More budgeting: Biblical Stewardship

Image by McGoo84

Biblical stewardship is more than a good budget, saving and giving the right amount of money. It is about having a proper biblical relationship with money.

Our problems with money don’t begin when we spend more than we make; they begin when we forget that God must be at the center of this part of our lives. When you have no bigger purpose for your cash than your own enjoyment, you are already in money trouble. –Paul David Tripp, Sex and Money: Pleasures That Leave You Empty and Grace That Satisfies

I liked to say, when I was a youth pastor, “There is a non-smoking, virgin section of hell.” My point was that being a follower of Christ is more than just not doing the wrong things, or even doing the right things. It is easy to fall into this same trap with money. Most people who write about the money miss this point entirely. I wrote about money years ago and I missed this point a lot. It is why I want to write about biblical stewardship now. You can spend less than you make, pay off all of your debt and give the magic amount to your church and still not have God in the center of your financial life.

We each have some sinful way of looking at money; I look at money to keep me safe. I look at money to be my functional savior and it ends up being my master. How many of us are now working harder than we want to work to pay for things we purchased long ago or things we think we need to keep up with our neighbors. We can easily become slaves to our desire for money.

Some people have shunned money and taken on a poverty theology some have tried to use Jesus as their personal ATM loving money more than God. Both of these ideas are sinful and will lead us toward a sinful way of handling our money. We need to look at money as a tool to be used and stewarded just like anything else in our lives. Money should be used properly to the glory of God and that should be our goal as Christians.

Improve your Budget

Photo by hisks

Great so now you have a budget written down and you are all ready to have your spending under control. How can you improve your budget? Pay attention to it for starters. The biggest mistake people make is to ignore the budget they have just put together. It is easy to assume that everything will take care of itself now that your monster spread sheet is put together or that you have set everything up on mint.com. But, alas, it simply isn’t that easy.

I will let you in on something, even if you used my budget template as I suggested, you forgot something on your budget. There is a bill that will come due that wasn’t part of your initial tracking period. That is OK. You will just need to adjust your budget now. Is it ok to change your budget? If it is intentional, absolutely. The problem arise when you simply overspend, without planning. You will need to adjust your budget several time until you have it to a good place and then you will, hopefully, get a raise or something else will change in your financial life that will require you to change or even rewrite your budget.

Understanding that your budget is a living document will help you not stress out when things come up that you require you to make adjustments.

What could I have forgotten?

- Did you put money aside for the Holidays? That is one of the biggest times to destroy your budget. Save money for travel, gifts and extra workout equipment to get rid of those holiday meals meals.

- Bills that don’t come due every month; Car insurance, homeowners insurance; subscription fees.

- Do you have an emergency fund? Cars need repairs, hot water tanks blow up. If you don’t want to blow your budget you need to have money put aside for these things, they will happen.

- It also helps to give yourself an allowance so you have some money to spend when you want something. Leaving yourself out of the budget will lead to burnout.

What else can you do to improve your budget?

Parable of the Sower and Stewardship

The Parable of the Sower and Stewardship

The parable of the sower is one of the toughest parables for me to read. Jesus really focuses in on my personal idols and it is a good but terribly difficult process.

As for what was sown among thorns, this is the one who hears the word, but the cares of the world and the deceitfulness of riches choke the word, and it proves unfruitful.

(Matthew 13:22 ESV)

This parable, particularly the section about the seed choked out by the “Cares of the world and the deceitfulness of money” is a strong warning to any Christian, like myself, who is interested in personal stewardship. It is easy for us to focus too much on money as an end in itself and not merely a means to an end. The end we should be focusing on is the progress of the gospel of Jesus Christ.

Image provided by funny-p

From a personal point I struggle with loving money and caring to much about things of this world. I wrestle with finding a balance between planning for the future of my children and being charitable with my money. I love my church, but when we were presented with the opportunity to purchase our church building, needing a huge down payment, my gut clenched.

I struggle with being charitable and giving to the work of God my church is doing. When the opportunity arises my love of money (in the bank especially) starts to reach out to choke me out. I know a lot of people struggle with this balance because I hear from them in my personal finance classes all the time asking how to balance the need for money in our culture with the Bible’s call to not serve money instead of God.

I don’t have a hard and fast answer. I wish I did. I have found that a Godly spouse is invaluable in pointing out your sinfulness and I constantly ask my wife if I am holding on too tight. She is good about telling me when I am being too stingy.

Me: Do you have an amount in your head you think we should give?

Wife: Yes, you go first.

Me: I was thinking X.

