Betterment Review

I have been using Betterment since February of 2012 for my long term investment and savings. I have wanted to do a Betterment review for a while but wanted to break it in before I gave my opinion. Betterment is a website that makes investing simple enough for everyone. It makes investing stress free and easy. I have tried picking my own stocks but fees ate up whatever profit I may have gained. Betterment’s fees are incredibly low and they allow you to set a risk level you are comfortable with for all you different savings goals.

Getting Started

If you are trying to save money you know now is a bad time. Low interest rates are great if you are looking to buy a house but if you want to save your money low interest rates are not your friend. Unless you have 50,000 or more to invest a lot of firms won’t even talk to you. This is one of the reasons I love betterment.

Betterment breaks down your accounts by the goal you are looking to achieve. So, when you create a new account it will ask you to select a goal. Like Safety Net, IRA, Educational.

Then you simply answer a few questions about your goal. How much would you like to have in that goal at what time? Do you need 20K in 10 years for a child’s education? How much can you start with? Based on those questions Betterment will recommend a portfolio on a simple Stocks(Risky but rewarding) v. Bonds (More secure but less reward) scale. So, for our down payment goal which we hope to use in the next few years we are less risky and have 80% in bonds but in our daughters college accounts which won’t be needed for 10 years at least we use 80% stocks. It will also tell you how much you need to deposit each month to reach your goal and that can be automatically done through Betterment as well and automatically drafted from your selected checking account.

Customer service was remarkable when I called Betterment to see why I couldn’t have more than three goals. (This was early on the now allow many more) I got a real person almost right away who was very helpful and got me into the beta test for more goals.

Returns

So far the best thing about Betterment besides the automation, which I am a big fan of has been the returns. Keeping in mind that past performance does not indicate future performance and all that we have had some great returns for our the college funds. The total balance has some more conservative accounts like our house down payment account but over all I have been very please with the returns. The functionality of the site is superb making it very easy to get started saving with more than .25% interest rate or whatever banks offer these days. They even let you try it out for 30 days free.

Fees

The fees are simple and inexpensive as well.

- If you deposit less than $100 per month it is a flat $3

- If you auto deposit at least 100$ a month your fee is a flat .35%

$5000 = $1/month - If you have $10000 or more across all of your goals your fee goes down to .25%

$10000 = $2/month. - Over $100,000 in all of your goals and your fee is only .15% and you get many other options to customize your plan.

Over all if you are ready to make the move into having your money make money for your Betterment is a great way to get started.

This article contains affiliate links… You get $25 and I get $10 if you sign up through these links…Betterment

What is a 401(k)?

What is a 401(k)?

Photo by 401k 2013

As I have written previously I work with a lot of college students in our church as a part of my ministry there. There are always questions about 401(k)s; What they are how they work. The fact is that many people simply don’t understand this very important retirement vehicle.

So, what is a 401(k)? It is a savings plan named after the section of the law that created it. It allows an employee to take a portion of their pre-tax income, up to $17,500 for 2013,(Those over 50 are allowed to add $5,500 to that amount) to a qualified employer sponsored investment plan. Many employers choose to match their employees contributions to some degree adding additional money to the pot.

So, what do those things mean? Pre-tax dollars means that the money contributed to your 401k are not counted as income when you are taxed. If your paycheck was $1000 and you contribute $100 to your 401k then you only pay taxes on $900. ($1000-$100) This allows you to save money up front on taxes. Because you will pay taxes on the money when you retire it is called a tax deferred plan. This also begs the question “Will taxes be higher now or when I retire” I would guess taxes have no where to go but up since we are only paying for 2/3 of the government we have now and we will eventually have to pay for the remainder.

Employer match

This is one of the sexiest aspects of the 401k plan. With the average 401k plan employers contributed 4% of the employee’s salary most commonly in the form of a direct match. An employer will match dollar for dollar every dollar an employee contributes up to a certain percent, the average is 4%. Meaning that if Joe contributes 4% of his paycheck to his 401k the company contributes the same amount to his 401k. This work out to be a 100% return on investment; Joe doubles the money in his 401k.

Not all employers do a direct percentage match some match $.50 on the dollar or some other amount but knowing how your 401k plan works is important to making the most of your plan. As in our above example Joe’s employer matches up to 4% of his salary. This means that if Joe is contributing less than 4% to his own retirement then he leaving his employers money on the table.

