Keeping Christmas Under Control

It is that time of year. People start thinking about Christmas shopping about this time. If you haven’t been keeping a Christmas fund already you may be thinking “How will I handle this?” How do we let the whole year go by without making plans to keep Christmas under control.

It is about Jesus…

Remember the true point of Christmas. It is a celebration of our Lord Jesus not our Lord Materialism. Create traditions with your children that will point your children toward the Gospel of Jesus Christ. We always do a birthday cake for Jesus on Christmas eve, for example. We have always based our gift giving on the idea that God has given his greatest gift to us and so we give gifts as a reminder of that Gospel truth. What type of ideas do you have to keep it simple and focused on Christ?

Christmas Under Control

For Christians Christmas shouldn’t be about materialism. The average American expects to spend $882 dollars on Christmas this year according to the American Research Group. All too often our culture pushes us toward worshiping at the retail altar. If you train your children early to appreciate the little things you are off to a good start. There is no reason to try to buy your children’s affections once a year.

For Christians Christmas shouldn’t be about materialism. The average American expects to spend $882 dollars on Christmas this year according to the American Research Group. All too often our culture pushes us toward worshiping at the retail altar. If you train your children early to appreciate the little things you are off to a good start. There is no reason to try to buy your children’s affections once a year.

- Set a budget – Determine how much money you can afford or want to afford before you open up amazon. We have a free budget sheet here.

- Something they want, something they need and something to read – This three point idea will help you keep things under control

- Secret Santa – If you have a larger family or group you feel you need to buy for then offer the idea of exchanging names and only buying for one or two people.

- Free gifts – Never forget the power of things that can’t be bought. Free babysitting coupons for a night out can be priceless.

Keep a running list…

If you are like me you freeze up when it comes to actually buying the gifts. We have the money, we planned for it but what does my wife actually want? I have taken to keeping a running list of anything my wife mentions or anything I think she may like throughout the year. This way I don’t have to worry too much when it comes to thinking for ideas.

What ideas do you have on keeping Christmas real? Put it in the comments..

No Spend Month

No Spend Month

My Wife and I are calling for a No Spend Month for August. Why? We let a few things get away from us. We had used our credit card in an attempt to build up some reward points and in the process over spent. We had carried a balance for a few months and decided to bite the bullet and pay it off. Fortunately for us we have the money to pay it off in another account, I just like having money in the bank.

So, in order to replace the money from that account we have decided to do our “No Spend Month.” What does that mean? We normally have budget allowances for categories like eating out, clothes, Christmas, and other but for this month all of that money is going to pay back our the money we used to pay off that Credit card.

Last night was the first time we were challenged. The girls are out of town and normally that means we go out to eat and treat ourselves. Last night we didn’t allow ourselves to do it. We went to the park and played Pokemon Go. We went home and my wife shopped and gotten us nicer meals for home than usual, but they came out of our grocery budget, which isn’t part of our “No Spend August” (Hey, you gotta eat)

We looked for ideas to do that didn’t cost us any extra money. Play a game, binge a show on Netflix, swim in our pool (no kids makes is peaceful). We even helped one another make plans to be successful in our respective goals.

Do you need a No Spend Month?

Even if you didn’t overspend there are some benefits to doing your own No Spend Month.

- It will help you live conservatively – We all need a reminder that this is possible every once in awhile.

- It will help you reach your goals faster – All that extra money you don’t spend can go right toward your goals

- It helps you realize you don’t need as much as you think – You can survive without spending that extra money.

- It will draw your family together – Think of creative ways to accomplish this as a family and do it together.

Don’t know how you could do it. Try these articles and give your ideas in the comments below.