Wife: Oh, I was thinking 2X.

That usually helps me to know that the thorns are coming to choke me out.

I wish I had better answers for this topic; it is one that I am constantly processing and one I will probably write about more as time goes on. Jesus is constantly calling is to something greater than the temptations of this world. He constantly calls us to lay up our treasure in heaven and not in this world. Balancing that with the reality of needing money to survive should drive us to constant prayer and vigilance to ensure we are focusing our efforts in the right place.

Negotiation Power – The $21,000 Question

Image by Henkster

The key is Negotiation

Many people are afraid of negotiation; they are afraid of being rejected, or of losing out on an opportunity, but not negotiating is costing you money.

Just today I was in a men’s store looking at suits. The guy helping me pulled out one suit but told me that it wasn’t part of the stores buy one get one deal. I tossed him a sceptical look and he immediately changed his mind. “I could do the deal on that suit” he said. Of course you could. I didn’t even have to ask, I just gave him a look. If I wanted those suits that look would have saved me $200 dollars.

Of course, there are many places where negotiation will get you nowhere. Don’t bother talking to the teenager behind the counter at McDonald’s about free fries with that burger; they don’t have the power or the interest to cut you a deal. But you should try it everywhere else, you never know where it may get you. After all, when faced with the choice between a smaller profit no profit most will choose a small profit.

The $21,000 question

This brings me to my $21,000 question. When I was looking to move from my last job to my current one I had just read an MBA document on how to negotiate with your new job and I was determined to try it. I was not an MBA and didn’t feel that I was in a position to negotiate but what did I have to lose?

When I was given the offer it was A LOT more than I was making at the time. I had every reason to scream “yes” immediately, but was still determined to take the chance. I informed them that I was looking at a $3000 bonus from my current job (which was true) and if I left the company now, I would be walking away from that opportunity. “Could you compensate for that with a signing bonus?” was the $21,000 question, I had read it in the MBA document. No one does signing bonuses at my level, it was crazy. The response? “We can add that to your salary offer, so you would get it every year, if that would work for you.” I have been at my current job for 7 years which means that one question has earned me an extra $21,000 over the course of my career. Remember the only time you really have control over your salary is when you take the job, after that you have very little direct control.

Maybe you don’t have that opportunity but there are a lot of places where you can try to negotiate:

- Car Purchases

Not just the price, ask for oil changes, car washes, extended warrantee. - Furniture Purchases

Price, delivery fee, throw in that lamp in the corner(we got a kids lunch box my daughter had been walking around with at the store) - Smaller shops – I try not to because I want to support small businesses, but they do have the most power to offer you a deal.

Where have you negotiated successfully? Tell me about it in the comments.

Give Yourself a Raise

One of the things I like to tell people in my stewardship presentations is that it is possible to give yourself a raise of roughly $2900 a year, depending on your personal situation. Not only is this possible, I highly recommend it to anyone who wants to act responsibly with their money.

Photo by TALUDA

If you are looking to pay off debt, make ends meet, or just invest YOUR money so YOU gain the interest you owe it to yourself and your family to give yourself a raise.

Now for a little background…Every paycheck the government takes a ton of your money before it even hits your pocket and every spring people get really excited that the government makes them fill out paperwork to get back the extra that the government took out in the first place. We call it tax season.

If you get a tax return back every year it means you are giving the government too much money every paycheck and they hold it all year and then give it back to you interest free when you file your taxes.

I don’t want to get political, but I believe it is irresponsible to allow the government to take your money all year only to give it back to you interest free in the spring.

The average tax return in 2011 was $2900. By filling out a new W-4 form you tell the government to take less of your money each paycheck. It reduces your refund but you will have more money in your pocket every paycheck. How do you decide what is right? The IRS actually supplies a handy little calculator for just such an occasion. It will give you the correct number to enter on your W-4 to get you the smallest refund and the largest paycheck. I, personally, like to have just enough money to pay for turbotax but you should do what you are comfortable with. For years before I knew the calculator existed I just moved my W-4 number up a each year so I was paying less every year.

The point is, that is your money they are taking and holding. Imagine going to the grocery store and paying too much for your groceries every week but not getting any change until the end of the year. You wouldn’t be excited about that money at the end of the year! It should have been in your pocket all along. That is exactly what happens with your taxes. People over pay their tax bill and get excited when they get their “change” in one lump sum because they don’t understand the process.

For this to work you must have a regular paycheck which has taxes withheld If you are responsible to pay your own taxes then this won’t work. You must also get a tax refund at the end of the year, if you don’t then you can’t get that money back throughout the year.

