Top posts of 2016

Top Posts of 2016

Check them out, they were popular for a reason

LastPass survivor Checklist – This article was about creating a survior checklist for your spouse in the event of your death. I assume anyone reading this site is, like me, the one who primarily takes care of the money. This process will deliver all of your passwords to my wife after I die so she has one last thing on her plate.

Contentment – The how of happiness – This article looks at Paul’s call to contentment in a Christian’s life.

How money minded people are throwing money away – I wanted to look at some of the some of the common advice from personal finance bloggers and see how bad they are

Rich young Ruler – A look at my personal views on Jesus parable of the Rich young ruler

25+ Free Things You Never Knew You Could Get For Free

Seed time has some great ideas for getting some free stuff. I love free stuff.

FTC Disclosure of Material Connection: In order for us to maintain this website, some of the links in the post above may be affiliate links. Regardless, we only recommend products or services we use personally and/or believe will add value to readers. Read more here.

HT to: http://ift.tt/1M3o2Qn

Student debt can be dangerous

Heading off to college is a great adventure for many young people. I know it was for me so many years ago. It was my first time living on my own, 6 hours from my parents. I was very fortunate that my chosen school only cost a few thousand dollars a year for tuition. I was able to work full time and pay as I went. The only student debt I managed to accrue was because I was stupid with my credit card.

College is a strategic inflection point for many young people. It is a time when many don’t get good council about money. A degree can take you far, but it can also become an anchor around your neck. Here are a few things to think about when you are entering college.

Is student debt a good investment for me?

Everyone is supposed to go to college right? But if you think about your student debt as an investment you can determine if it is right for you. I can’t tell you how many young people I have worked with who didn’t need to go to college. They trained for years only to discover they didn’t like their chosen career. Now they have the student debt, but not the great job to go with it. We are told in the scripture how dangerous it is to pursue wealth (1 tim 6:6-10), but it is foolish to pursue and expensive degree without the ability to pay it back the student debt. Jesus told us to count the cost of following him and we should count the cost of our education decisions as well.

Everyone is supposed to go to college right? But if you think about your student debt as an investment you can determine if it is right for you. I can’t tell you how many young people I have worked with who didn’t need to go to college. They trained for years only to discover they didn’t like their chosen career. Now they have the student debt, but not the great job to go with it. We are told in the scripture how dangerous it is to pursue wealth (1 tim 6:6-10), but it is foolish to pursue and expensive degree without the ability to pay it back the student debt. Jesus told us to count the cost of following him and we should count the cost of our education decisions as well.

Many people consider their college years a right of passage, and to be sure many of us did our greatest growing and met our best friends and even our spouses (ring by spring of your money back) during these years. To be sure these years are very special, but that doesn’t mean you must pay a fortune to have these experiences. I don’t mind if people need time to “find themselves” and discover who they are, but it is foolishness to assume this must be done in a traditional college environment and can’t be done elsewhere.

Will my job pay for my degree?

A few years ago there was a push to get for-profit colleges to prove that students would be able to make money in the career of their chosen field. I don’t know why this isn’t a test for everyone. When you are signing up for student aid they have you work through a lot of financial worksheets. I don’t recall ever being asked if my chosen career path would provide enough money to pay back my loans. Maybe they don’t want you to ask that question. (I’ll be over here in my tinfoil hat)

I have talked with many recent grads. I ask them how they intend to pay off the student debt, which is larger than my mortgage, with a job that only pays $40k a year. This isn’t the barista job that they took because they couldn’t get employment in their field. This is the job in their chosen field. It is as if this thought has never occurred to them. Or worse yet, their thought is that someone else should pay it off because they are working in a “public” field.

One should not complain when what fulfills your heart doesn’t fulfill your wallet.

Is there another way to get this education or experience?

When I started looking into colleges to become a pastor my advisers tried to talk me into schools costing $40k a year. (in 1997) I decided to go a small bible college where I could learn by doing just as much as I would learn in the class room. I took an internship in the youth department and I read all I could get my hands on.

There are fields where you can get your hands on experience without going to a traditional university and in some cases maybe you should. After all once you have your first job or two on your resume no one cares where you went to school. (That is what hiring managers tell me in the tech field anyway)

Do you think I am full crap or do I have a good point? Let me know in comments below.

