Tax Code War on Women

The real “w

ar on women” is in the U.S. tax code, says Diana Furchtgott-Roth, director of Economics21 at the Manhattan Institute. Single working women face higher tax rates when they marry, a reality that discourages marriage or encourages women who do marry to quit the workforce. When married women decide whether to enter the labor force, “their tax rate begins at the rate on the last dollar of income earned by their spouse,” Congressional Research Service specialist Jane Gravelle explained in a Senate Budget Committee hearing.

This article by Diana Furchtgott-Roth is an interesting read and is something young couples should consider when determining things like if and who will stay home with children. This appears to assume that Women are the secondary income earners in their family which may be mostly true but not always.

Currently, the U.S. tax code discourages work, discourages marriage and encourages women not to advance. This is the real problem for women that politicians should focus on.

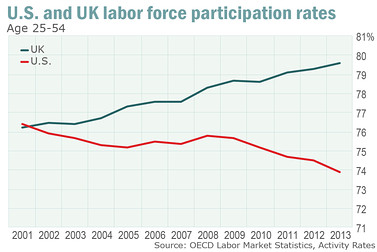

Of course the tax code also discourages men from working in some cases, but the penalties of marriage do seem to practically hinder women more. The chart above compares US and UK women’s participation rates. The UK does not have the marriage penalties that the US does because couples still file separately and have their own deductions. All in all it was an interesting read for someone who is not a big “Women’s Studies” kind of guy.

HT to: http://ift.tt/1hoH2wI

About the author