If you are looking to get more control over you money, to pay off debt, save for the future or just keep it out of government hands. This is a great first step.

As always you should do you own due diligence when it comes to these issues. This article is for informational purposes only and is not to be considered tax preparation or legal advice.

Create a Budget

So, you’ve read part one of this series you know why you should have a budget and how it can help you answer some fundamental questions. If you haven’t read it; read it now. In this article the question is “how do I create a budget?” If you have never actually had a written budget it may feel complex. Figuring out how to create a budget can feel confusing, but it doesn’t have to be.

So, you’ve read part one of this series you know why you should have a budget and how it can help you answer some fundamental questions. If you haven’t read it; read it now. In this article the question is “how do I create a budget?” If you have never actually had a written budget it may feel complex. Figuring out how to create a budget can feel confusing, but it doesn’t have to be.

When I talk with people one on one I usually recommend one or two methods depending on the preference of the individual. I will talk through both here.

Create a budget on Paper.

- Gather up all of your bills for the past month.

If you don’t have them from last month then keep them when they come this month. - Track every penny you spend.

Do it in a notebook, or keep receipts of your spending or use one debit card for all spending then use the statement to actually make your budget you won’t have to guess. - Put it down on paper.

If you don’t want to create your own there are plenty of places to find budget templates. However, searching those out may lead to more confusion so here is a simple budget template to get you started. - Fill in the green spaces that apply to you and the yellow column on the right will tell you what percentage of your income you are spending on any particular category.

- You may not need every single line so only use what suits you. I actually find it most useful to keep categories as broad as possible. But, you need to do what is right for you and knowing that takes experience, so play with it.

- My wife and I have gone through dozens of forms of budgets in our time of trying to organize our finances.

Create a budget with Mint.

- Mint is a free online personal finance program. (Also available on mobile platforms) It is owned by Intuit the same company that owns Quicken and many other programs. They have been in the business for a long time and they are very reputable and secure.

- Sign up for an account on mint.com

- Register your primary spending accounts

- Mint will automatically pull in your all of your account activity and automatically categorize it for you. (Watch out they are not always accurate)

- Use Mints built in budgeting feature to set up the categories for your spending. Mint will let you know how much you have left in every category. You can even set up a alerts to let you know.

Having a budget down on paper, even digital paper is the first step in getting your personal finances under control. There is something about actually writing things down that acts as a commitment device. But, understand that a budget isn’t set in stone. Month to month things may vary and you will have to account for that. For the first few months you should keep a close eye on things and maybe make adjustments as needed.

Why do I need a budget?

“Why do I need a budget?”

When discussing personal finance or stewardship. One question comes up when I start talking about budgets.

“Why do I need a budget?”

I normally respond, “The same reason you need a map or a GPS.”

A budget tells you how you are going to get to where you want to go. Of course, that assumes you already know where you are and where it is you want to go with your money. Many people don’t. A budget will also answer the question “Where am I now?” from a financial perspective.

Why do I need a budget?

It is possible to get where you want to go without a map or a GPS if you are familiar with the area and you pay attention. However, if you are in unfamiliar territory or don’t pay close attention then it will be difficult to get from point A to B. Don’t think of a budget as a chain to keep you in line. It is a tool to achieve your goals. You can use it to get out of debt, or to give more to those in need or what ever goal you feel called to.

How can I set up a budget?

Setting up a budget can take many forms and I will talk about them at length on this site. But, first I want to give a general overview of the concept.

Know where you are.

Many people I talk to about their finances don’t have a very good idea of where they stand financially. I ask them to keep track of every penny for thirty days and to break down their spending in to different categories. This can be done in a notebook, on a smartphone or with something like mint.com but doing it will give you some good information.

- You will know where your money is going.

- You will know where it isn’t going. (Which can be just as important)

- You will know if you are spending more than you are making regularly.

These answers will give you a good idea of where you are financially. It may not be a pretty picture, but it is your picture and now you know what you can do to improve it or overhaul it completely.

Know where you want to be.

You really can’t make a plan until you know where you want to be. Do you want to spend less so you can get out of debt? Do you want to be able to give more to your church or ministry? Do you want to stop losing ground and spend less than you make?

These decisions are, of course, very personal ones and it is something you will need to decide on your own (with your spouse) or with good council. Getting an outside opinion can be embarrassing but I have found that asking someone who isn’t emotionally involved in the details can often offer insight you wouldn’t have gotten otherwise.