Getting your money out of your 401(k)

Getting your money out of a 401(k) can be difficult or have penalties depending on the circumstances of your plan. Traditionally, you can only make withdraws from a 401(k) under certain circumstances.

- When the employee retires, becomes disabled or is no longer employed by the employer who sponsored the plan.

- The employee hits age 59.5

- The employee experiences a hardship as defined under the plan, if the plan permits hardship withdrawals

- Upon the termination of the plan

With some plans it is possible to take a loan of 50% of the vested value of the account but not all plans allow for this option.

Summary

A 401(k) is a retirement plan that has some great aspects and that also has some drawbacks.

Pros:

- Most employers contribute additional money to the retirement of the employee.

- Tax benefits.

Cons:

- Mandatory withdraws at age 70.5

- Taxes are likely to be higher when you actually have to pay them on the money in the account unless you believe you will be in a lower tax bracket when you are pulling money from your account.

Obviously, I can’t cover everything there is about 401(k)s but hopefully this gives a basic idea about what they are and how they are used.

Photo by 401k 2013

A Penny Saved and other thoughts

Our culture is full of phrases and cliches about money. Some of them are true and some of them are just crap.

Is a penny saved really a penny earned?

There is an idea in the personal finance world called the rule of 10. Basically, every dollar you save now is 10 dollars you will have in retirement if invested properly. This assumes wise investments and paying off high interest debt. It may not be actually 10 fold depending on a vast number of circumstances but a penny saved is actually much more than a penny earned if you treat it properly.

A fool and his money are soon parted.

This old classic means that a fool will spend his money foolishly and will soon be without. It is, unfortunately, all too true. With 76% of Americans living paycheck to paycheck it is clear that we have a nation of fools. Even when you drive through the poorest neighborhoods you see satellite dishes, nice clothes and I can’t tell you how many crappy cars drive by my house with killer stereos. We feel the need to live a lifestyle greater than we can truly afford and it pushes us further into debt.

The borrower is subject to the lender.

If you have debts you are working for the people you owe that money to. We are all enslaved to one degree or another to the debts that we owe. Many people struggle to get out from under their college loans to pursue their dreams. The more money we borrow to finance the lifestyles we think we deserve the longer we are forced to work for our debt holder.

Riches have wings.

Money, if given a chance, will fly out of your hand and out of your control. This is why I encourage people to run a tight budget. Accounting for every dollar in some way and moving the money into accounts that are not easily accessible. If you do not plan how you will spend you money it will be spent in ways you did not plan and of course those ways will be less effective than you intended and will be a waste.

It’s Never Enough

It doesn’t matter how much money you make, if money is your idol and you are seeking satisfaction in it; it will never be enough. Lifestyle creep will slip in and you will always feel like you don’t have enough money. Satisfaction will never come from the trinkets that you are able to buy in this world. Jesus said “What does it profit a man to gain the whole world and lose is soul?” If your life is focused on more important things than money becomes secondary and becomes a tool not your master.

Image by puuikibeach

Automate Your Finances

One of the best steps in getting your budget under control is to automate finances. As much as possible, make your financial matters a hands off activity. This way you are eliminating human error like forgetting to send the payments or spending more than your budget  allows, and your savings happens without your effort.

allows, and your savings happens without your effort.

Limit access to money

One of the most effective ways to automate your finances and control your spending is to limit access to your money. Your money is going to be spent the question is if it will be spent where you would like. The best example of this is 401(k). This money is normally taken out of your paycheck before you see it, like taxes. So, you do not have a choice in how you spend that money. Most people never even pay attention to how much money is taken from them in taxes.

This can be done in very simple ways. If your company has a direct deposit option you can limit yourself by only depositing the amount you need for your budget into your main checking account while remaining funds should be deposited into a savings or investment account. This helps control lifestyle creep (the propensity to spend more as you make more) because you don’t actually see an increase in your main bank account where it can be easily spent.

Example:

If your monthly budget for your bills is $1000 and you get paid once per month you would only deposit $1000 into your main checking account. If your paycheck was $1200 then you would deposit $200 in a savings account.

If you got paid every two weeks you deposit $500 per check if you can balance your bills on two different pay periods, that may take some time to set up and get right.

This prevents you from having easy access to “extra money”. I use quotes there because all of your money should have a purpose even if it isn’t immediate, and there should be a plan for all of your money. Don’t let your money sit around and be lazy, send it off to work for you in an interest bearing account, or in an investment of some kind.

