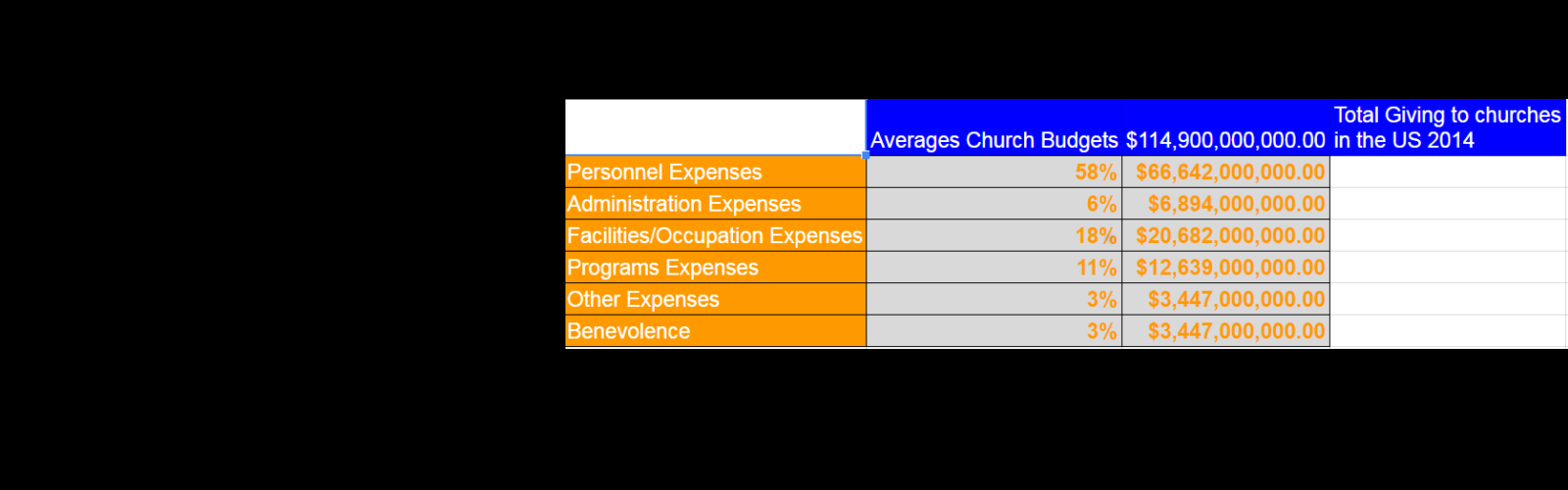

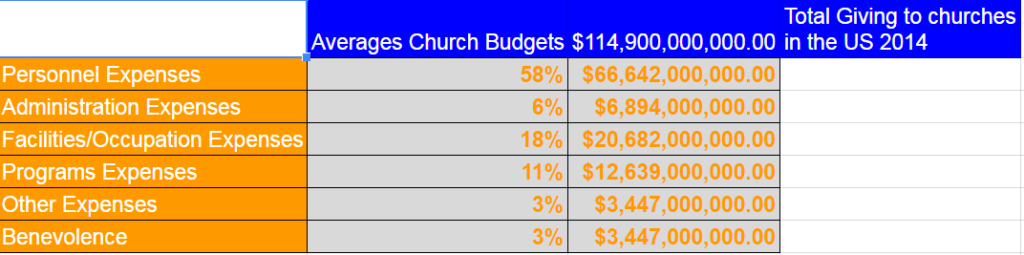

Church Budgets

This headline grabbed my attention…According to this article from Christianity Today, quoting a report from the Giving USA Foundation, American churches collected 114.9 BILLION dollars in 2014. (Numbers not available for 2015). We look at how church budgets break down on average. As we have discussed here before most of that money goes to keep the lights on and supply for the internal structure of the churches, as opposed to benevolence giving. (giving to those in need). If the popularity of Bernie Sanders has taught us anything it is that young people are more interested in our collective monies being used to help individuals and not to perpetuate the status quo, although they don’t care that said money is taken by force.

Let’s use the number collected by the Evangelical Credit union on church budgets to determine approximately how much of that money is being spent on what:

These numbers are an average simplification therefore the number to not equal 100%.

From Evangelical Credit union

Breaking these numbers down a bit we see some interesting things.

Personnel

This includes salaries, both full and part time, pension plan contribution, other benefits and taxes paid on behalf of employees.

Administration

Office supplies, postage, travel and membership dues.

Facilities

Utilities, maintenance and upkeep, debt (Mortgage) any other debt or fees associated with the building.

Program expenses

Children and youth programs, Adult programs, evangelism and outreach efforts, (benevolence has been pulled out to its own category)

Other Expenses

Building fund and cash reserves

Benevolence

Both local and international.

