Betterment Review

I have been using Betterment since February of 2012 for my long term investment and savings. I have wanted to do a Betterment review for a while but wanted to break it in before I gave my opinion. Betterment is a website that makes investing simple enough for everyone. It makes investing stress free and easy. I have tried picking my own stocks but fees ate up whatever profit I may have gained. Betterment’s fees are incredibly low and they allow you to set a risk level you are comfortable with for all you different savings goals.

Getting Started

If you are trying to save money you know now is a bad time. Low interest rates are great if you are looking to buy a house but if you want to save your money low interest rates are not your friend. Unless you have 50,000 or more to invest a lot of firms won’t even talk to you. This is one of the reasons I love betterment.

Betterment breaks down your accounts by the goal you are looking to achieve. So, when you create a new account it will ask you to select a goal. Like Safety Net, IRA, Educational.

Then you simply answer a few questions about your goal. How much would you like to have in that goal at what time? Do you need 20K in 10 years for a child’s education? How much can you start with? Based on those questions Betterment will recommend a portfolio on a simple Stocks(Risky but rewarding) v. Bonds (More secure but less reward) scale. So, for our down payment goal which we hope to use in the next few years we are less risky and have 80% in bonds but in our daughters college accounts which won’t be needed for 10 years at least we use 80% stocks. It will also tell you how much you need to deposit each month to reach your goal and that can be automatically done through Betterment as well and automatically drafted from your selected checking account.

Customer service was remarkable when I called Betterment to see why I couldn’t have more than three goals. (This was early on the now allow many more) I got a real person almost right away who was very helpful and got me into the beta test for more goals.

Returns

So far the best thing about Betterment besides the automation, which I am a big fan of has been the returns. Keeping in mind that past performance does not indicate future performance and all that we have had some great returns for our the college funds. The total balance has some more conservative accounts like our house down payment account but over all I have been very please with the returns. The functionality of the site is superb making it very easy to get started saving with more than .25% interest rate or whatever banks offer these days. They even let you try it out for 30 days free.

Fees

The fees are simple and inexpensive as well.

- If you deposit less than $100 per month it is a flat $3

- If you auto deposit at least 100$ a month your fee is a flat .35%

$5000 = $1/month - If you have $10000 or more across all of your goals your fee goes down to .25%

$10000 = $2/month. - Over $100,000 in all of your goals and your fee is only .15% and you get many other options to customize your plan.

Over all if you are ready to make the move into having your money make money for your Betterment is a great way to get started.

This article contains affiliate links… You get $25 and I get $10 if you sign up through these links…Betterment

Organize Your Finances

I am not normally one for New Year’s Resolutions but with that time of year coming up it is time to look at how to organize your finances.

This isn’t something that anyone really looks forward to but it is something most of us wish we would have done earlier. You can follow the “Why budget; just make more money” model but not all of us have the ability to do this.

- Create a budget – This topic has been written about previously on this site. If you have no budget at all this is the place to start

- Improve your budget – A few tips and tricks to help you improve any budget you already have.

- Take a look at your withholdings and give yourself a raise.

- Review these tips to see if you there is anything you can do to save some money.

- Start an investment account at an easy to use firm like Betterment

This is a good time to review your financial plan and see if you are heading in the right direction. Especially before you blow all of your money on gifts that people will only return.

Image by artisrams

Article contains sponsored links

Please give me my idol

Am I asking God to give me my idol?

Image by itineranttightwad

I have been seeking a new job recently and have had some very promising leads. I am hoping to have a decent pay raise when I take a new position and I have found myself thinking about all the things I will be able to do with this new money; how much better it will make my life; how much safer and more secure I will be. All things I should be relying on God for, not a job.

It is amazing how easily these little bits of sinfulness can slip into our lives; it is no wonder that Martin Luther called the human heart an idol factory and why Jesus said it is hard for a rich man to enter the kingdom of Heaven. It is hard for us who have so much to realize how much we need to rely on God for our daily bread.

