Create a Budget

So, you’ve read part one of this series you know why you should have a budget and how it can help you answer some fundamental questions. If you haven’t read it; read it now. In this article the question is “how do I create a budget?” If you have never actually had a written budget it may feel complex. Figuring out how to create a budget can feel confusing, but it doesn’t have to be.

So, you’ve read part one of this series you know why you should have a budget and how it can help you answer some fundamental questions. If you haven’t read it; read it now. In this article the question is “how do I create a budget?” If you have never actually had a written budget it may feel complex. Figuring out how to create a budget can feel confusing, but it doesn’t have to be.

When I talk with people one on one I usually recommend one or two methods depending on the preference of the individual. I will talk through both here.

Create a budget on Paper.

- Gather up all of your bills for the past month.

If you don’t have them from last month then keep them when they come this month. - Track every penny you spend.

Do it in a notebook, or keep receipts of your spending or use one debit card for all spending then use the statement to actually make your budget you won’t have to guess. - Put it down on paper.

If you don’t want to create your own there are plenty of places to find budget templates. However, searching those out may lead to more confusion so here is a simple budget template to get you started. - Fill in the green spaces that apply to you and the yellow column on the right will tell you what percentage of your income you are spending on any particular category.

- You may not need every single line so only use what suits you. I actually find it most useful to keep categories as broad as possible. But, you need to do what is right for you and knowing that takes experience, so play with it.

- My wife and I have gone through dozens of forms of budgets in our time of trying to organize our finances.

Create a budget with Mint.

- Mint is a free online personal finance program. (Also available on mobile platforms) It is owned by Intuit the same company that owns Quicken and many other programs. They have been in the business for a long time and they are very reputable and secure.

- Sign up for an account on mint.com

- Register your primary spending accounts

- Mint will automatically pull in your all of your account activity and automatically categorize it for you. (Watch out they are not always accurate)

- Use Mints built in budgeting feature to set up the categories for your spending. Mint will let you know how much you have left in every category. You can even set up a alerts to let you know.

Having a budget down on paper, even digital paper is the first step in getting your personal finances under control. There is something about actually writing things down that acts as a commitment device. But, understand that a budget isn’t set in stone. Month to month things may vary and you will have to account for that. For the first few months you should keep a close eye on things and maybe make adjustments as needed.

Biblical Stewardship

Image by Mompes

Biblical stewardship is what this blog is all about. which has to do with heart and mindset as much as the practical approach to money. Stewardship is an unusual word in our age. Uless you are talking about environmental stewardship you won’t hear it much.

From a Christian perspective it is the understanding that you own nothing, but that everything belongs to the LORD; we have been temporarily entrusted with the proper use of those resources.

The dictionary definition of Stewardship is:

the conducting, supervising, or managing of something;especially: the careful and responsible management of something entrusted to one’s care.

The church at large has done a poor job at balancing concepts of biblical stewardship. Our views of how to handle money seem to flow with the larger economic situations. For example, during the booming growth of the 1990’s “prosperity” theology took off and crept into mainstream church thought. Now, during a recession many people are shunning such theology for a theology of poverty. I don’t believe either of these extremes is a realistic example of biblical stewardship. Biblical stewardship is the recognition that we own nothing, but are managers of God’s money and resources. We are to use our resources as God would like us to use them and and not allow money to take over our life choke out our fruitfulness. (Parable of the sower)

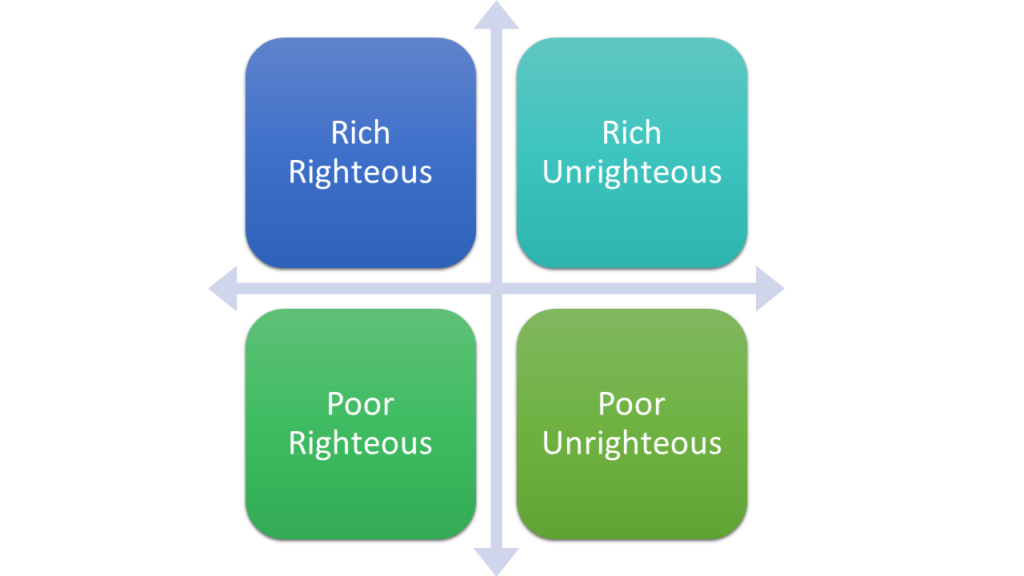

Mark Driscoll and Gerry Breshears talk about four ways money can be stewarded in their book Doctrine They are broken down into two sets of two categories: Rich/Poor and Righteous/Unrighteous. Some people are rich and deal righteously with the treasure God has entrusted into their care. Some people are poor who do not handle their lot righteously. Stewardship is not something merely for the well to do. Both rich and poor are called to be good stewards of their money.

Mark Driscoll and Gerry Breshears talk about four ways money can be stewarded in their book Doctrine They are broken down into two sets of two categories: Rich/Poor and Righteous/Unrighteous. Some people are rich and deal righteously with the treasure God has entrusted into their care. Some people are poor who do not handle their lot righteously. Stewardship is not something merely for the well to do. Both rich and poor are called to be good stewards of their money.

Neither the circumstances of the global economy, nor our personal economy should determine how we steward the money entrusted to us. How we steward God’s money should be determined by the biblical principles God has laid out, humility and generosity. If you are a believer then all of your decisions. financial or otherwise, should be made in light of what the God of the universe has already given you in his Son. Working out the details is what this website is about. Subscribe and follow along on the journey as we look at both practical money saving advice as well as scriptural issues.

If you have just found this site take a look around…