http://www.livingwellspendingless.com/31-days/livingwellspendingzero/

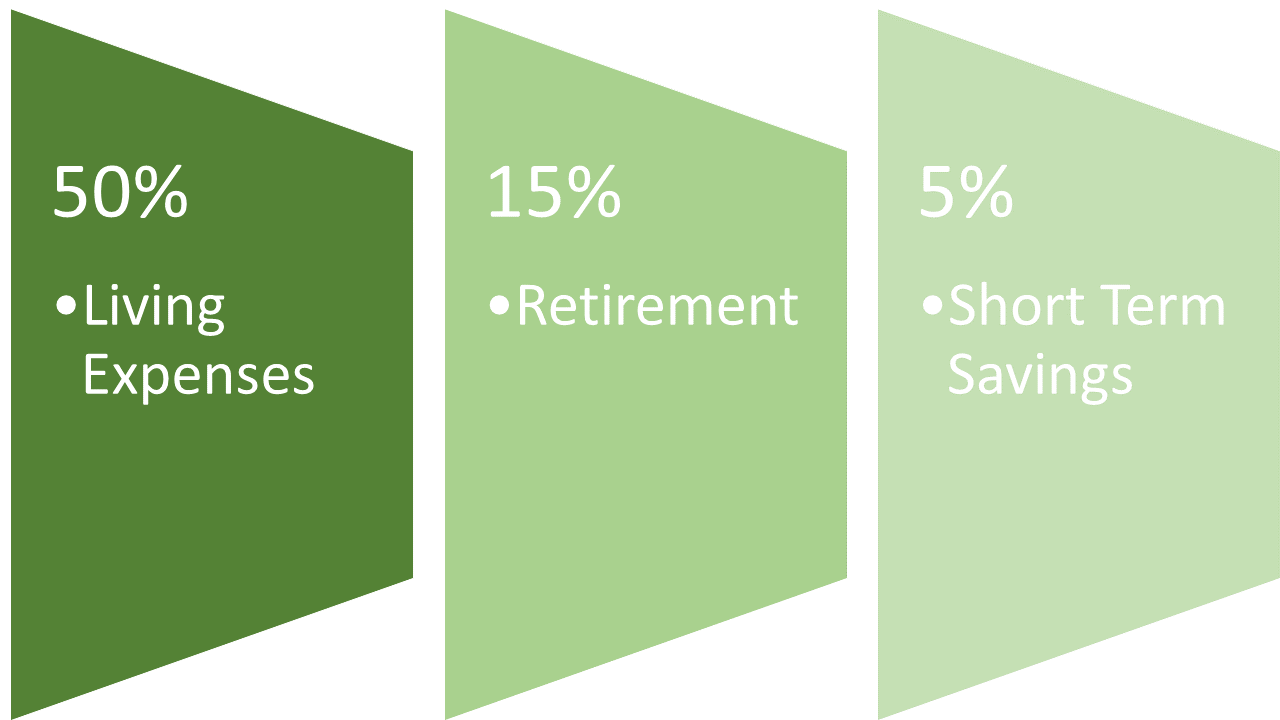

50/15/5 Rule

I have recently gotten an email from Fidelity introducing a concept they call the 50-15-5 rule. You live on 50% of your income invest 15% in retirement and 5% in short term emergency savings. Of course, that is only 70%. The remainder can be used on what you like, according to Fidelity, paying off debt, or investing more.

gotten an email from Fidelity introducing a concept they call the 50-15-5 rule. You live on 50% of your income invest 15% in retirement and 5% in short term emergency savings. Of course, that is only 70%. The remainder can be used on what you like, according to Fidelity, paying off debt, or investing more.

This is a great idea if you have the disposable income. Many people don’t have that kind of luxury. It did help me see I am not putting enough away for retirement. Lifestyle creep has worked its way into my life and my budget. Extra money I have been earning over the years is eating into my budget and not being used intentionally.

If you have trouble keeping to a budget this may be an easier way to go. You put away your savings mark off 50% of your income and spend it to live. The other 30% you can use for discretionary items, like giving. It would be easier than doing a zero based budget or some other method if you are aren’t a numbers persons.

I have been examining different budget methods. I am a numbers geek, but not everyone is. There are many other methods out there to use to control your spending. If one of them works for you then use it. Just be intentional about stewarding your money.

Christian Stewardship Sermon

This is a sermon from Proverbs on Christian stewardship. Jason preached at the Veritas Tri-village congregation on 6/12/2016.

This is a sermon from Proverbs on Christian stewardship. Jason preached at the Veritas Tri-village congregation on 6/12/2016.

- Christian stewardship begins with understanding that God is the owner of everything (Ps 24:1). Christians understand that we are bought with a price and that it is God who gives us the power to gain wealth (Deut 8:18).

- Christian Stewardship is a spiritual discipline which can be exercised to produce godliness in the life of a Christian (1Tim 4:7)

- A good Christian steward, one who honors the Lord with their wealth.

- Worships with their offering

- Sacrifices with their giving

- Is Generous

- A cheerful giver

- Trusts the Lord will provide

- Plans and is intentional

- Stewardship is a Gospel issue

Podcast: Play in new window | Download

25+ Free Things You Never Knew You Could Get For Free

Seed time has some great ideas for getting some free stuff. I love free stuff.