We Americans, even the poorest of us are in the among the richest in people in the world and because we don’t want for many necessities we don’t think daily about how desperate we are and how much we cannot do ourselves.

Personally, I was looking for this job to be my functional savior against my lack of satisfaction. I am not satisfied in my God and those wonderful things he has given me. Sure, I say how much I am thankful every night when I pray over our meal or with my daughters before bed but the words have a hard time sinking in to my stony heart.

I often talk about the story of the rich young ruler from Matthew 19.

And behold, a man came up to him, saying, “Teacher, what good deed must I do to have eternal life?” And he said to him, “Why do you ask me about what is good? There is only one who is good. If you would enter life, keep the commandments.” He said to him, “Which ones?” And Jesus said, “You shall not murder, You shall not commit adultery, You shall not steal, You shall not bear false witness, Honor your father and mother, and, You shall love your neighbor as yourself.” The young man said to him, “All these I have kept. What do I still lack?” Jesus said to him, “If you would be perfect, go, sell what you possess and give to the poor, and you will have treasure in heaven; and come, follow me.” When the young man heard this he went away sorrowful, for he had great possessions.

And Jesus said to his disciples, “Truly, I say to you, only with difficulty will a rich person enter the kingdom of heaven. Again I tell you, it is easier for a camel to go through the eye of a needle than for a rich person to enter the kingdom of God.” When the disciples heard this, they were greatly astonished, saying, “Who then can be saved?” But Jesus looked at them and said, “With man this is impossible, but with God all things are possible.” (Matthew 19:16-26, ESV)

We are so attached to our possessions that although we would deny it with our words our hearts are very much like this rich man. Jesus is pointing out the idol that sat at the altar of this young mans heart and he refused to cast it down. What I find interesting is that the disciples were astonished that it was hard for a rich man to enter the kingdom of heaven. How often to we assume that material success is a sign of God’s approval? I have heard it when it comes to money and the individual. “God is blessing me with this new car because of my obedience” Applied to churches “They must be doing something right because they have a huge crowd”

Jesus makes it pretty clear here and other places that external circumstances are not a direct indication of God’s approval or disapproval. ” For he makes his sun rise on the evil and on the good, and sends rain on the just and on the unjust.” (Matt 5:45)

This story serves as an example to me and hopefully to us all that our things are never to be more important to us than our Lord. It is not our jobs or our family that ultimately provides they are conduits through which God provides our needs.

Image by itineranttightwad

What is a 401(k)?

What is a 401(k)?

Photo by 401k 2013

As I have written previously I work with a lot of college students in our church as a part of my ministry there. There are always questions about 401(k)s; What they are how they work. The fact is that many people simply don’t understand this very important retirement vehicle.

So, what is a 401(k)? It is a savings plan named after the section of the law that created it. It allows an employee to take a portion of their pre-tax income, up to $17,500 for 2013,(Those over 50 are allowed to add $5,500 to that amount) to a qualified employer sponsored investment plan. Many employers choose to match their employees contributions to some degree adding additional money to the pot.

So, what do those things mean? Pre-tax dollars means that the money contributed to your 401k are not counted as income when you are taxed. If your paycheck was $1000 and you contribute $100 to your 401k then you only pay taxes on $900. ($1000-$100) This allows you to save money up front on taxes. Because you will pay taxes on the money when you retire it is called a tax deferred plan. This also begs the question “Will taxes be higher now or when I retire” I would guess taxes have no where to go but up since we are only paying for 2/3 of the government we have now and we will eventually have to pay for the remainder.

Employer match

This is one of the sexiest aspects of the 401k plan. With the average 401k plan employers contributed 4% of the employee’s salary most commonly in the form of a direct match. An employer will match dollar for dollar every dollar an employee contributes up to a certain percent, the average is 4%. Meaning that if Joe contributes 4% of his paycheck to his 401k the company contributes the same amount to his 401k. This work out to be a 100% return on investment; Joe doubles the money in his 401k.