Automate your bills

Most utilities offer a budget program which allows you to pay the same amount all year round instead of being hit with high electric bills for your air conditioning in the summer and for your heating in the winter. They will average the last year of your bills and give you one median payment. This allows you to set up a recurring payments of a single amount; no forgetting and no sticker shock on your bills.

For years we split our bills in half and paid half every two weeks with our paychecks, to make sure we didn’t spend it while we were waiting for the bill. It forced us to do some manual work thanks to those three paycheck months but it wasn’t bad. Now we use a different account for monthly bills that doesn’t get touched so we always have enough money and the bills are set to pay the full amount automatically.

How have you automated your finances and made your life simpler?

- Automate your finances

13 Free Entertainment Ideas

Image by zigazou76

When you are trying to live with stewardship in mind you often have to think differently than you may normally to have fun and entertain yourself. Here are a 13 free entertainment ideas. (or Almost free). Many of these things consider sunk costs, example number one assumes you already have a GPS or a smartphone.

- Go Geocaching – What is Geocaching? It is a real world GPS scavenger hunt. You use a GPS to find a set of coordinates where someone else has hidden a cache (usually Tupperware). Our kids love it because you trade toys in the caches and they love to find new parks to explore. We love it because it gets the whole family out of the house and doing something together.

- Hit up the public library – You can just sit and read to your younger ones while your older ones check out all sorts of new books they have never heard of. Most libraries have some sort of story time where the librarians of volunteers read a book to your kids.

- Play a board game – We have an extensive collection of board games and we love to play. Instead of going out and spending money find like minded people and have dinner together followed by some game time. Trade games with people if you have ones you are done with or don’t like. Introduce your children to the games you play instead of playing another round of Candyland. Our kids love Settlers of Catan Jr. (And I like it better than the original)

- Family movie night – This is a tradition in our house. We either get new movies from the library or watch some of our favorites. Make popcorn or a treat that goes with the theme of the movie, curl up on the couch and create memories.

- Public parks – Find out what is happening at your local and state parks. There are nature lessons and hikes, photography clubs and even geocaching gatherings. You just have to know what is going on and when.

- Set up a walking tour of your town – Local historical groups are a great resource then once you are started pack lunch make a map and take a walk. History will come alive as you actually walk through the areas where events took place.

- Take a photo walk – Take a camera and walk somewhere take pictures of anything you find interesting. It is amazing the cool things you drive by all the time but don’t notice.

- Check out any number of free courses online – Coursera, iTunes, Openculture or others that will allow you to learn something new for free.

- Take the day and clean up that one room – Not really fun but it really needs to be done. You know that space that you have been meaning to clean out/up for a while but things just keep piling up? Take a few hours and clean it. You will feel so much better.

- Learn how to fix something around the house – I really like to fix things(or at least try to) but I am not very confident on the how-to part. You tube is great for that. Last month I drained my hot water tank to fix a knocking sound it had been making. Just to your research and you may be able to fix it by yourself and save yourself the repairman bill.

- Have a water fight(summer) – This was a great morning in our house. We bought big squirters at the dollar store filled up a bucket and the four of us had a fight for about an hour.

- Have a snowball fight (Winter) – If it is winter take some time to make a batch of balls and have a snowball fight.

- Try new shows on Youtube – Youtube isn’t just for cat videos anymore. There are actually networks of content being created by quality brands. Try Geek and Sundry, Machinima, and more

What are things you do to entertain yourself for little or no money? Let us know in the comments.

Amazon Subscribe and Save

Most people know about Amazon. Many people order electronics, books and toys from the E-tailer. Fewer people know that you can order all sorts of household items from Amazon. We order most of our non-perishable household supplies from amazon as well.

Amazon started from an online bookseller in 1995 to being one of the largest internet companies in the world selling everything from books to furniture. Amazon has prices lower than most stores and they often deliver free to your door (if you have a prime membership or order $25 or more in qualified products).

But Amazon Subscribe and Save is almost a secret compared to other offerings by the online giant. If you can plan carefully it can save you a ton of money.

What is Amazon Subscribe and Save?

Amazon Subscribe and Save is a subscription ordering service. You set up a subscription to have a product delivered in 1-6 month intervals and receive an additional 5% off your purchase. If you have 5 orders arrive on the same monthly subscription delivery date you save an additional 15% off your entire order. This is where the planning comes in. Take a look or keep track of what you are buying and how often.