Image provided by donkeyhotey under the CC 2.0 license

How a community can help your finances.

I have written before on my crazy ideas on how a community (a church specifically) can help one another financially, these are a little more down to earth. Being a good steward of your money goes against the flow of our materialistic consumption driven culture. It is hard to be the one who is looked at as cheap or broke, even if you aren’t. A solid group of like minded people can help support you in times of trouble.

- Like minded people are positive peer pressure. — I get asked at work at least once a week when I am buying a new PS4 or Xbox one. I hear the guys talking about the new games and I really want to regress to my bachelor days of spending the whole weekend in my room playing games. This isn’t the kind of peer pressure I need to be a good steward of my money, let alone my time.Just last week I wanted to go out to eat and asked one of the people that we were going to hang out with if they wanted to go. They said they had already spent their eating out budget, and so I felt influenced to save our money and eat at home before we all got back together to go hiking.A group of people that are all thinking the same way can help support you when you are feel like the only one not burying themselves in debt.

- You community can give you someone to do things with. — When everyone else wants to go out to eat and waste money on things you can gather your community to do a meal in together, or find an activity that doesn’t cost money.

Years ago our routine was to get together with two other couples and have a family style dinner and play board games. We saved money by eating together and had a blast creating memories and friendships.

- Your community can be your financial support.– As I have written before I think the church could do a better job of being the emergency fund for one another. Apart from that we can be a network for one another to help find jobs, get work or share the load when things happen.

It seems like every couple in our church is adopting right now and they are being supported, in part, by the community around them.

If you are going to be a good steward of your money, time and talent. It is very helpful to get a community around you to help. Let us know in the comments how you have been helped by you community.

Have Millennials Been Robbed of Their Birthright?

The National Center for Policy Analysis has an interesting article out about the effects of our big government on our newest citizens.

Burdened with an obligation to pay government debt they did not incur, young Americans – those born between the early 1980s and the beginning of the 21st century, or millennials – begin life at least partially robbed of their birthright.

Is this an example of Robin Hood in reverse where the wealthiest generation is taking money from the poorest to support their own lifestyle? Maybe. The bible tell us that a wise man lays up an inheritance for his grandchildren. Not a debt. We are continually forcing our children to pay for things they did not ask for and do not want just to support politically powerful interest groups. That isn’t the biblical model of stewardship.

HT to: http://ift.tt/1IJadZO

When Does Saving Turn into Hoarding?

Over at Christianpf.com they had a good discussion on this topic with some good practical ideas on what to look at. I have a question as a thought experiment. Should Christians have a self imposed (I believe any sort of forced cap would be immoral) income or networth cap? I read about a church that did this for their leadership about 15 years ago. It felt like an over reaction to the prosperity “gospel” of the day and I wasn’t sure how I felt about it. But now I wonder if there is some wisdom in it.

We talk a lot here about how personal finance is personal and much of it deals with a position of the heart, but while we can talk about shades of gray eventually grey becomes black and I have been thinking a lot about where grey becomes black in the case of savings v. hoarding.

The Bible clearly states that saving is a good thing (see Proverbs 21:20) and that hoarding is not (see Luke 12:20-21). But is there a clear distinction between the two? And how can we know if we have crossed the line? There must be a line, but is it completely subjective or not? Should we think nationally where we may be in the bottom 10% or globally where if you are American you are in the top 1% no matter how poor you are?

I would love to have a constructive conversation about this because I process by talking things through. Does the Bible speak to this? I think John did in Luke 3 when he tells the people give one of their coats away if they have 2 and their neighbor has none. My family has more coats than we can fit in our closet! But so do most of our “poorer” neighbors.

So, what would this look like? I have no idea as I said it is a thought experiment and I would love to hear from anyone even if you think I am crazy. Drop a line in the comments below.

No Article This Week

I have been going t hrough some crazy personal things, this week. I know this is how blogfade starts, but that is not the case here. I actually have 4 articles I want to write based on things that are happening to me and my career, I just haven’t made/had time. I would rather not put up something just because I should. I want to put up something of quality instead.

hrough some crazy personal things, this week. I know this is how blogfade starts, but that is not the case here. I actually have 4 articles I want to write based on things that are happening to me and my career, I just haven’t made/had time. I would rather not put up something just because I should. I want to put up something of quality instead.