The numbers seem a bit off to me, even if you allow for program expenses to be outreach a full 82% of church budgets are paying salaries, building and to keep the lights on. Spending that is is some way inward facing. That is 94 BILLION dollars being spent by churches in the US to pay their pastors, buy their buildings and run their organizations. Charitywatch.org would give us a failing rating.

Of course, Charitywatch isn’t a fair comparison because pastors and staff are not strictly overhead, they are actually doing the work of the ministry in many cases. If we assume that half of the Pastors’ salaries are not overhead, but ends of our giving then our numbers are a little better at 53%. I am not sure of the best solution here, but I have been bothered by that 82% number ever since I read it. It feels like that money is more like paying country club dues that it is advancing the work of the Kingdom of God.

This is one of the primary reasons I have been attracted to the house church or cell church models over the years, it feels like a more efficient use of our collective resources. That being said I am part of a traditional model that thinks about this regularly and doesn’t actually fit these numbers for various reasons.

What do you think about these numbers?

Free Home Phone with Google Hangouts

With our kids getting older we felt we needed a home phone. Being who I am I wanted a free home phone. We don’t want a landline , but we don’t want to buy cell phones for our kids either.

With our kids getting older we felt we needed a home phone. Being who I am I wanted a free home phone. We don’t want a landline , but we don’t want to buy cell phones for our kids either.

We thought about adding another line to our Ting.com plan. That would only cost us $6 a month plus usage. Then I realized I could get a free home phone.

Stewards of Fatherhood

I am going to depart from my normal topics to discuss something else, Fatherhood. This site is about the various forms of stewardship Christians are called to and this includes the stewardship of the name Father. God the Father existed through all eternity and it is not a coincidence that he created fathers on this planet. He didn’t create fathers and then say “Oh, since there are fathers on earth I will call myself father so they can understand.” No, The Father was before creation and formed creation to reflect who he is. And he is merciful and gracious enough to allow us to bear his name in our own fatherhood.

I am going to depart from my normal topics to discuss something else, Fatherhood. This site is about the various forms of stewardship Christians are called to and this includes the stewardship of the name Father. God the Father existed through all eternity and it is not a coincidence that he created fathers on this planet. He didn’t create fathers and then say “Oh, since there are fathers on earth I will call myself father so they can understand.” No, The Father was before creation and formed creation to reflect who he is. And he is merciful and gracious enough to allow us to bear his name in our own fatherhood.

Those of us who are privileged and blessed enough to have children take on one of the names of God himself, and we should not do so lightly. Who we are as fathers will be the starting point for how our children understand God. We will color the lenses through which they see him. If we are harsh and mean then when they hear that God is our Father they will assume that he is harsh as well. If we are gracious and loving then they will naturally assume God is a loving Father as well.

Although I fail often, I try to bear this in mind as I determine how to deal with my own children. I want them to know the Father who loved the world so much that he gave is only Son to die on the cross for their sins. I want them to not be hindered by my performance as Father, but to be encouraged to peace when they think of God as Father.

There are many things we men steward in this life, our time, money and talent, but none of them are as important as stewarding the name and reputation of God the Father.

Fatherhood is not simply controlling your children or having them do well in school. But, it is the intentional communication of the Gospel through our words and actions.

Christmas, Materialism and the Christian

Let’s face it, this time of year even the best of us have a hard time fighting off Christmas materialism. Christians have often allowed the secular marketing powers to dictate what is means to celebrate Christmas. Whether that is buying the newest and greatest toy for our kids (or ourselves) or forgetting what it is we are really celebrating.

Let’s face it, this time of year even the best of us have a hard time fighting off Christmas materialism. Christians have often allowed the secular marketing powers to dictate what is means to celebrate Christmas. Whether that is buying the newest and greatest toy for our kids (or ourselves) or forgetting what it is we are really celebrating.

I want to put out a warning to us all, including myself to guard our hearts and direct them to the real purpose of the season. Do I love the lights, the songs, the traditions of Christmas time? Yes, I love seeing them through my kids eyes and seeing them anew myself. I love even more when those traditions push us toward Christ and away from the values of our secular society.

Think about how you celebrate Christmas and what is communicates to your family and those around you. We celebrate advent, a church period starting at the end November and ending on Christmas. Advent means arrival and we do things during this time to help our family remind ourselves of the significance of Jesus birth. We have never done the Santa thing (we do love St. Nick). We give gifts not based on good works, but on grace. We have made sure our kids realize that this isn’t a time to “be good” but to realize you are bad and God loved you regardless and sent in son to die for you. We remind them of this with a Christmas Eve birthday cake for Jesus.