FTC Disclosure of Material Connection: In order for us to maintain this website, some of the links in the post above may be affiliate links. Regardless, we only recommend products or services we use personally and/or believe will add value to readers. Read more here.

HT to: http://ift.tt/1M3o2Qn

Why you and your spouse should have the money talk.

Recently, my wife and I have been slacking off on our money talk. I am the money nerd in our family so I track most of the data and I wanted to get back on track with keeping her in the loop.

1. The money talk keeps you accountable

It is easy to get sloppy with money. I am guilty of using more money than I should to by special treats for my family. Having a consistent money talk with my wife keeps me accountable. I know I will have to talk to her about those little treats. It makes me think twice and helps to keep us directed toward our goals. It isn’t that I am hiding bad things but those little treats are working against our goals.

2. The money talk keeps you on the same page.

It is easy to put the budget on cruise control. But, things can get out of line easily. Having the money talk will make sure you and your spouse are on the same page. It makes sure that the goals you set at one time are still the goals want to be pursuing. It gives you the opportunity to review and change those goals should the need arise.

3. The money talk brings you together.

This one was a big one for us most recently. I felt like I had let my family down by making some minor mistakes with the budget. We have a pretty complicated system and it is hard to manage sometime. Having the money talk was hard for me because it required me to admit I had made the mistakes and seek my wife’s forgiveness. It was tough on my pride, but it brought us together as a couple

Bottom line the more you talk about money the smoother it will go if you both are walking in grace.

Do you have any tips on how to have this conversation?

Image by kabaldesch0

Student debt can be dangerous

Heading off to college is a great adventure for many young people. I know it was for me so many years ago. It was my first time living on my own, 6 hours from my parents. I was very fortunate that my chosen school only cost a few thousand dollars a year for tuition. I was able to work full time and pay as I went. The only student debt I managed to accrue was because I was stupid with my credit card.

College is a strategic inflection point for many young people. It is a time when many don’t get good council about money. A degree can take you far, but it can also become an anchor around your neck. Here are a few things to think about when you are entering college.

Is student debt a good investment for me?

Everyone is supposed to go to college right? But if you think about your student debt as an investment you can determine if it is right for you. I can’t tell you how many young people I have worked with who didn’t need to go to college. They trained for years only to discover they didn’t like their chosen career. Now they have the student debt, but not the great job to go with it. We are told in the scripture how dangerous it is to pursue wealth (1 tim 6:6-10), but it is foolish to pursue and expensive degree without the ability to pay it back the student debt. Jesus told us to count the cost of following him and we should count the cost of our education decisions as well.

Everyone is supposed to go to college right? But if you think about your student debt as an investment you can determine if it is right for you. I can’t tell you how many young people I have worked with who didn’t need to go to college. They trained for years only to discover they didn’t like their chosen career. Now they have the student debt, but not the great job to go with it. We are told in the scripture how dangerous it is to pursue wealth (1 tim 6:6-10), but it is foolish to pursue and expensive degree without the ability to pay it back the student debt. Jesus told us to count the cost of following him and we should count the cost of our education decisions as well.

Many people consider their college years a right of passage, and to be sure many of us did our greatest growing and met our best friends and even our spouses (ring by spring of your money back) during these years. To be sure these years are very special, but that doesn’t mean you must pay a fortune to have these experiences. I don’t mind if people need time to “find themselves” and discover who they are, but it is foolishness to assume this must be done in a traditional college environment and can’t be done elsewhere.

Will my job pay for my degree?

A few years ago there was a push to get for-profit colleges to prove that students would be able to make money in the career of their chosen field. I don’t know why this isn’t a test for everyone. When you are signing up for student aid they have you work through a lot of financial worksheets. I don’t recall ever being asked if my chosen career path would provide enough money to pay back my loans. Maybe they don’t want you to ask that question. (I’ll be over here in my tinfoil hat)

I have talked with many recent grads. I ask them how they intend to pay off the student debt, which is larger than my mortgage, with a job that only pays $40k a year. This isn’t the barista job that they took because they couldn’t get employment in their field. This is the job in their chosen field. It is as if this thought has never occurred to them. Or worse yet, their thought is that someone else should pay it off because they are working in a “public” field.

One should not complain when what fulfills your heart doesn’t fulfill your wallet.

Is there another way to get this education or experience?

When I started looking into colleges to become a pastor my advisers tried to talk me into schools costing $40k a year. (in 1997) I decided to go a small bible college where I could learn by doing just as much as I would learn in the class room. I took an internship in the youth department and I read all I could get my hands on.