Not all employers do a direct percentage match some match $.50 on the dollar or some other amount but knowing how your 401k plan works is important to making the most of your plan. As in our above example Joe’s employer matches up to 4% of his salary. This means that if Joe is contributing less than 4% to his own retirement then he leaving his employers money on the table.

Getting your money out of your 401(k)

Getting your money out of a 401(k) can be difficult or have penalties depending on the circumstances of your plan. Traditionally, you can only make withdraws from a 401(k) under certain circumstances.

- When the employee retires, becomes disabled or is no longer employed by the employer who sponsored the plan.

- The employee hits age 59.5

- The employee experiences a hardship as defined under the plan, if the plan permits hardship withdrawals

- Upon the termination of the plan

With some plans it is possible to take a loan of 50% of the vested value of the account but not all plans allow for this option.

Summary

A 401(k) is a retirement plan that has some great aspects and that also has some drawbacks.

Pros:

- Most employers contribute additional money to the retirement of the employee.

- Tax benefits.

Cons:

- Mandatory withdraws at age 70.5

- Taxes are likely to be higher when you actually have to pay them on the money in the account unless you believe you will be in a lower tax bracket when you are pulling money from your account.

Obviously, I can’t cover everything there is about 401(k)s but hopefully this gives a basic idea about what they are and how they are used.

Photo by 401k 2013

A Penny Saved and other thoughts

Our culture is full of phrases and cliches about money. Some of them are true and some of them are just crap.

Is a penny saved really a penny earned?

There is an idea in the personal finance world called the rule of 10. Basically, every dollar you save now is 10 dollars you will have in retirement if invested properly. This assumes wise investments and paying off high interest debt. It may not be actually 10 fold depending on a vast number of circumstances but a penny saved is actually much more than a penny earned if you treat it properly.

A fool and his money are soon parted.

This old classic means that a fool will spend his money foolishly and will soon be without. It is, unfortunately, all too true. With 76% of Americans living paycheck to paycheck it is clear that we have a nation of fools. Even when you drive through the poorest neighborhoods you see satellite dishes, nice clothes and I can’t tell you how many crappy cars drive by my house with killer stereos. We feel the need to live a lifestyle greater than we can truly afford and it pushes us further into debt.

The borrower is subject to the lender.

If you have debts you are working for the people you owe that money to. We are all enslaved to one degree or another to the debts that we owe. Many people struggle to get out from under their college loans to pursue their dreams. The more money we borrow to finance the lifestyles we think we deserve the longer we are forced to work for our debt holder.

Riches have wings.

Money, if given a chance, will fly out of your hand and out of your control. This is why I encourage people to run a tight budget. Accounting for every dollar in some way and moving the money into accounts that are not easily accessible. If you do not plan how you will spend you money it will be spent in ways you did not plan and of course those ways will be less effective than you intended and will be a waste.

It’s Never Enough

It doesn’t matter how much money you make, if money is your idol and you are seeking satisfaction in it; it will never be enough. Lifestyle creep will slip in and you will always feel like you don’t have enough money. Satisfaction will never come from the trinkets that you are able to buy in this world. Jesus said “What does it profit a man to gain the whole world and lose is soul?” If your life is focused on more important things than money becomes secondary and becomes a tool not your master.

Image by puuikibeach

Prevent Fights About Money in Marriage

Photo by yourdon

I have talked to many couples about money over the years and there always seems to be some tension around money within marriages. According to some evidence fighting over money greatly increases chances of divorce. It may be a testament to how powerful the love of money is in our culture.

My wife and struggled with how to handle our finances in a biblical fashion and how to handle money issues within our marriage with the grace of the gospel and we have learned a few things about preventing fights about money in marriage:

- Don’t become money Pharisees: Many church folks talk about money with a very legalistic mindset. We set hard and fast rules to live by when it comes to our money and then we experience the same guilt with money that we do with every other sin in our lives because we broke the rules. You will both make mistakes or have already and there must be grace for those mistakes just like any other sins that have been forgiven by Jesus.