Image by duchesssa

Biblical Stewardship

Image by Mompes

Biblical stewardship is what this blog is all about. which has to do with heart and mindset as much as the practical approach to money. Stewardship is an unusual word in our age. Uless you are talking about environmental stewardship you won’t hear it much.

From a Christian perspective it is the understanding that you own nothing, but that everything belongs to the LORD; we have been temporarily entrusted with the proper use of those resources.

The dictionary definition of Stewardship is:

the conducting, supervising, or managing of something;especially: the careful and responsible management of something entrusted to one’s care.

The church at large has done a poor job at balancing concepts of biblical stewardship. Our views of how to handle money seem to flow with the larger economic situations. For example, during the booming growth of the 1990’s “prosperity” theology took off and crept into mainstream church thought. Now, during a recession many people are shunning such theology for a theology of poverty. I don’t believe either of these extremes is a realistic example of biblical stewardship. Biblical stewardship is the recognition that we own nothing, but are managers of God’s money and resources. We are to use our resources as God would like us to use them and and not allow money to take over our life choke out our fruitfulness. (Parable of the sower)

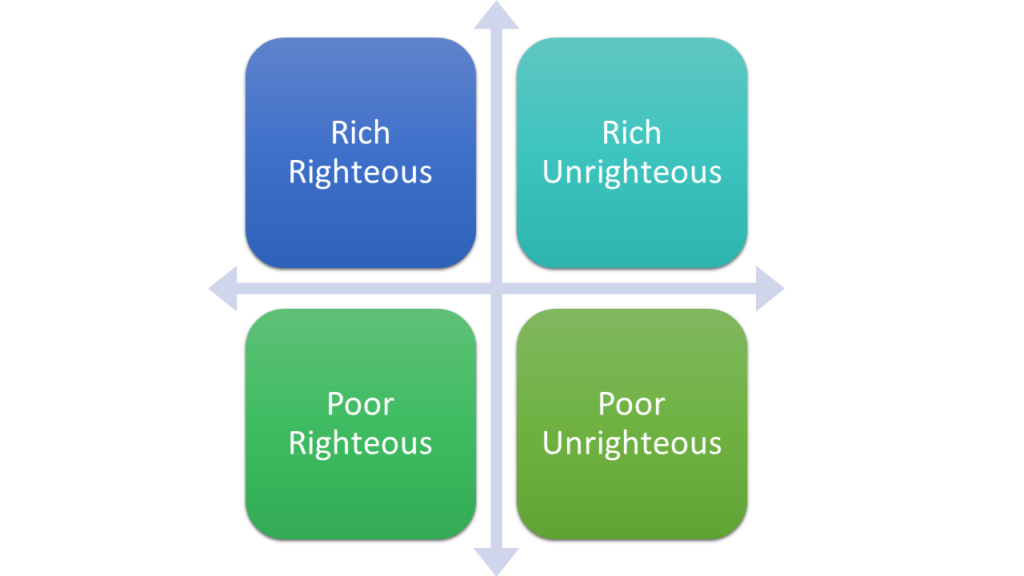

Mark Driscoll and Gerry Breshears talk about four ways money can be stewarded in their book Doctrine They are broken down into two sets of two categories: Rich/Poor and Righteous/Unrighteous. Some people are rich and deal righteously with the treasure God has entrusted into their care. Some people are poor who do not handle their lot righteously. Stewardship is not something merely for the well to do. Both rich and poor are called to be good stewards of their money.

Mark Driscoll and Gerry Breshears talk about four ways money can be stewarded in their book Doctrine They are broken down into two sets of two categories: Rich/Poor and Righteous/Unrighteous. Some people are rich and deal righteously with the treasure God has entrusted into their care. Some people are poor who do not handle their lot righteously. Stewardship is not something merely for the well to do. Both rich and poor are called to be good stewards of their money.

Neither the circumstances of the global economy, nor our personal economy should determine how we steward the money entrusted to us. How we steward God’s money should be determined by the biblical principles God has laid out, humility and generosity. If you are a believer then all of your decisions. financial or otherwise, should be made in light of what the God of the universe has already given you in his Son. Working out the details is what this website is about. Subscribe and follow along on the journey as we look at both practical money saving advice as well as scriptural issues.

If you have just found this site take a look around…

Image by Mompes

Sample Budget

If you are looking for a simple way to get started budgeting this little file can help you out.

Just fill in the green spaces where applicable and the yellow will calculate on their own.

Excel

Google Drive

If you are interested in learning a little more about creating your first budget check out our series on budgeting or our self paced budget course