We don’t want our girls to look at this as a jackpot time for themselves, but as a time of thankfulness and giving. We don’t buy a lot, but maybe more than many. We make sure they spend their own money to buy for each other and the girls we sponsor through Compassion International. I hope to protect them, at least a little, from the materialism that is so prevalent this time of year. Do we do it right? Not sure, but we are being intentional in our approach to the holiday. Being intentional and not allowing this time to run a muck is a great first step to fighting off Christmas Materialism.

How do you guide your children and yourselves through this holy time of the year?

Image by Sonya News under CC Attribution

How a community can help your finances.

I have written before on my crazy ideas on how a community (a church specifically) can help one another financially, these are a little more down to earth. Being a good steward of your money goes against the flow of our materialistic consumption driven culture. It is hard to be the one who is looked at as cheap or broke, even if you aren’t. A solid group of like minded people can help support you in times of trouble.

- Like minded people are positive peer pressure. — I get asked at work at least once a week when I am buying a new PS4 or Xbox one. I hear the guys talking about the new games and I really want to regress to my bachelor days of spending the whole weekend in my room playing games. This isn’t the kind of peer pressure I need to be a good steward of my money, let alone my time.Just last week I wanted to go out to eat and asked one of the people that we were going to hang out with if they wanted to go. They said they had already spent their eating out budget, and so I felt influenced to save our money and eat at home before we all got back together to go hiking.A group of people that are all thinking the same way can help support you when you are feel like the only one not burying themselves in debt.

- You community can give you someone to do things with. — When everyone else wants to go out to eat and waste money on things you can gather your community to do a meal in together, or find an activity that doesn’t cost money.

Years ago our routine was to get together with two other couples and have a family style dinner and play board games. We saved money by eating together and had a blast creating memories and friendships.

- Your community can be your financial support.– As I have written before I think the church could do a better job of being the emergency fund for one another. Apart from that we can be a network for one another to help find jobs, get work or share the load when things happen.

It seems like every couple in our church is adopting right now and they are being supported, in part, by the community around them.

If you are going to be a good steward of your money, time and talent. It is very helpful to get a community around you to help. Let us know in the comments how you have been helped by you community.

Can I use reward cards?

One of the questions I get almost every time I speak on stewardship is around the use of reward cards. You know, the ones where they give you rewards points or cash back for spending money through them. As a general rule I am against consumer debt, credit cards, car loans and the like, but there is always someone who asks me about using cards for the cash back or for the rewards. They feel they can game the system somehow and make the banks pay.

My answer is as straight…absolutely depends. There are some folks who are diligent enough to pay off the card every month without fail. Those folks will make money from reward cards in the long run, but it doesn’t take much to ruin that streak and cost you all your winnings. Just like Vegas the house always wins.

A study of how rewards cards affect behavior in 2010 found that even a reward as small as 1% can change consumer behavior:

…consumers generally spend more and increase their debt when offered one percent cash-back rewards. The impact of a relatively small reward generates large spending and debt accumulation. On average, each cardholder receives $25 in cash-back rewards during our sample period. We find that average spending increases by $68 per month and average debt increases by over $115 per month in the first quarter after the cash-back reward program starts.

We all assume we are the exception to the rule, but that is not often the case. Banks spend millions of dollars to analyze the results of the incentives they give. That is why make the profits that they do.

I am not that person. I can do things if they are automatic. We use a reward card to funnel a few bills through that I automatically pay, but if I use it for anything else I end up paying interest even though I have the money to pay it off. I just like having the money in the bank more than not paying interest even though I know it is the wrong thing to do.

However, if you pay off your bill every month without fail you can make a little extra money with a reward card. It may just be best to ignore the fact that it is a reward cad and not try to game the system or you may find that you are the one being played.

Why Considering Stewardship

I started writing on Christian stewardship for several reasons. I came to faith in a part of Christianity that is what most would call the “prosperity gospel” or the “Health and wealth” gospel and I found myself disturbed at the way those churches taught people to handle their finances. They simply treated God like a get rich quick scheme. If you offered your money on the right alter God would make you rich. It was just that simple. I know families that gave everything they had to the church and when they needed financial help were basically told they needed to have more faith, but were given no help my the church.

Then I started seeking wisdom in the world for financial advice. I read “Rich Dad Poor Dad”, “The Millionaire Next Door” and, still one of my favorites, “The Richest Man in Babylon.” These books had a lot of great financial advice but very little to say about how the Gospel should influence your money choices. I saw a great need in the church. A balance if you will between these two views.

It seems to me as I read many personal finance articles even those written by Christians they still boil down to spend less than you make, get out of debt, save for retirement and give. And maybe that is enough, but it seems like there is really more to it than that. This blog has become a place for me to stretch out some ideas I have about what Christian stewardship is all about. I may get a little crazy sometimes, but I hope to find truth in the scriptures for regarding my money and my love of it.