- Remember to communicate: It is easy if one spouse “Does the bills” or “Handles the money” for the other spouse to feel left out especially if that spouse also doesn’t bring in any income. I have had to work very carefully to keep my wife involved and help her to know that our money is OUR money. We have gone as far as to schedule a weekly finance meeting where we go over spending, budget and planning. Mint.com creates great little graphs for my presentations.

- Create and commit to your budget together: The initial budget should be something you and your spouse decide on together. It may be a tough conversation but you can help one another by calling out the idols you have in your life around money. My wife, by nature of taking care of our home, is responsible for spending a large share of our budget that isn’t automated. She does her best to stick to the budget we agree to and we discuss it when it needs to be changed.

- No questions asked money: If you can afford it allow one another play money. If my wife wants to order a new gadget for her camera she doesn’t have to ask me she just buys it. Similarly, I don’t have to ask her when I want to go out for lunch. We each have our own accounts with direct deposits that are ours alone.

- Automate things: When possible automate savings and bills. Saving is much less painless when you don’t have to do anything to accomplish it. We have a whole article on how to do it here.

- Ask “Why do I feel this way”: We all have experiences with money that lead us to think a certain way about it. I, for example, value my savings like an idol just for its own sake. I trust that having no debt and money in the bank will save me from life’s circumstances instead of trusting in Jesus as my savior.

- Know your Role: No not that men are the breadwinners and woman should be home barefoot and in the kitchen. (Although my wife hates shoes and loves to cook). Know how your individual styles complement one another. Or know what you can and cannot do. By way of example: My wife will hold onto cash like it is gold. She will spend that $50 in her purse several times. Each time intending to deposit it to cover the purchase she just made. I ,on the other hand, will hold onto cash and spend on a card because it isn’t concrete money to me.

This list, like most of this blog, is a monument to our failures. We have learned many of these lessons the hard way. What else can you do in order to prevent fights about money in marriage?

Automate Your Finances

One of the best steps in getting your budget under control is to automate finances. As much as possible, make your financial matters a hands off activity. This way you are eliminating human error like forgetting to send the payments or spending more than your budget  allows, and your savings happens without your effort.

allows, and your savings happens without your effort.

Limit access to money

One of the most effective ways to automate your finances and control your spending is to limit access to your money. Your money is going to be spent the question is if it will be spent where you would like. The best example of this is 401(k). This money is normally taken out of your paycheck before you see it, like taxes. So, you do not have a choice in how you spend that money. Most people never even pay attention to how much money is taken from them in taxes.

This can be done in very simple ways. If your company has a direct deposit option you can limit yourself by only depositing the amount you need for your budget into your main checking account while remaining funds should be deposited into a savings or investment account. This helps control lifestyle creep (the propensity to spend more as you make more) because you don’t actually see an increase in your main bank account where it can be easily spent.

Example:

If your monthly budget for your bills is $1000 and you get paid once per month you would only deposit $1000 into your main checking account. If your paycheck was $1200 then you would deposit $200 in a savings account.

If you got paid every two weeks you deposit $500 per check if you can balance your bills on two different pay periods, that may take some time to set up and get right.

This prevents you from having easy access to “extra money”. I use quotes there because all of your money should have a purpose even if it isn’t immediate, and there should be a plan for all of your money. Don’t let your money sit around and be lazy, send it off to work for you in an interest bearing account, or in an investment of some kind.

Automate your bills

Most utilities offer a budget program which allows you to pay the same amount all year round instead of being hit with high electric bills for your air conditioning in the summer and for your heating in the winter. They will average the last year of your bills and give you one median payment. This allows you to set up a recurring payments of a single amount; no forgetting and no sticker shock on your bills.