There are fields where you can get your hands on experience without going to a traditional university and in some cases maybe you should. After all once you have your first job or two on your resume no one cares where you went to school. (That is what hiring managers tell me in the tech field anyway)

Do you think I am full crap or do I have a good point? Let me know in comments below.

Image provided by donkeyhotey under the CC 2.0 license

StayFocusd Review

Working on a computer is distracting to say the least. I even find it hard to write because facebook, youtube, feedly are all just a click away. I have found myself surfing those sites for far too long during work. This convicted me that I was not “working as unto the Lord” (Col 3:23) and I was not stewarding or making good use of my time. So, I found a tool that keeps me in line.

StayFocusd

In their own words…

StayFocusd increases your productivity by limiting the amount of time that you can spend on time-wasting websites…StayFocusd is a productivity extension for Google Chrome that helps you stay focused on work by restricting the amount of time you can spend on time-wasting websites. Once your allotted time has been used up, the sites you have blocked will be inaccessible for the rest of the day.

It is fully customizable, you determine when it keeps you in line and what sites are issues for you. You also determine what sites you want it to count and how long you have on those sites. Beware if you run out of time and try to give yourself more. Changes won’t be in effect until the next day. They are very good at not letting you give into yourself.

I have used StayFocusd for a few years now and I have not regretted it. I keep myself from wasting too much time at work or even at home, so I will actually work on accomplishing my goals. It has helped me to push toward completing my blogs, my book and tons of other things.

One of the best commitment devices StayFocused has for you,if you are particularly good at giving up on your commitments, is the requirement to type an entire paragraph without error before you can make changes. If you are the person who will give up as soon as it gets tough they will hold your feet to the fire if you ask. I haven’t found that I need that level of commitment but I will not judge you.

Check it out, start with the basic settings and see how you need to change it from there. Just be warned if you try to give yourself more freedom, they will shock a kitten! (Not really, I hope they are kidding)

Feature image by Dimitris Kalogeropoylos

How money minded people are throwing money away

If you follow many bloggers advice you are throwing money away without even realizing they are doing it. Personal finance writers talk a lot about delayed gratification. That’s the ability to put off things that you want now for better things later. We tell you to save up for the things you want instead of putting it on a credit card because it will cost you less and it is better to not be in debt. Every personal finance writer worth their keyboard can tell you about the Marshmallow Test and how it shows a child’s ability to delay reward and how it links to later success.

If you follow many bloggers advice you are throwing money away without even realizing they are doing it. Personal finance writers talk a lot about delayed gratification. That’s the ability to put off things that you want now for better things later. We tell you to save up for the things you want instead of putting it on a credit card because it will cost you less and it is better to not be in debt. Every personal finance writer worth their keyboard can tell you about the Marshmallow Test and how it shows a child’s ability to delay reward and how it links to later success.

But here’s the thing, if you are delaying rewards just for later earthly rewards like a better retirement account then you are still throwing money away. Here is what Jesus had to say about it:

“Do not lay up for yourselves treasures on earth, where moth and rust destroy and where thieves break in and steal, but lay up for yourselves treasures in heaven, where neither moth nor rust destroys and where thieves do not break in and steal. For where your treasure is, there your heart will be also. (Matthew 6:19-21 ESV)

Often times when we are thinking about money we only get as far as this world. Saving for college, saving for an early retirement, saving for the new car or to get out of debt are all very good goals, but they are not the ultimate goals if you are a Christian. And far too often the people who are thinking about their money and being good stewards are still far to short sighted. If your 401(k) and your bank accounts and you houses look just like those of the people who are making the same amount of money as you then you are surely throwing money away where moth and rust may corrupt. Or worse yet you are heading down a path that Paul warns us is incredibly dangerous.

But those who desire to be rich fall into temptation, into a snare, into many senseless and harmful desires that plunge people into ruin and destruction. For the love of money is a root of all kinds of evils. It is through this craving that some have wandered away from the faith and pierced themselves with many pangs. (1 Timothy 6:9-10 ESV)

Loving after money and desiring it can lead you to wander from the faith. We need to be aware of our own sinfulness and if we are one of these people who for whom money may cause our ruin, we should give it away all the more.

Ask yourself today, am I being selfish with my money? Am I giving sacrificially as the Bible calls me to do? Am I trusting God to provide or am I trusting in my savings account? If you aren’t sure of the answers, ask your spouse or a brother or sister who will be honest with you.