5 Bible Verses about Money we don’t like to talk about

I recently read a similar post and it got me thinking about some of the Bible verses about money that we don’t like to talk about in the church. I suppose it depends on which end of the denominational spectrum you are from, but I selected a few that I think apply to everyone.

I recently read a similar post and it got me thinking about some of the Bible verses about money that we don’t like to talk about in the church. I suppose it depends on which end of the denominational spectrum you are from, but I selected a few that I think apply to everyone.

- Deut 14:22 –Those people who do talk about tithing take all their evidence from the Old Testament, and conveniently ignore this scripture that tells the believer to take their tithe and consume it is celebration of the Lord. If the temple is too far away the believer is instruction to sell their tithe take the money travel to the temple and “spend the money for whatever you desire—oxen or sheep or wine or strong drink, whatever your appetite craves. And you shall eat there before the LORD your God and rejoice, you and your household.” The tithe was meant to for the believer to celebrate the goodness of God, not just to be given to the temple.

I was taught that if I didn’t pay my tithe on time I owed an extra 20%. So, the idea of using to throw a party to celebrate the goodness of God would be blasphemy. But my wife and I have put this in to practice and invited people to celebrate God’s goodness in our lives.

2. Prov 21:13 — “Whoever closes his ear to the cry of the poor will himself call out and not be answered.” Social justice is becoming trendy and many folks want to use government to force people to do what they believe to be right. I don’t find it possible to love my brother by putting a gun to his head and forcing him “do the right thing”, but I do think about how I can help those who are less fortunate. Not in the short term, but long term. How can I help to break the cycle of poverty. It is one of the reasons I teach people about money.

3. Luke 6:20 — “Blessed are you poor, for yours is the kingdom of heaven . . . Woe to you rich, for you have received your consolation” Smithsonian magazine had an article earlier this year showing that 90% of Americans consider themselves middle class. Most of us don’t think we are poor. When we hear this scripture we think we are the blessed ones, but Americans are the rich Jesus is talking to. We are the 1% from the world’s perspective. We, as a church and individuals, must do more in order to help our brothers and sisters.

4. 1 Tim 6:8-9 — “But if we have food and clothing, with these we will be content. But those who desire to be rich fall into temptation, into a snare, into many senseless and harmful desires that plunge people into ruin and destruction.” We all assume we are not the one Paul is talking about. After all, I am not the one who pursues wealth, I just want to use money to promote God’s kingdom, of course I get to keep some too, that is beside the point. If we desire to be rich we will fall to many temptations don’t be fooled. This passage is directed at us all.

5. Luke 12:19-21 — “And I will say to my soul, “Soul, you have ample goods laid up for many years; relax, eat, drink, be merry.”’ But God said to him, ‘Fool! This night your soul is required of you, and the things you have prepared, whose will they be?’ So is the one who lays up treasure for himself and is not rich toward God.” This is the closest thing I have found in the Bible talking about the American idea of retirement. We want to sit back with our stored up treasure and eat drink and be merry. Rich toward God means more than giving him a small percentage off the top.

What other money scriptures don’t get enough recognition?

Make sure you don’t miss an article, subscribe to our newsletter.

4 Sinking Funds You Need

A sinking fun d is simply saving up in advance for expenses that are inevitable. Often times we ignore upcoming expenses lead ourselves into a emergency. So, here are some sinking funds you need to think about.

d is simply saving up in advance for expenses that are inevitable. Often times we ignore upcoming expenses lead ourselves into a emergency. So, here are some sinking funds you need to think about.

1. Gifts – if you know anyone who is getting married anytime soon. If you celebrate Christmas or many other holidays you will need to buy gifts at some point. We like to keep a “Christmas” account funded with direct deposits throughout the year. We pull from it whenever we need to purchase a gift for any reason, but we use it mostly at the end of the year for Holiday spending and travel. It helps save our budget at the end of the year.

2. New Car – Your car is dying. Let’s face it. You are eventually going to need a new car. We have published another article on this topic specifically. You should always have a car payment. If you save up money as you are driving your current car into the ground you may have enough to pay cash or at least have a good down payment for your next car when you current one dies.

3. Phones – Our most cherished possessions and the bane of our existence when things go wrong. If you are like me every two years you want a new phone. I listen to a lot of tech podcasts and they are always talking about new phones. I also use ting.com so I have to pay off contract price for my phones, but pay much less for my service. If you like tech toys start putting money away not because your phone is dying faster than your car.

4. House Repairs – If you like it or not, you are going to need money to keep your home up and running. You should have an emergency fund for small things, but what about a new roof, or remodeling your house or larger items. You may need to repave the driveway or have a pipe burst in the laundry room. You could use your emergency fund for this, but that isn’t exactly what it is for. If you know it is coming it isn’t an emergency, it may just be something you didn’t plan for.

What are other sinking funds you plan for?