For years we split our bills in half and paid half every two weeks with our paychecks, to make sure we didn’t spend it while we were waiting for the bill. It forced us to do some manual work thanks to those three paycheck months but it wasn’t bad. Now we use a different account for monthly bills that doesn’t get touched so we always have enough money and the bills are set to pay the full amount automatically.

How have you automated your finances and made your life simpler?

- Automate your finances

Is College Worth The Cost?

My church is full of college students. I have sat down and talked with many of them about how they are going to pay for their loans when they get out of school or now that they are out of school. It is sad how few of them understood what they were getting into when they signed on the dotted line.

In constant 2010 dollars the cost of a college education at a 4 year public institutions have increased 145% from 1990 to 2010. (http://nces.ed.gov/fastfacts/display.asp?id=76). That seems like a lot and since the jobs young people are promised when they graduate are not so easily found many people are questioning the decision that for so long has been a given.

Image from: http://www.finaid.org/savings/tuition-inflation.phtml

How does that compare to general inflation? Not very well if you are the one looking to fund an education. Inflation, the purchasing power of your money has been out paced by the increases in college costs.You can think of inflation as the amount the price of consumer goods increase on average. Either we can remember or our parents have told us stories of how things used to cost less. That is the effect of inflation. The price of consumer goods tends to increase for various reasons over time. However, this chart shows that the cost of college has increased much faster than general inflation, somewhere in the area of 150%-200% faster than general inflation, depending on the year. (http://www.finaid.org/savings/tuition-inflation.phtml)

Does all of this mean that college is no longer the deal that it once was? Not at all. The earning potential of the average college graduate is still much higher than that of the average high school graduate. According to G. Scott Thomas over at BizJournals:

Adults with bachelor’s degrees in the late 1970s earned 55 percent more than adults who had not advanced beyond high school. That gap grew to 75 percent by 1990 — and is now at 85 percent.

That alone could mean the difference around 1 million dollars over the course of a career, assuming one pursues a career that pays reasonably well in the first place.

For the question “Is college is worth the cost?” A fine arts degree may be your hearts desire but there is no guarantee it will pay the bills.

In my opinion the question is “Could I pursue my passion in another way?” Could you pursue an apprenticeship of some sort to learn what you need to know? With the rise of online learning could you learn what you need to pursue your career. I have heard from a few managers in my field that they don’t even pay attention to the education section of the resume in many cases because it matters more what you have actually done in the field.

Maybe you could start your own business or be self employed depending on what you want to do, you can certainly hire yourself without a degree.

Image from BusinessInsider

My fear in working with so many students struggling with college is that I really think we may be on the edge of some sort of education bubble. If you compare the increase in tuition to that of housing prices a few years ago it is staggering. The small bump that we saw in housing prices is noting compared to the skyrocket in costs of tuition. I don’t know that we will see degree foreclosures but I think something may be seriously wrong with they way we are doing higher education. Easy credit and government guarantees are helping more people take out loans but it is also making colleges more expensive as many are building resort style facilities to attract students who bring with them more government backed money. It is a spiral very similar to what we saw with housing I just hope it doesn’t crash as hard or many of us will be hurt in the process.

There are many variables in deciding if college, or what type is best for you and there are many ways to reduce your costs if you take your time and make wise decisions. But, we shouldn’t assume that a four year degree is right for everyone and it is fine if our children make different decisions as long as they are making wise ones. After all it is they who will have to work off that debt in the long run.

Here are some questions to consider:

- You loan payment will be approx $100 per month for every $10,000 that you borrow. Can you get a job to make that much with the degree you are pursuing? $100,000 in debt to be a youth pastor ($20k a year) not a good idea.

- Is there a different way I can pursue my passion without incurring large student loan debt?

- Is the traditional four year college even the right choice for me and what I want to do with my life.

- Do I want to work for someone else the rest of my life?

By the time my girls are reaching that age there are a lot more viable options for higher education than pushing everyone into the same college mold. But who knows what the future holds for education.

