to 20 years to pay off a credit card.

You can use this handy Google doc if you like.

All of this information will become very important as we move forward in getting rid of our debts.

Image by Kantamate555

About the author