What is available in Amazon Subscribe and Save?

What all is available from Amazon by subscription? Almost everything! Non-perishable grocery products, cleaning supplies, baby supplies diapers, cat food and dog food almost everything you could want that doesn’t grow on trees. You can see the vast selection here. If there are products that you buy regularly you should compare prices to amazon.

Keep an eye out

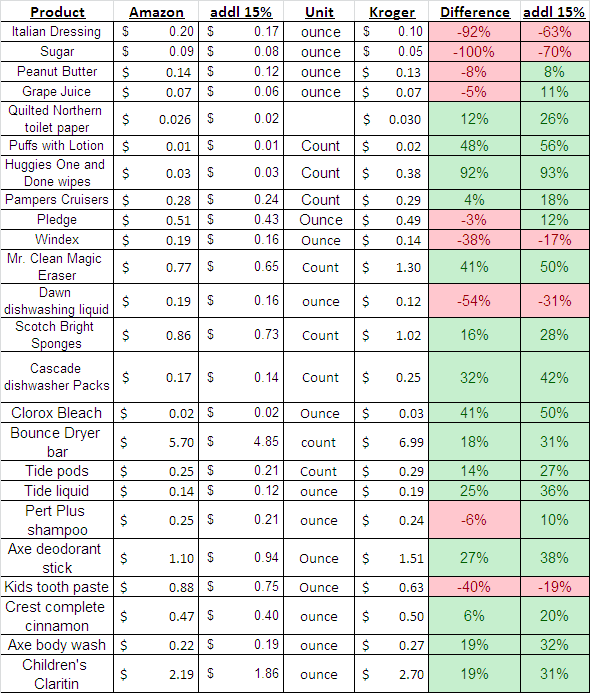

Just as many with many deals, you have to watch carefully. Just because you are buying in bulk or subscribing does not mean you are always getting the best deal. In preparation for this article I took a walk through our local Kroger and compared the prices on Amazon. While some prices were great savings others items were cheaper at the store. There were a few items that would be a better deal on Amazon if timed correctly to enable the additional 15% savings for having 5 items delivered at the same time.

Here are the prices I reviewed. Red means Amazon was a higher price; green indicate Amazon had a better price.

This article contains affiliate links. Cover Photo by 401(K) 2013Give Yourself a Raise

One of the things I like to tell people in my stewardship presentations is that it is possible to give yourself a raise of roughly $2900 a year, depending on your personal situation. Not only is this possible, I highly recommend it to anyone who wants to act responsibly with their money.

Photo by TALUDA

If you are looking to pay off debt, make ends meet, or just invest YOUR money so YOU gain the interest you owe it to yourself and your family to give yourself a raise.

Now for a little background…Every paycheck the government takes a ton of your money before it even hits your pocket and every spring people get really excited that the government makes them fill out paperwork to get back the extra that the government took out in the first place. We call it tax season.

If you get a tax return back every year it means you are giving the government too much money every paycheck and they hold it all year and then give it back to you interest free when you file your taxes.

I don’t want to get political, but I believe it is irresponsible to allow the government to take your money all year only to give it back to you interest free in the spring.

The average tax return in 2011 was $2900. By filling out a new W-4 form you tell the government to take less of your money each paycheck. It reduces your refund but you will have more money in your pocket every paycheck. How do you decide what is right? The IRS actually supplies a handy little calculator for just such an occasion. It will give you the correct number to enter on your W-4 to get you the smallest refund and the largest paycheck. I, personally, like to have just enough money to pay for turbotax but you should do what you are comfortable with. For years before I knew the calculator existed I just moved my W-4 number up a each year so I was paying less every year.

The point is, that is your money they are taking and holding. Imagine going to the grocery store and paying too much for your groceries every week but not getting any change until the end of the year. You wouldn’t be excited about that money at the end of the year! It should have been in your pocket all along. That is exactly what happens with your taxes. People over pay their tax bill and get excited when they get their “change” in one lump sum because they don’t understand the process.

For this to work you must have a regular paycheck which has taxes withheld If you are responsible to pay your own taxes then this won’t work. You must also get a tax refund at the end of the year, if you don’t then you can’t get that money back throughout the year.

If you are looking to get more control over you money, to pay off debt, save for the future or just keep it out of government hands. This is a great first step.

As always you should do you own due diligence when it comes to these issues. This article is for informational purposes only and is not to be considered tax preparation or legal advice.