Cover image by TaxCredits

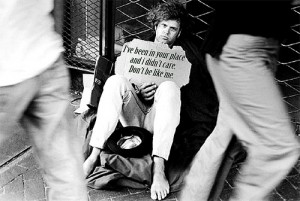

Give to everyone? Is Jesus Kidding?

Image by jorgempf

Are we really called to give to everyone? Luke 6:30 and Matthew 5:42 are two scriptures I would really like to remove from the Bible, if I am being honest.

Give to everyone who begs from you, and from one who takes away your goods do not demand them back.

I live in a city and people are begging all the time, on every freeway off ramp, on every street corner. I have been approached multiple times in parking lots with stories of running out of gas and loss of debit card, and a dead cell phone. How am I to handle these things as a Christian? These scriptures make it fairly clear that I am to give to anyone who begs (some bibles say “asks”), but Paul says that anyone who doesn’t work doesn’t eat. So, it is not as straightforward as just giving to everyone, at least I don’t want it to be.

I want to handle my money responsibly, but I also want to be obedient to Jesus and not be selfish with my money. How do we handle this dilemma. I will be upfront that I don’t know if I have a solid correct answer. This article is more about exploring the issue. If you are looking for a hard and fast answer: move along.

Why do we not want to give to everyone?

As with many things, asking why we feel a certain way can be very helpful.

- I don’t like the idea I’m being ripped off.

- I don’t want to be made a fool of.

- I don’t want to be parted with my hard earned cash under false pretenses.

I give all the time when people I know are in need because I know them and their situation. They aren’t faking it.

The gospel answers to these questions, of course, come from a proper understanding of stewardship; It isn’t my money in the first place, it is God’s. He has the right to require it of me anyway he likes, if I am to call myself a believer. Does it matter if the individual is sinning by lying to me. That is up to God to handle and he will either by forgiving them and making them his children or by allowing them to bear the punishment for their sins.

So, am I simply worried about being a bad steward of God’s money? Maybe, but them I am reminded of a story I have heard about CS Lewis.

One day, Lewis and a friend were walking down the street and came upon a begger who reached out to them for help. While his friend kept walking, Lewis stopped and proceeded to empty his wallet. When they resumed their journey, his friend asked, “What are you doing giving him your money like that? Don’t you know he’s just going to squander all that on ale (beer)?” Lewis paused and replied, “That’s all I was going to do with it.”

If I am honest, even if I gave $20 to everyone beggar on every off ramp holding a sign that says “stranded” I would still give away less money than I waste on frivolous things.

Is there a biblical reason not to give to everyone?

Money is at best a temporary solution to the issue facing the person asking. Giving money to a person on the street is a great way for us to feel better about ourselves without actually doing any good for the person we give the money to in many cases. It seems to me that in the biblical context people knew more about one another. If you saw the same person begging in the same place every day for a year you could assume they were not able to work. You could ask if you didn’t already know their story. However, in our day that is very unlikely.

Paul was pretty clear in saying that if a man doesn’t work he doesn’t eat. Laziness was not acceptable. But how do we know if that is the case if we don’t have a relationship with the people in need?

As Christians we are called to give and help above and beyond. That is why Jesus called us to give to everyone who asks. He didn’t qualify it because he knew we would look for any excuse at all to not obey.

What do you think? What are your considerations when it comes to giving to everyone that asks of you?

Extra Income, what should I do?