So, if you would like something to read may I suggest some of our specials of the day:

Give me my idol – This is be relevant for the new articles I will be writing shortly…

Questions about money before marriage – Marriage season is upon us, even if you are already married check out these conversation starters for you and your spouse.

100 money saving tips – Always helpful…

Image by adventur

Tax Code War on Women

The real “w

ar on women” is in the U.S. tax code, says Diana Furchtgott-Roth, director of Economics21 at the Manhattan Institute. Single working women face higher tax rates when they marry, a reality that discourages marriage or encourages women who do marry to quit the workforce. When married women decide whether to enter the labor force, “their tax rate begins at the rate on the last dollar of income earned by their spouse,” Congressional Research Service specialist Jane Gravelle explained in a Senate Budget Committee hearing.

This article by Diana Furchtgott-Roth is an interesting read and is something young couples should consider when determining things like if and who will stay home with children. This appears to assume that Women are the secondary income earners in their family which may be mostly true but not always.

Currently, the U.S. tax code discourages work, discourages marriage and encourages women not to advance. This is the real problem for women that politicians should focus on.

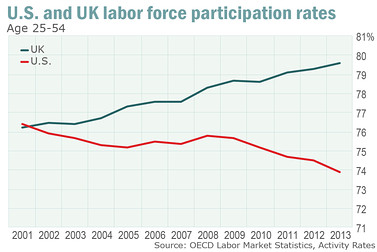

Of course the tax code also discourages men from working in some cases, but the penalties of marriage do seem to practically hinder women more. The chart above compares US and UK women’s participation rates. The UK does not have the marriage penalties that the US does because couples still file separately and have their own deductions. All in all it was an interesting read for someone who is not a big “Women’s Studies” kind of guy.

HT to: http://ift.tt/1hoH2wI

My Story

Why do I write this stuff? I am not rich, I am not a money expert. I still struggle with imposter syndrome. Which means I feel like a fake when I write advice to people knowing how much I have screwed up my finances, but this blog is nothing if not a tribute to my failures in this area. This is part of my story.

Why do I write this stuff? I am not rich, I am not a money expert. I still struggle with imposter syndrome. Which means I feel like a fake when I write advice to people knowing how much I have screwed up my finances, but this blog is nothing if not a tribute to my failures in this area. This is part of my story.

When I became a Christian I was quickly lead into the health and wealth movement of the late ’90s. (Don’t judge me I was 16 and didn’t know any better) I attended a bible college run by a televangelist believing the whole time it was God’s plan to make me rich so I could be a shining light and give more to mission. I just knew that as long as I paid my tithe (10% of the sanctified gross income) God was obligated(yes I said obligated) to bless the other 90% and prosper me financially (Don’t judge me I was 18 and didn’t know better)

God slowly began to pull me out of that area of Christianity and to a Vineyard Church. It was during this time that God really started to show me things about money that I was not able to see before. I started to realize that the tithe is not the militant demand I had always been taught. I started studying what the Bible had to say about money and what people like Robert Kiyosaki had to say about money. What I found opened my eyes to things I never learned growing up.

I started to learn that God wanted sacrificial giving and that the tithe was not really applicable to the New Testament church. I learned that debt is a suckers game most of the time and it used by most of us to finance a lifestyle we can’t really afford to begin with.

I had come into our marriage with credit cards and stupidity, a really bad combination. My wife and I began to do things to pay down our debt, save more money and live more simply. I did what everyone did in 2005 I started a blog about what I was doing. It did pretty well but it was practical advice for the most part, I missed out on the part about being more generous . My wife and I were so focused on fixing our mistakes that we made a bigger mistake by not obeying God and giving. We gave, but not as much as we could and should have. We were selfish and scared of financial ruin. I spent some time after the housing bubble being bitter with God because we lost our shirts in the real estate market but ultimately realized God had a plan for that as well.

I went back to school and afterward I started this site to process through my mistakes as well as help people with their questions. There are a lot of people looking for answers. I don’t have them but I am good at processing through questions with people. At least that is what I have been told…

I write this because I want to help people understand how to steward their gifts well, whether that is money, talent or something else. I want to prevent people from making the same mistakes I made or worse ones. I want to help people keep their marriages together instead of fighting about money. I hope if you find this you enjoy it and somehow it can help you be a better steward of all God has given you, which if you can read this is a lot.