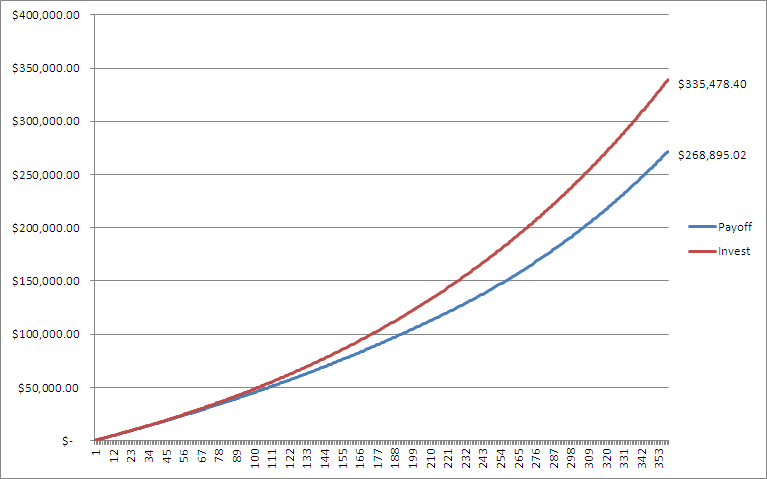

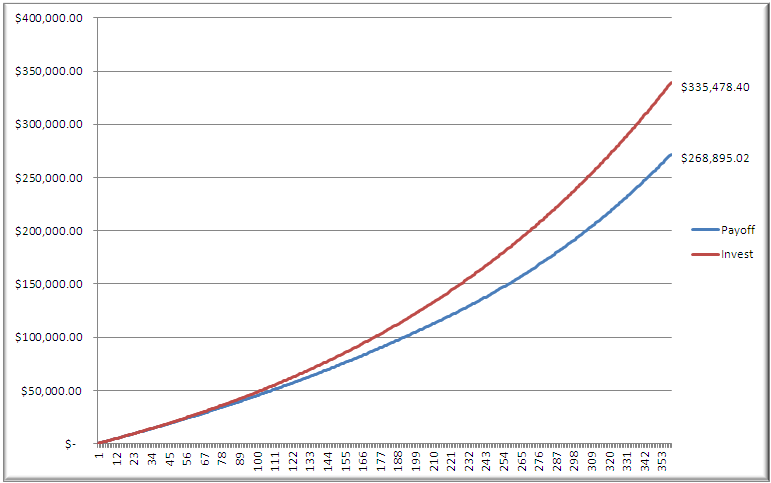

To Pay or not to Pay (off your debt)

I get a form of this question all the time. Should I pay off debt or invest it? Paying off existing debt is a safe bet. Think of it this way, if you are paying 19% on a credit card then by paying off that card you are saving 19% interest. That is money in your pocket every month that you can use to pay off other bills or start investing.

If you debt is low interest and/or tax deductible you may be better off by paying your monthly minimums and investing the extra money you have. Here is why..

Using debt to make money

Imagine if I told you that I would pay you 100$ tomorrow if you loaned me 90$ today? Suppose that you didn’t have 90$, but you could borrow it from a friend and pay him back 95$ next week. You would make 5$. You can do the same thing with your debt if you have a solid investment plan and some time.

According to most resources, the average return from the stock market over the long term is between 7% and 12%. If you are paying 4% on your mortgage, for example, you could take extra money and pay off that debt or you could take the same extra money and invest it. Sure, you would be paying interest on that money, but over time you will make more money investing. There would be some months where you may not, if the stock market has a bad run, but over time you should make more money.

This type of decision is not to be entered into lightly. Previous performance is no indication of future performance. That means that the stock market could make 1% over the next 30 years and you would lose money.

Additionally, it may be more important for you to be out of debt and play things safe. You may want to leave the rat race and start your own business. This is why I normally tell people to pay off their debt. It is the right emotional choice for most people, but it is possible to make more money and possibly pay off your debt sooner with the proper investment strategy.

The chart below shows the difference in total value over 30 years when you invest at a conservative 6.5% instead of paying off a mortgage that has a rate of 3.5%. The numbers include the equity in the home as well as investment income. Once the mortgage is paid off the money that was being used to pay off the mortgage is then invested at 6.5%

Of course, there are many assumptions involved in these calculations. Your particular situation may be different, but many people have never even considered the benefits of not paying off their debt.

This is for informational purposes only, everyone should do their own investigation and due diligence.